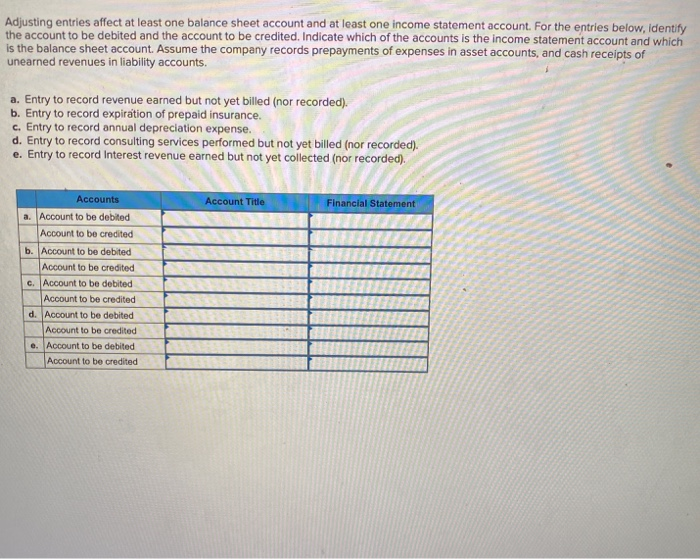

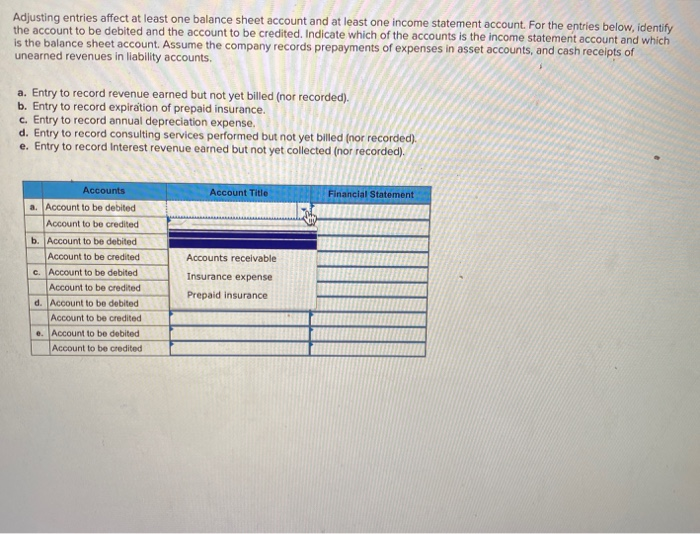

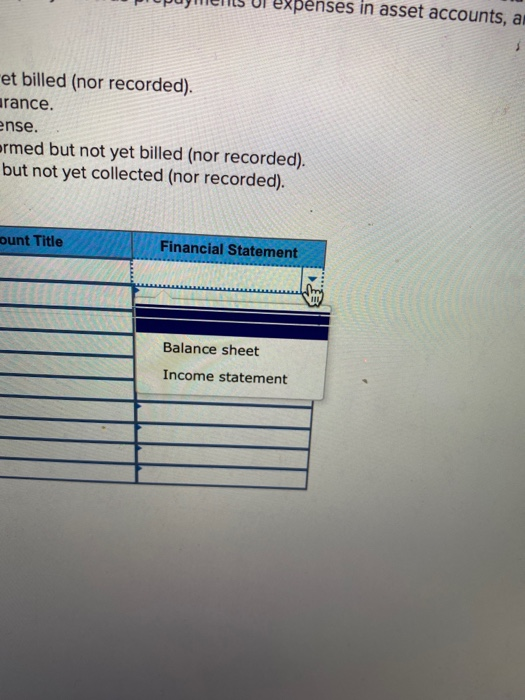

Adjusting entries affect at least one balance sheet account and at least one income statement account. For the entries below, identify the account to be debited and the account to be credited. Indicate which of the accounts is the income statement account and which is the balance sheet account. Assume the company records prepayments of expenses in asset accounts, and cash receipts of unearned revenues in liability accounts. a. Entry to record revenue earned but not yet billed (nor recorded). b. Entry to record expiration of prepaid insurance. c. Entry to record annual depreciation expense. d. Entry to record consulting services performed but not yet billed (nor recorded). e. Entry to record Interest revenue earned but not yet collected (nor recorded). Account Title Financial Statement Accounts a. Account to be debited Account to be credited b. Account to be debited Account to be credited c. Account to be debited Account to be credited d. Account to be debited Account to be credited e. Account to be debited Account to be credited Adjusting entries affect at least one balance sheet account and at least one income statement account. For the entries below, identify the account to be debited and the account to be credited. Indicate which of the accounts is the income statement account and which is the balance sheet account. Assume the company records prepayments of expenses in asset accounts, and cash receipts of unearned revenues in liability accounts. a. Entry to record revenue earned but not yet billed (nor recorded). b. Entry to record expiration of prepaid insurance. c. Entry to record annual depreciation expense. d. Entry to record consulting services performed but not yet billed (nor recorded). e. Entry to record Interest revenue earned but not yet collected (nor recorded). Account Title Financial Statement Accounts receivable Accounts a. Account to be debited Account to be credited b. Account to be debited Account to be credited c. Account to be debited Account to be credited d. Account to be debited Account to be credited e. Account to be debited Account to be credited Insurance expense Prepaid insurance Expenses in asset accounts, a et billed (nor recorded). arance. ense. ormed but not yet billed (nor recorded). but not yet collected (nor recorded). ount Title Financial Statement HIV Balance sheet Income statement