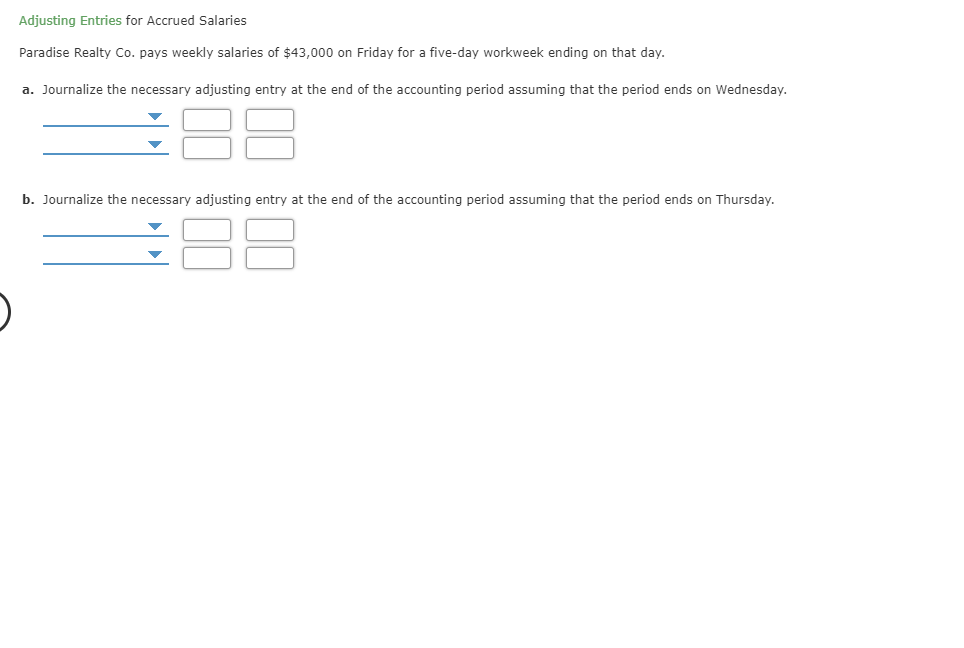

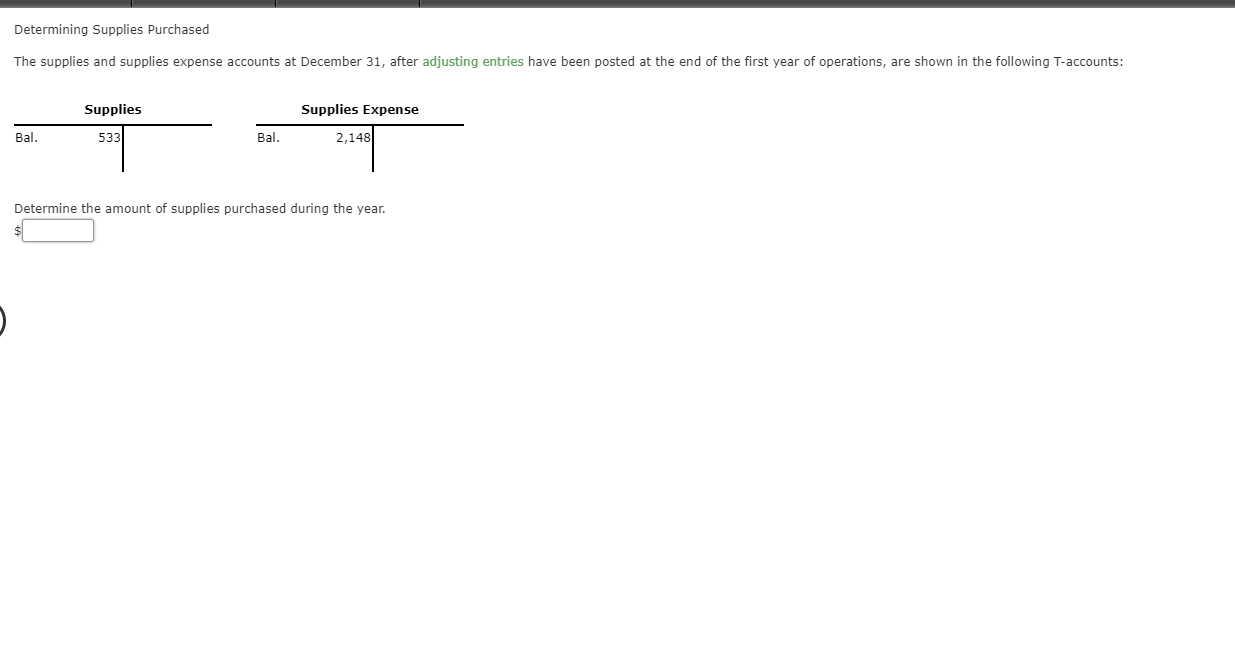

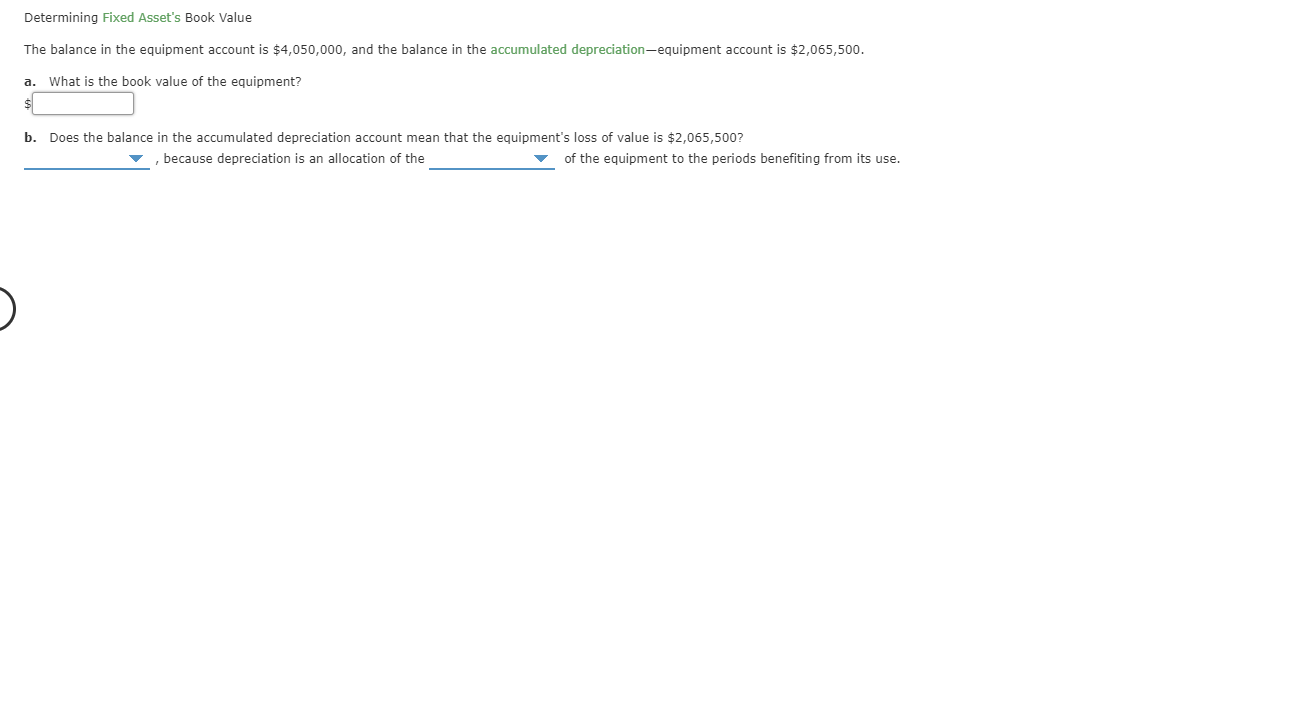

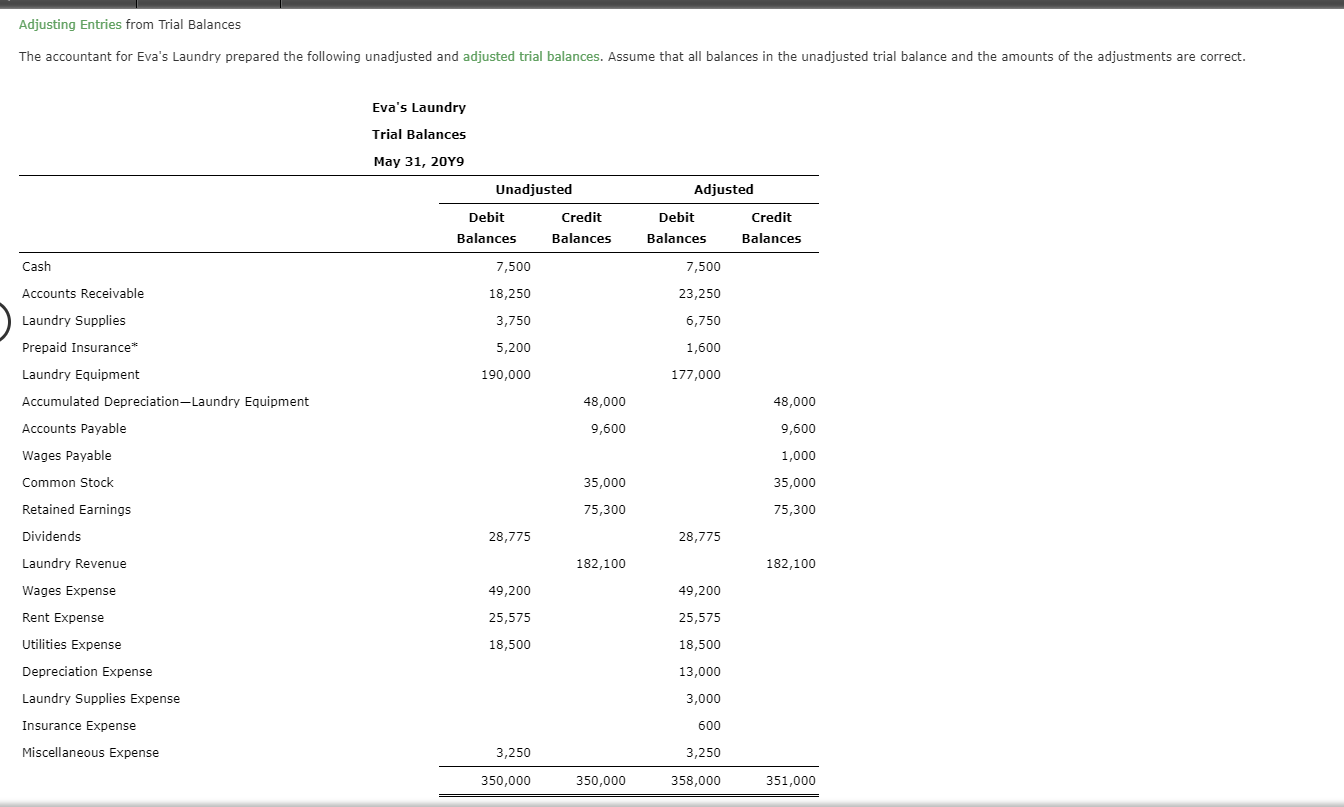

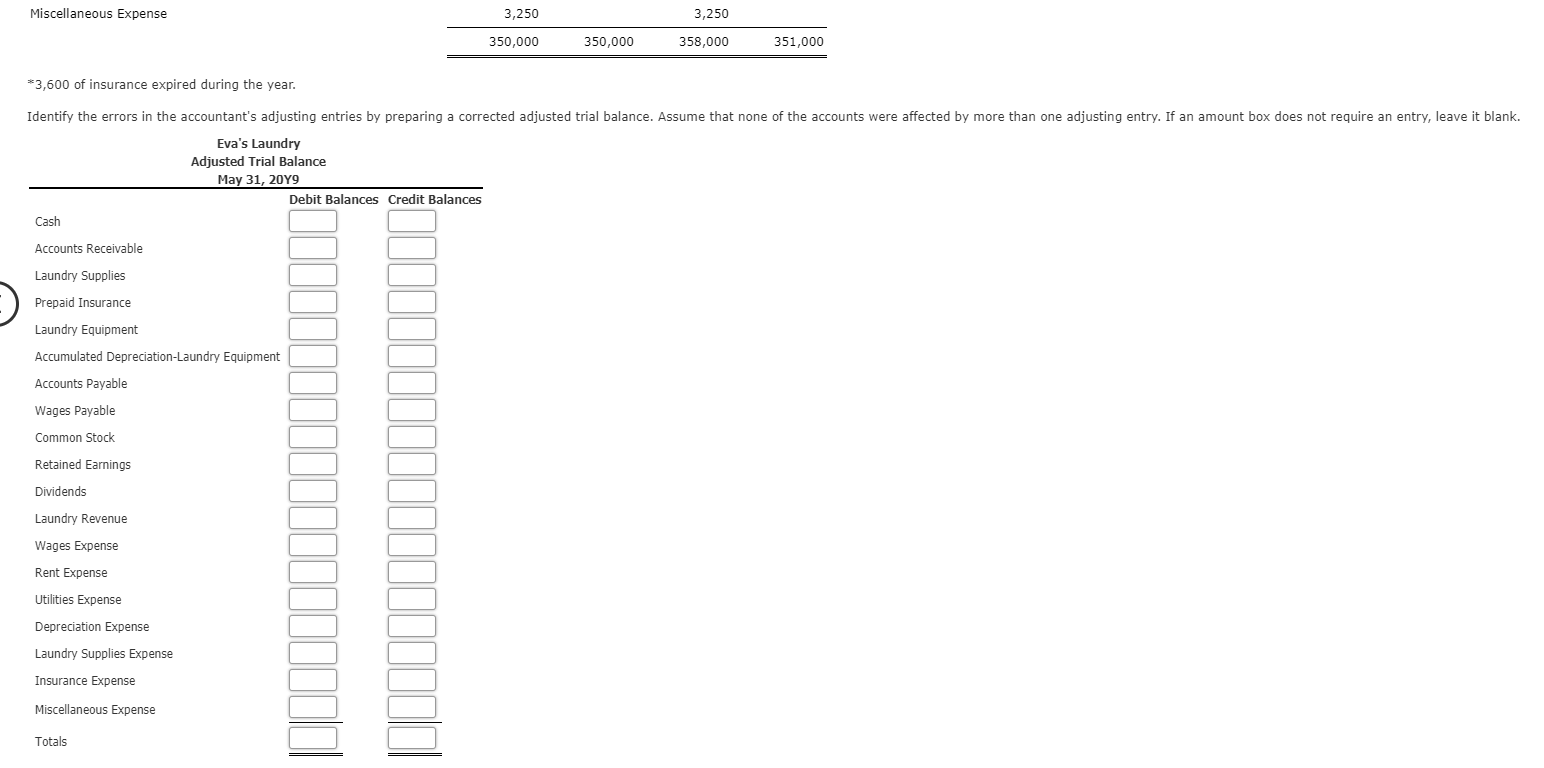

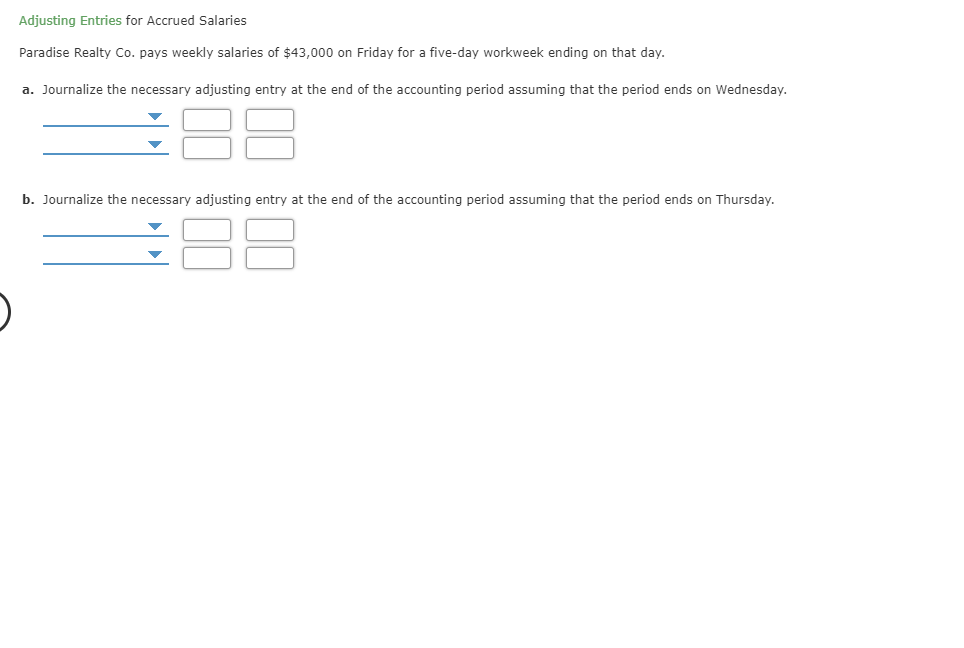

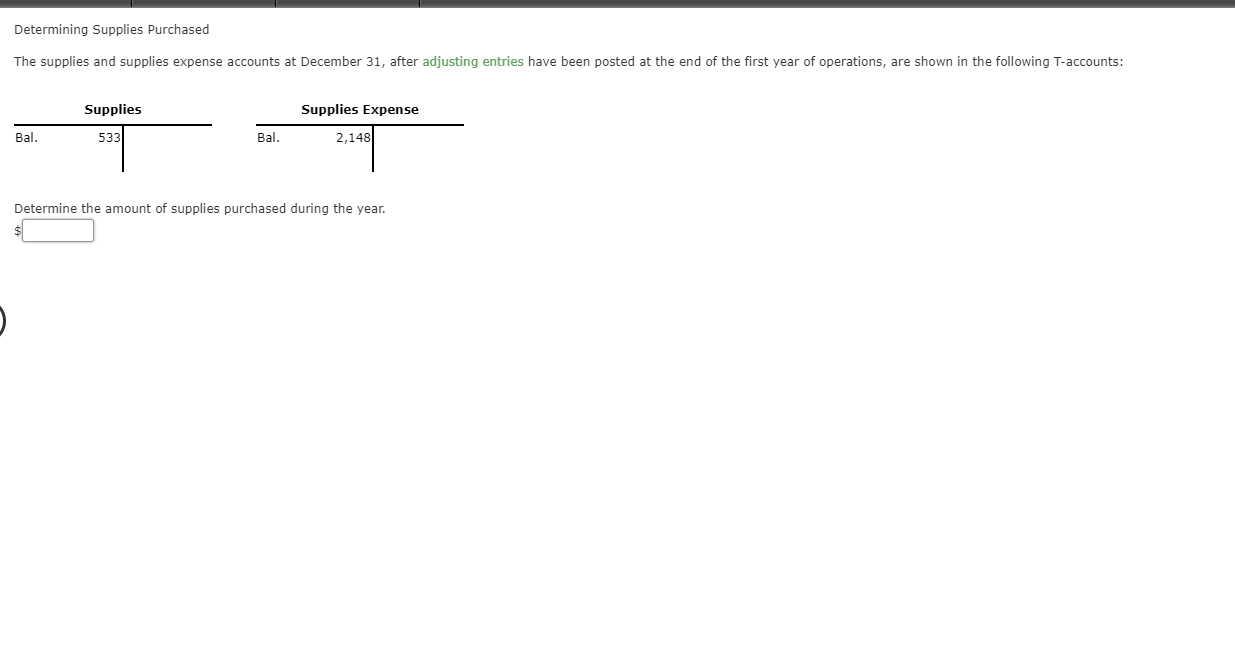

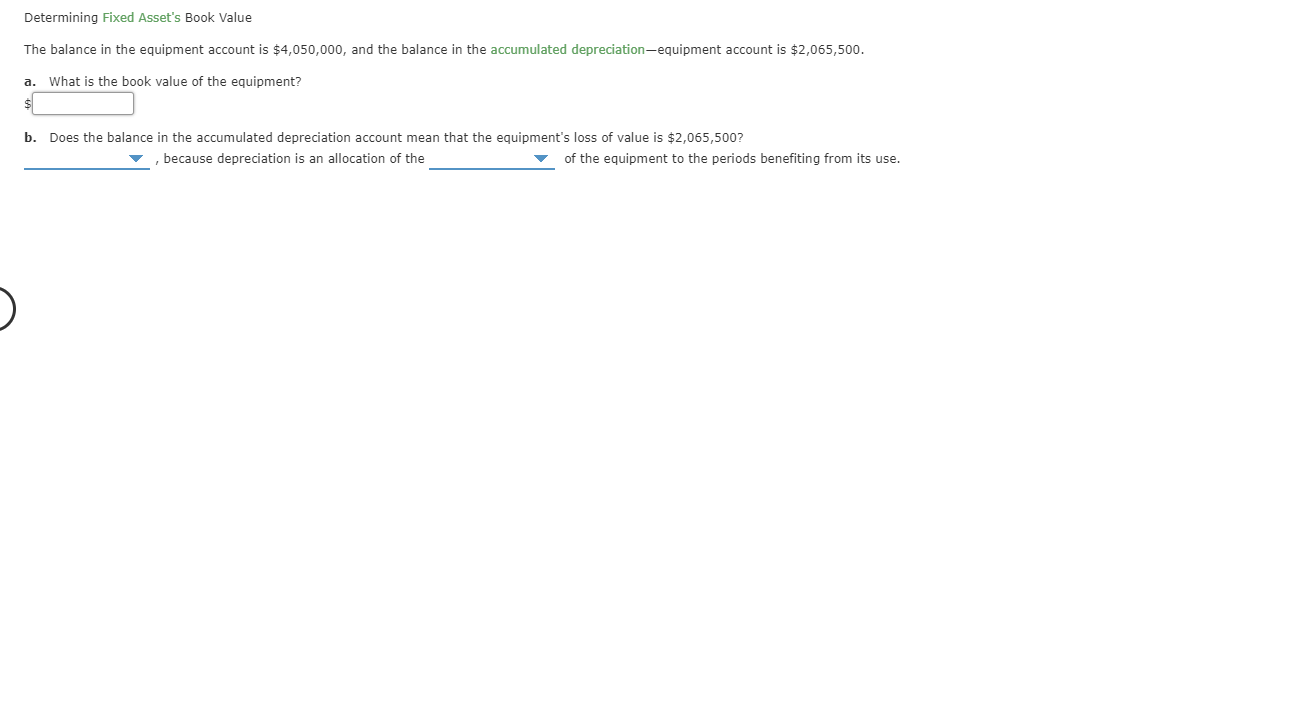

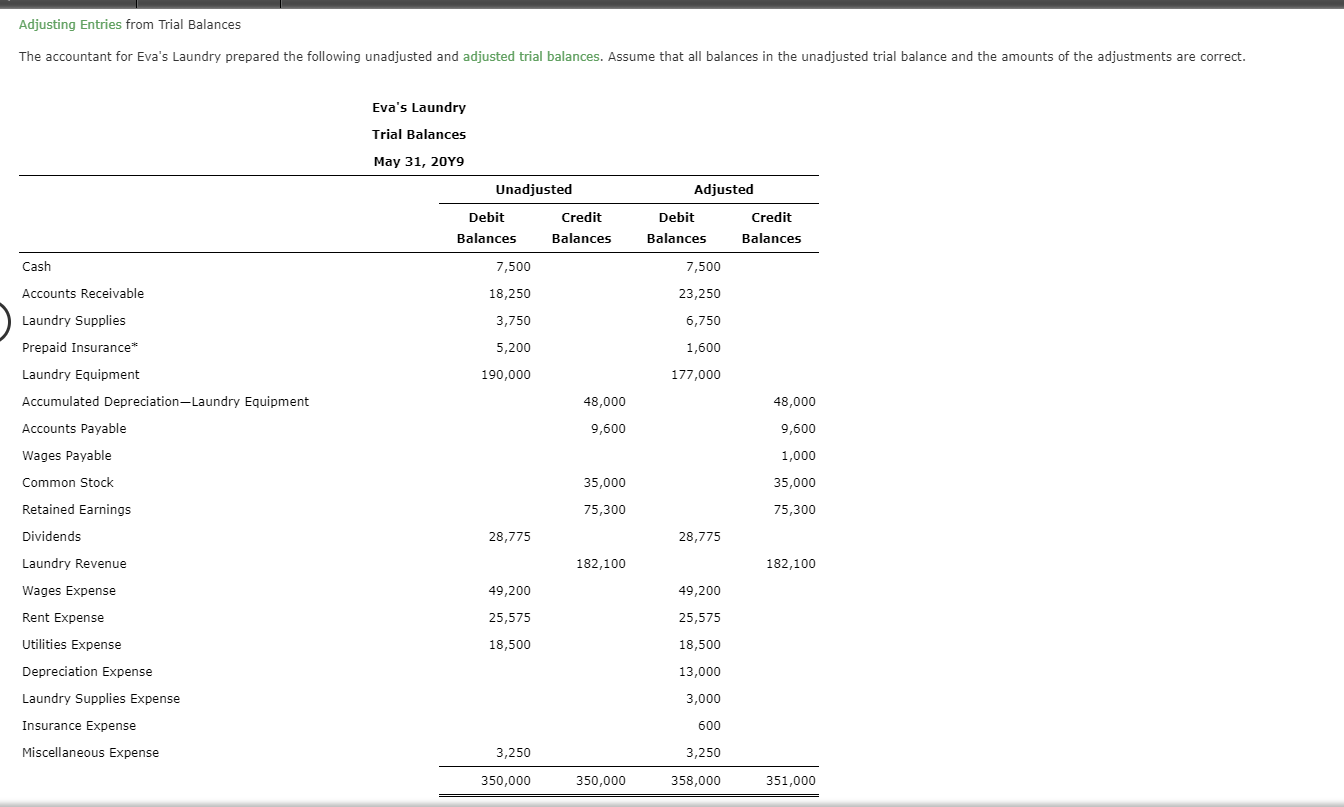

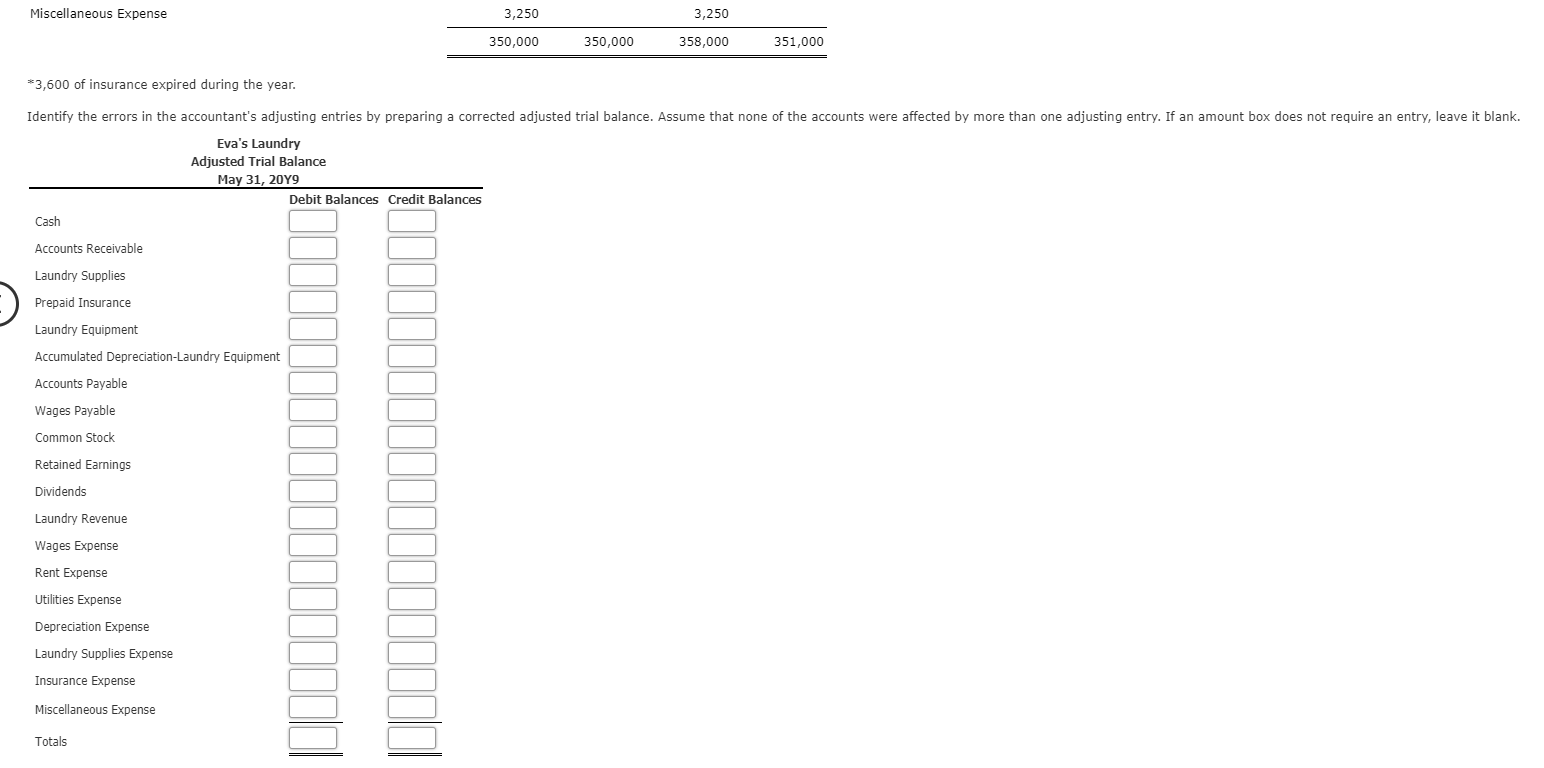

Adjusting Entries for Accrued Salaries Paradise Realty Co. pays weekly salaries of $43,000 on Friday for a five-day workweek ending on that day. a. Journalize the necessary adjusting entry at the end of the accounting period assuming that the period ends on Wednesday. b. Journalize the necessary adjusting entry at the end of the accounting period assuming that the period ends on Thursday. Determining Supplies Purchased The supplies and supplies expense accounts at December 31, after adjusting entries have been posted at the end of the first year of operations, are shown in the following T-accounts: Supplies Expense Supplies 533 2,148 Bal. Bal. Determine the amount of supplies purchased during the year. Determining Fixed Asset's Book Value The balance in the equipment account is $4,050,000, and the balance in the accumulated depreciation-equipment account is $2,065,500. a. What is the book value of the equipment? b. Does the balance in the accumulated depreciation account mean that the equipment's loss of value is $2,065,500? because depreciation is an allocation of the of the equipment to the periods benefiting from its use. Adjusting Entries from Trial Balances The accountant for Eva's Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted trial balance and the amounts of the adjustments are correct. Eva's Laundry Trial Balances May 31, 20Y9 Unadjusted Adjusted Credit Debit Credit Debit Balances Balances Balances Balances Cash 7,500 7,500 18,250 Accounts Receivable 23,250 Laundry Supplies 3,750 6,750 Prepaid Insurance 5,200 1,600 190,000 Laundry Equipment 177,000 48,000 Accumulated Depreciation-Laundry Equipment 48,000 Accounts Payable 9,600 9,600 Wages Payable 1,000 35,000 Common Stock 35,000 Retained Earnings 75,300 75,300 Dividends 28,775 28,775 Laundry Revenue 182,100 182,100 Wages Expense 49,200 49,200 Rent Expense 25,575 25,575 Utilities Expense 18,500 18,500 Depreciation Expense 13,000 Laundry Supplies Expense 3,000 Insurance Expense 600 Miscellaneous Expense 3,250 3,250 351,000 350,000 350,000 358,000 Miscellaneous Expense 3,250 3,250 350,000 350,000 358,000 351,000 *3,600 of insurance expired during the year. Identify the errors in the accountant's adjusting entries by preparing a corrected adjusted trial balance. Assume that none of the accounts were affected by more than one adjusting entry. If an amount box does not require an entry, leave it blank. Eva's Laundry Adjusted Trial Balance May 31, 20Y9 Debit Balances Credit Balances Cash Accounts Receivable Laundry Supplies Prepaid Insurance Laundry Equipment Accumulated Depreciation-Laundry Equipment Accounts Payable Wages Payable Common Stock Retained Earnings Dividends Laundry Revenue Wages Expense Rent Expense Utilities Expense Depreciation Expense Laundry Supplies Expense Insurance Expense Miscellaneous Expense Totals