Question

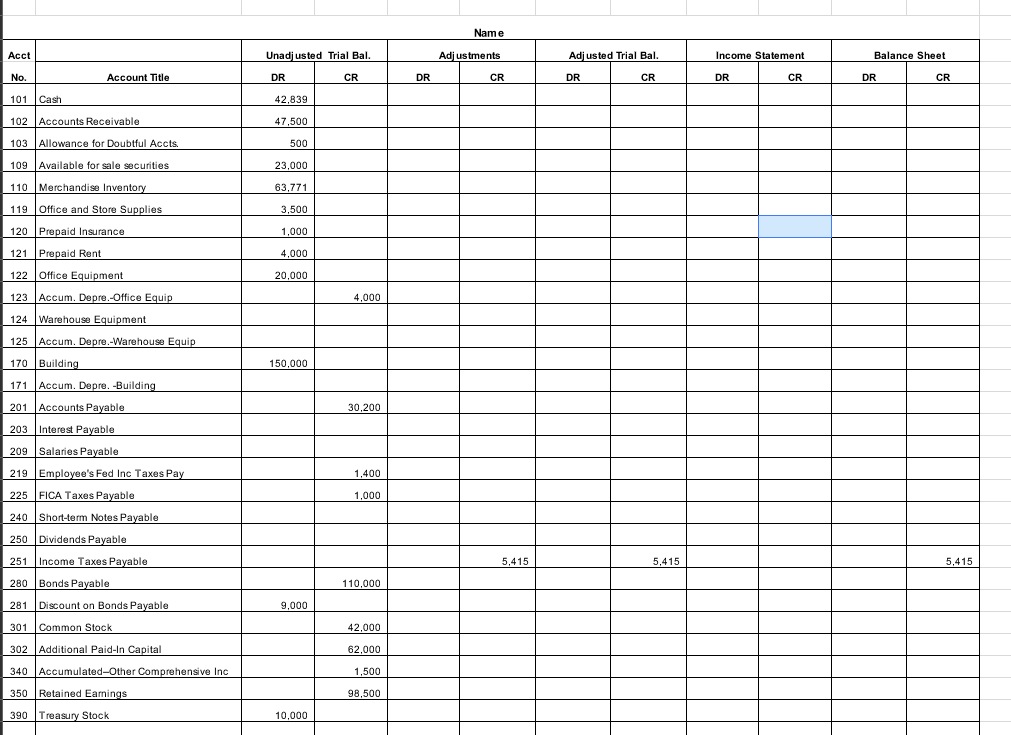

ADJUSTING ENTRIES Complete the excel spreadsheet by using the following supplementary data. All of the account titles you will need in preparing the adjusting entries

ADJUSTING ENTRIES

Complete the excel spreadsheet by using the following supplementary data. All of the account titles you will need in preparing the adjusting entries have already been included in the worksheet in their proper numerical sequence.

a) Store and office supplies on hand as of January 31 are $1,600.

b) Insurance expense expired during the month was $200.

The balance in the Prepaid Rent account is for a 2-month period ending February 28. The company will be moving to new facilities by the end of February.

The Building will be depreciated over 20 years, using straight-line depreciation with no salvage value. The Office Equipment has an estimated life of five years with no salvage value.

Interest and amortization should be accrued on the bonds payable.

Note: the discount on bonds payable is amortized on the straight-

line method for the month of January.

YourName estimates that in the future approximately 3.0 percent of total accounts receivable will be uncollectible.Use the balance sheet method and adjust to this number.

The marketable securities have a market value of $22,000 as of Jan 31 Use accounts 801 and 109 for the unrealized gain/loss). Unrealized Gains/Losses is part of Owners' Equity and is included as a part of Other Comprehensive Income and Accumulated Other Comprehensive Income in the Equity section of the balance sheet.

Record corporate income tax expense as $4,951 Note that when computing income tax for the corporation Unrealized Gains is not taxable.

COMPLETE WORKSHEET

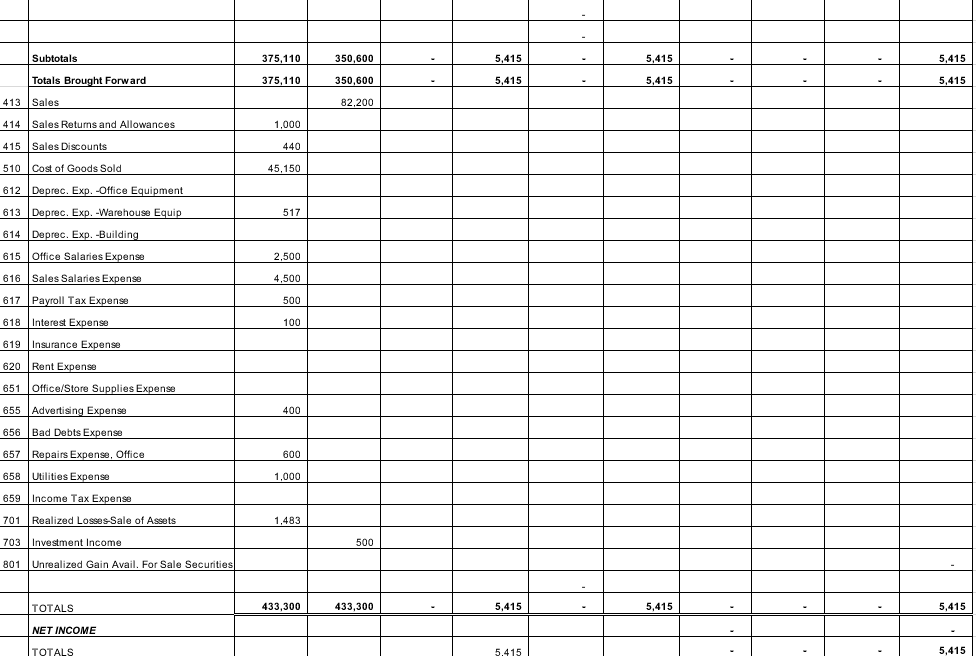

Name Acct Unadj ustedTrial Bal ustments usted Trial Bal Income Statement Balance Sheet Account Title DR CR DR CR DR CR DR CR DR CR 101 Cash 102 Accounts Receivable 103 Allowance for Doubtful Accts. 109 Available for sale securities 110 Merchandise Invento 119 Office and Store Supplies 120 Prepaid Insurance 121Prepaid Rent 122 Office Equipment 123 Accum. Depre.-Office Equi 124 Warehouse Equipment 125 Accum. Depre.-Warehouse Equi 170 Buildin 171 Accum. Depre. -Buildin 201 Accounts Payable 203 Interest Payable 209 Salaries Payable 219 Employee's Fed Inc Taxes Pa 225 FICA Taxes Payable 240 Short-term Notes Payable 250 Dividends Payable 251 Income Taxes Payable 280 Bonds Payable 281 Discount on Bonds Payable 301 Common Stock 302 Additional Paid-In Capital 340 Accumulated-Other Comprehensive In 350 Retained Eamings 390 Treasury Stock 42,839 500 150,000 5.415 5.415 5.415 110,000 42.000 98.500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started