please help me.

please help me.

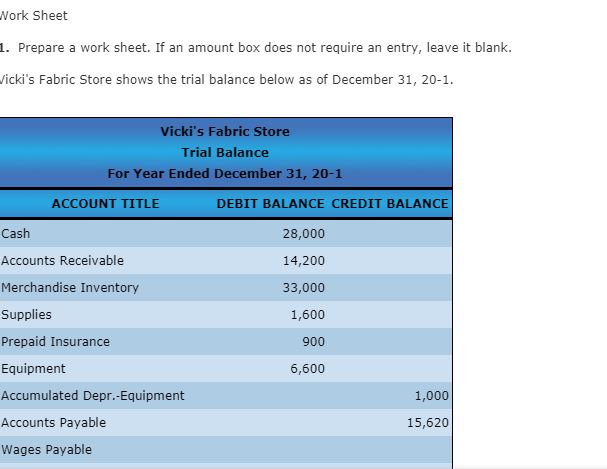

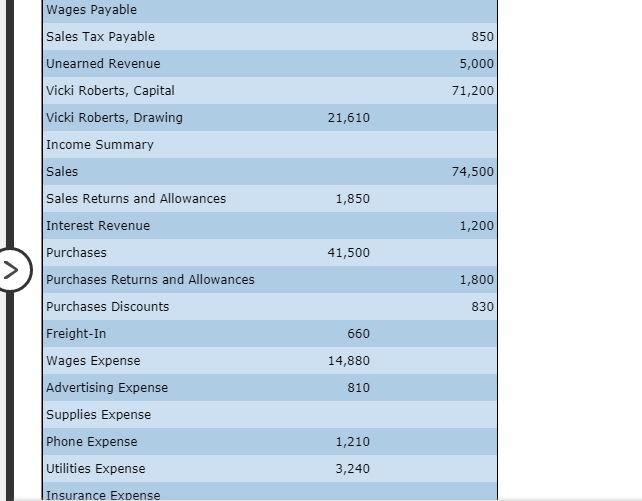

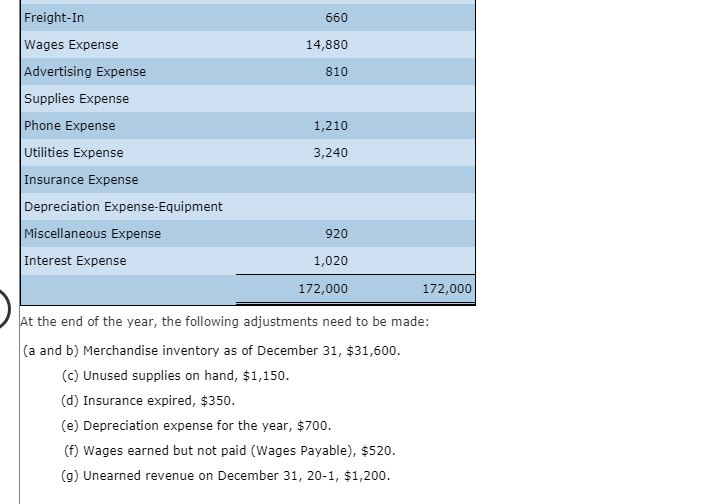

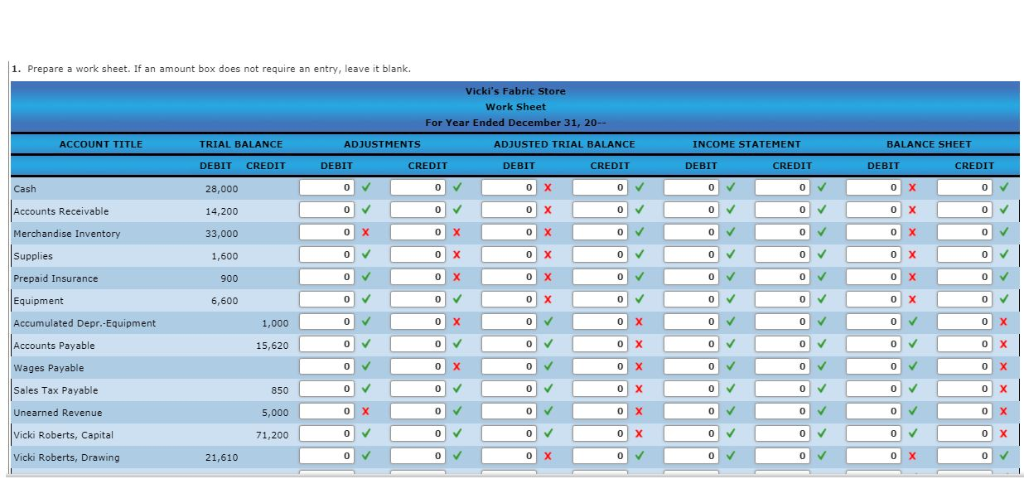

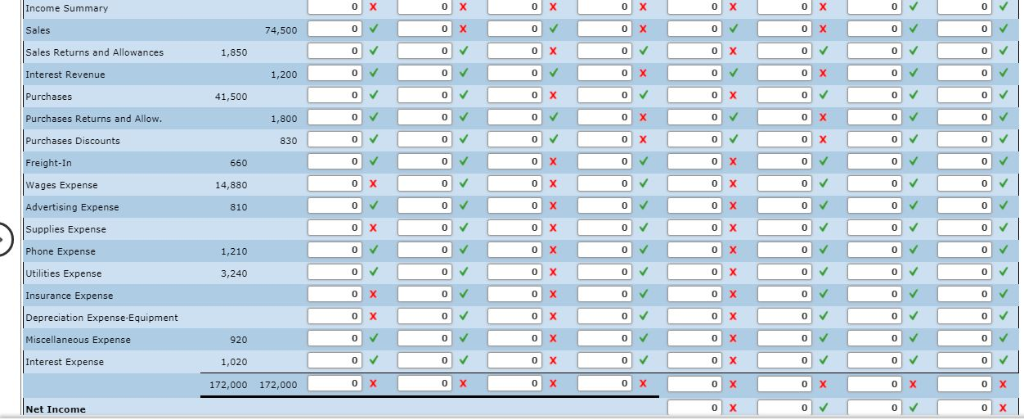

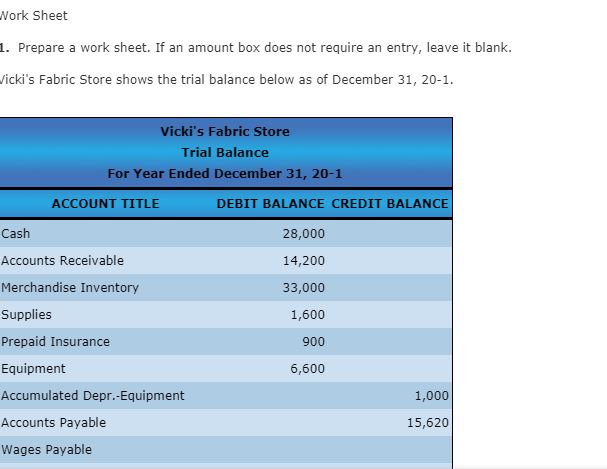

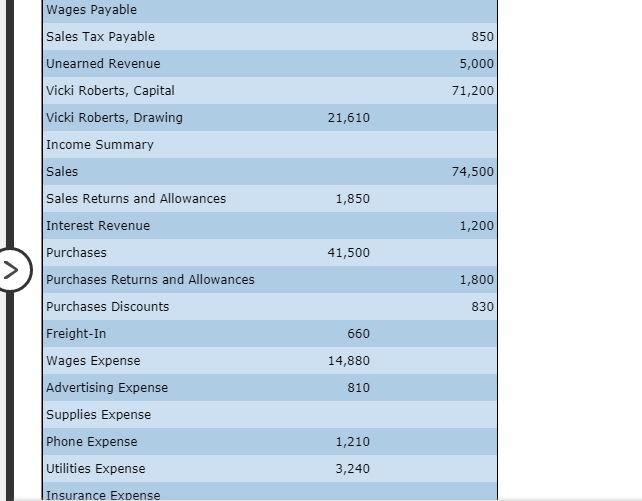

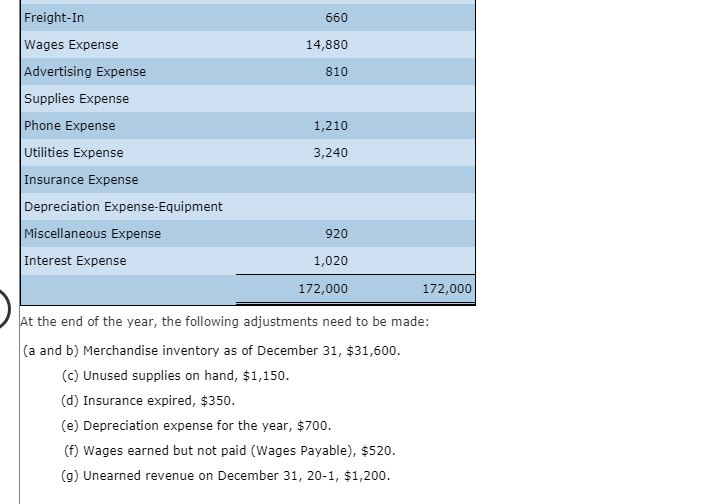

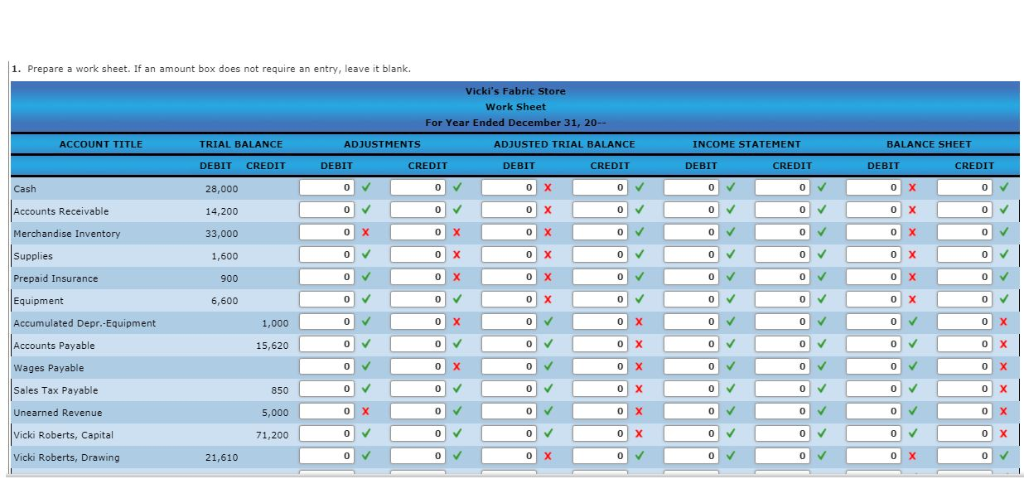

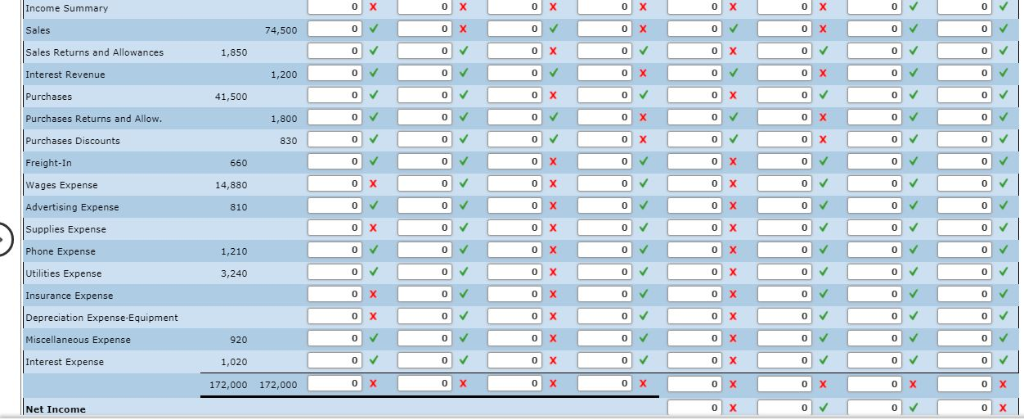

Work Sheet 1. Prepare a work sheet. If an amount box does not require an entry,, leave it blank. Vicki's Fabric Store shows the trial balance below as of December 31, 20-1 Vicki's Fabric Store Trial Balance For Year Ended December 31, 20-1 ACCOUNT TITLE DEBIT BALANCE CREDIT BALANCE Cash 28,000 Accounts Receivable 14,200 Merchandise Inventory 33,000 Supplies 1,600 Prepaid Insurance 900 Equipment 6,600 Accumulated Depr.-Equipment 1,000 Accounts Payable 15,620 Wages Payable Wages Payable Sales Tax Payable 850 Unearned Revenue 5,000 Vicki Roberts, Capital 71,200 Vicki Roberts, Drawing 21,610 Income Summary Sales 74,500 Sales Returns and Allowances 1,850 Interest Revenue 1,200 Purchases 41,500 Purchases Returns and Allowances 1,800 Purchases Discounts 830 Freight-In 660 Wages Expense 14,880 Advertising Expense 810 Supplies Expense Phone Expense 1,210 Utilities Expense 3,240 Insurance Expense Freight-In 660 Wages Expense 14,880 Advertising Expense Supplies Expense 810 Phone Expense 1,210 Utilities Expense Insurance Expense Depreciation Expense-Equipment 3,240 Miscellaneous Expense 920 Interest Expense 1,020 172,000 172,000 At the end of the year, the following adjustments need to be made: (a and b) Merchandise inventory as of December 31, $31,600. hand, $1,150 (c) Unused supplies on (d) Insurance expired, $350 (e) Depreciation expense for the year, $700. (f) Wages earned but not paid (Wages Payable), $520 (g) Unearned revenue on December 31, 20-1, $1,200 1. Prepare a work sheet. If an amount box does not require an entry, leave it blank. Vicki's Fabric Store Work Sheet For Year Ended December 31, 20- ACCOUNT TITLE TRIAL BALANCE ADJUSTMENTS ADJUSTED TRIAL BALANCE INCOME STATEMENT BALANCE SHEET DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT 0X X Cash 28,000 0 Accounts Receivable 0 0 14,200 0 X Merchandise Inventory C C 33,000 Y 0 Supplies 1,600 / 0 Prepaid Insurance 900 Equipment X C C 6,600 0 0 C 0 0 X 0 0 Accumulated Depr.-Equipment 1,000 Accounts Payable V V C 15,620 0 Wages Payable Sales Tax Payable 0 0 Y 850 Unearned Revenue X 5.000 C Vicki Roberts, Capital 0 0 X 0 0 71,200 Vicki Roberts, Drawing X 21,610 0 V 0 x 0 X 0 X 0 X Income Summary 0 X 0 X 0 X X 0 0 Sales 74,500 0 X 0 Sales Returns and Allowances 1,850 0 X Y Interest Revenue 1,200 Purchases o x C 41,500 C 0 C Purchases Returns and Allow. 1,800 0 X Purchases Discounts C C 830 0 X Freight-In 0 0 0 660 X 0 X X 0 0 14,880 Wages Expense 0 X Advertising Expense 0 V 810 Supplies Expense 0 0 X 0 Phone Expense 1,210 Utilities Expense 0 V 3,240 0 x 0X 0 X 0 X O Insurance Expense Depreciation Expense-Equipment X O X C C Miscellaneous Expense 920 Interest Expense 0V 0 X o x 1.020 0 X 0 X 0 X 0 X O 172,000 172,000 Net Income

please help me.

please help me.