Answered step by step

Verified Expert Solution

Question

1 Approved Answer

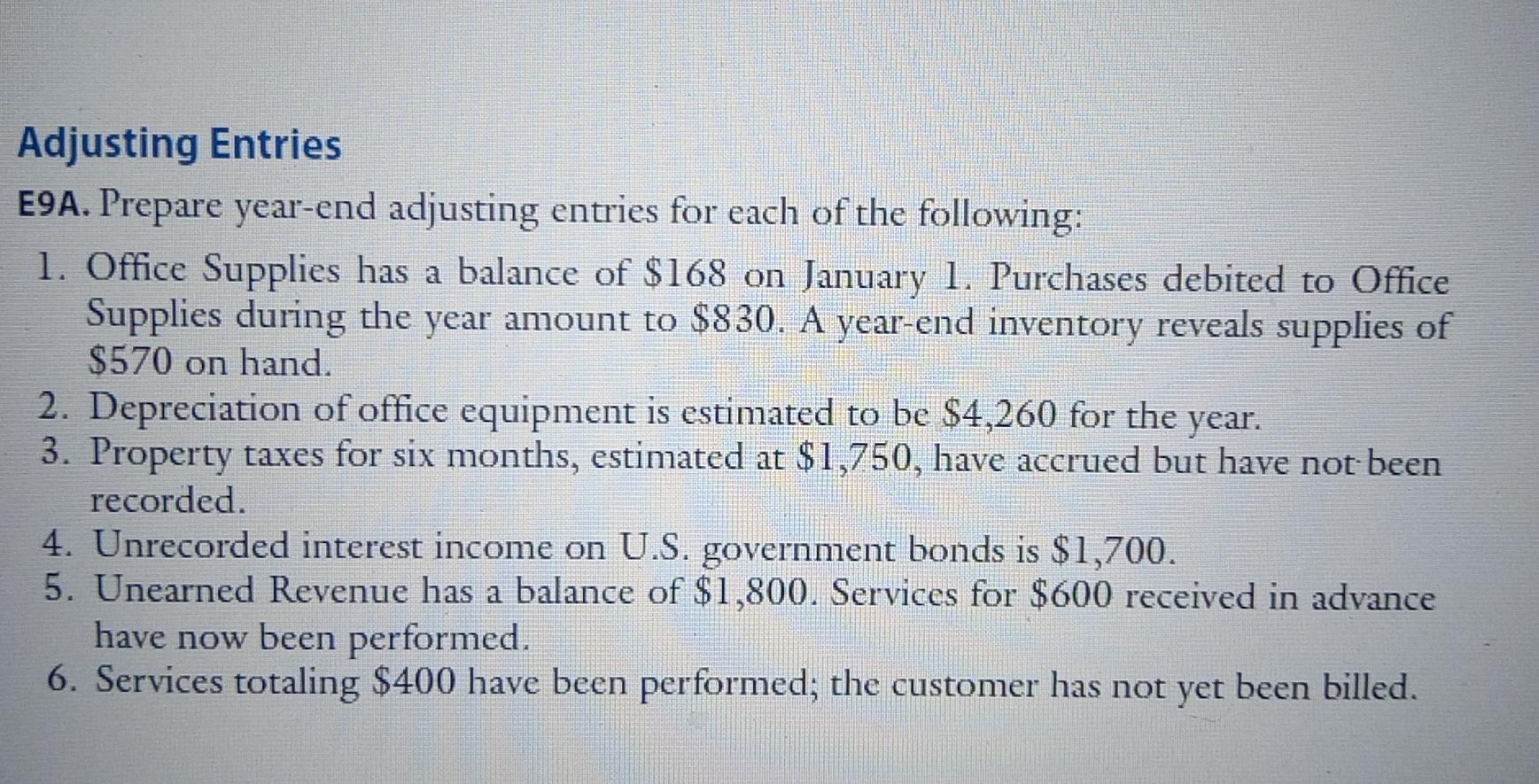

Adjusting Entries E9A. Prepare year-end adjusting entries for each of the following: 1. Office Supplies has a balance of $168 on January 1. Purchases debited

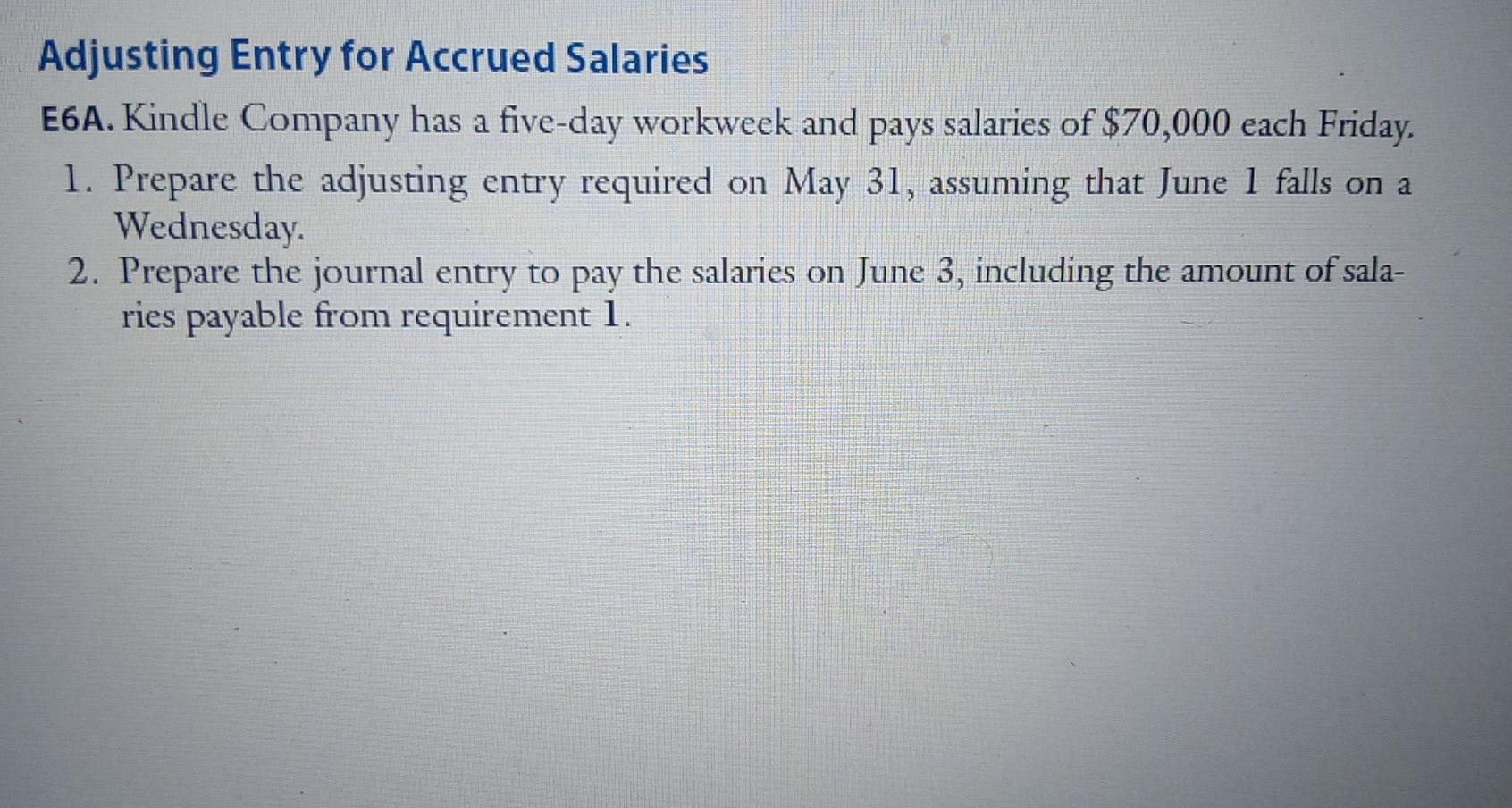

Adjusting Entries E9A. Prepare year-end adjusting entries for each of the following: 1. Office Supplies has a balance of $168 on January 1. Purchases debited to Office Supplies during the year amount to $830. A year-end inventory reveals supplies of $570 on hand. 2. Depreciation of office equipment is estimated to be $4,260 for the year. 3. Property taxes for six months, estimated at $1,750, have accrued but have not been recorded. 4. Unrecorded interest income on U.S. government bonds is $1,700. 5. Unearned Revenue has a balance of $1,800. Services for $600 received in advance have now been performed. 6. Services totaling $400 have been performed; the customer has not yet been billed. Adjusting Entry for Accrued Salaries E6A. Kindle Company has a five-day workweek and pays salaries of $70,000 each Friday. 1. Prepare the adjusting entry required on May 31, assuming that June 1 falls on a Wednesday 2. Prepare the journal entry to pay the salaries on June 3, including the amount of sala- ries payable from requirement 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started