Answered step by step

Verified Expert Solution

Question

1 Approved Answer

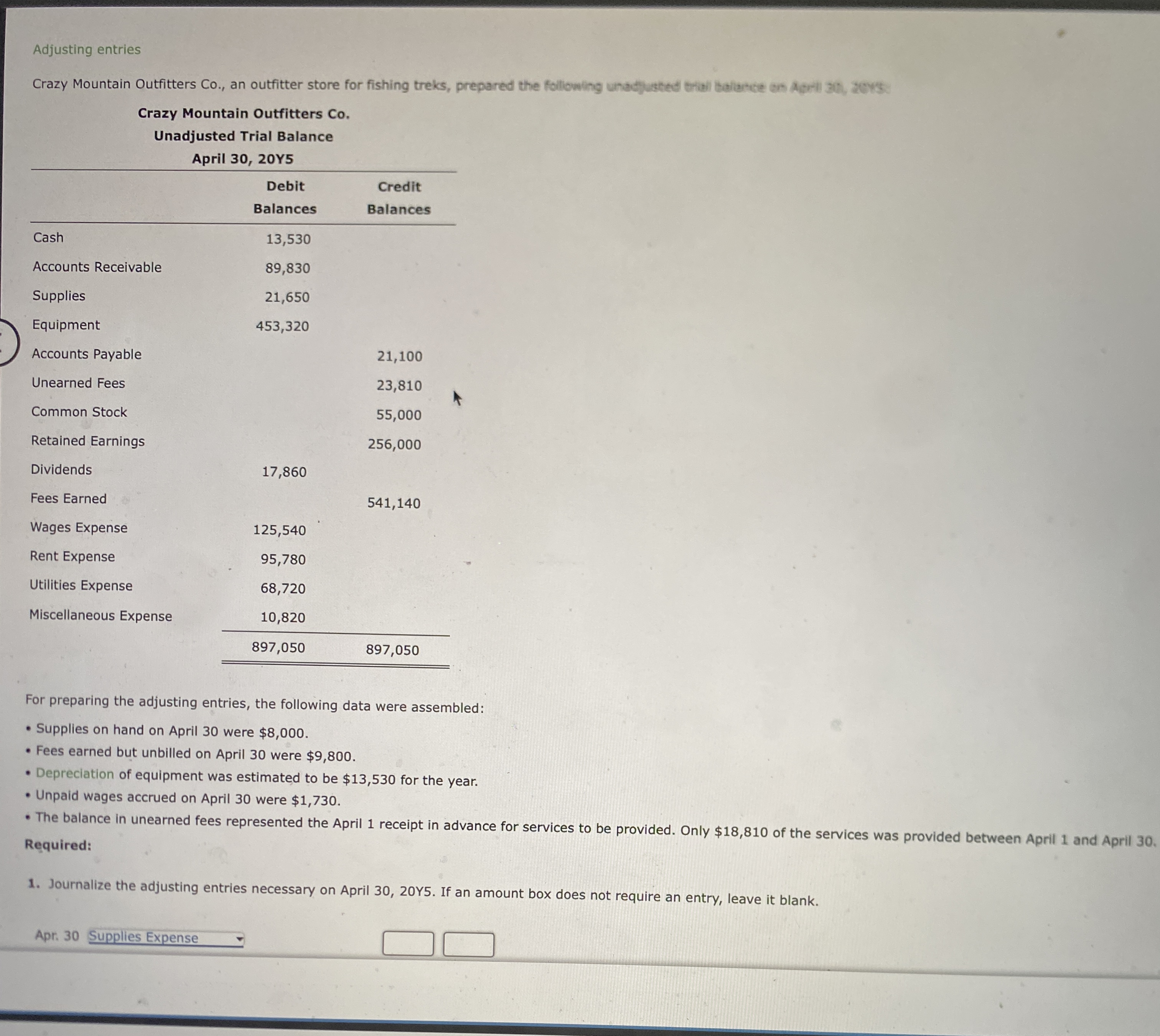

Adjusting entries For preparing the adjusting entries, the following data were assembled: - Supplies on hand on April 30 were $8,000. - Fees earned but

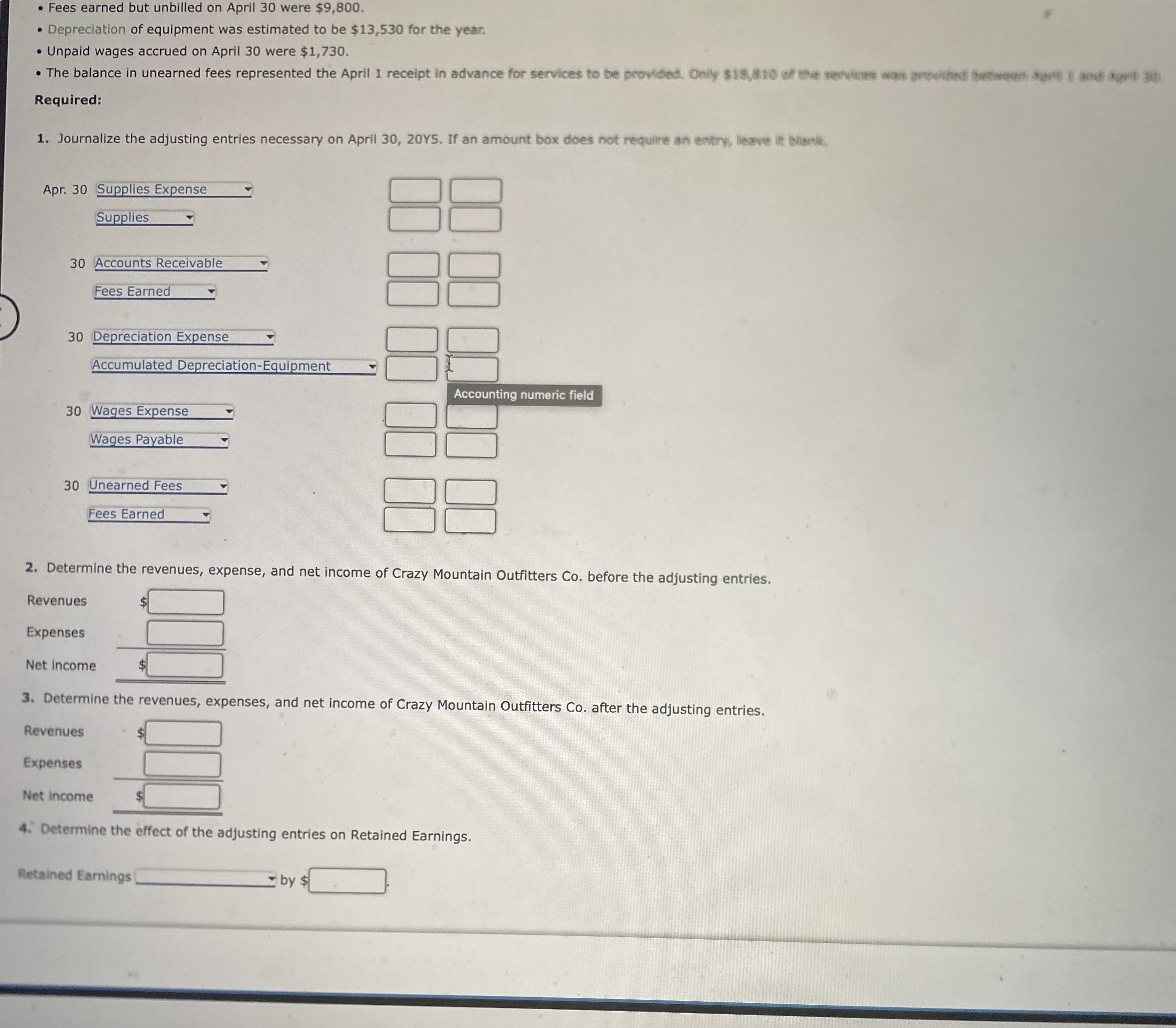

Adjusting entries For preparing the adjusting entries, the following data were assembled: - Supplies on hand on April 30 were $8,000. - Fees earned but unbilled on April 30 were $9,800. - Depreciation of equipment was estimated to be $13,530 for the year. - Unpaid wages accrued on April 30 were $1,730. - The balance in unearned fees represented the April 1 receipt in advance for services to be provided. Only $18,810 of the services was provided between April 1 and April 30 Required: 1. Journalize the adjusting entries necessary on April 30,20Y5. If an amount box does not require an entry, leave it blank. - Fees earned but unbilled on April 30 were $9,800. - Depreciation of equipment was estimated to be $13,530 for the year. - Unpaid wages accrued on April 30 were $1,730. Required: 1. Journalize the adjusting entries necessary on April 30, 20Y5. If an amount box does not requitre an entiry, leave ik blankik. 2. Determine the revenues, expense, and net income of Crazy Mountain Outfitters Co. before the adjusting entries. Revenues Expenses Net income 3. Determine the revenues, expenses, and net income of Crazy Mountain Outfitters Co. after the adjusting entries. 4. Determine the effect of the adjusting entries on Retained Earnings. Retained Earnings by

Adjusting entries For preparing the adjusting entries, the following data were assembled: - Supplies on hand on April 30 were $8,000. - Fees earned but unbilled on April 30 were $9,800. - Depreciation of equipment was estimated to be $13,530 for the year. - Unpaid wages accrued on April 30 were $1,730. - The balance in unearned fees represented the April 1 receipt in advance for services to be provided. Only $18,810 of the services was provided between April 1 and April 30 Required: 1. Journalize the adjusting entries necessary on April 30,20Y5. If an amount box does not require an entry, leave it blank. - Fees earned but unbilled on April 30 were $9,800. - Depreciation of equipment was estimated to be $13,530 for the year. - Unpaid wages accrued on April 30 were $1,730. Required: 1. Journalize the adjusting entries necessary on April 30, 20Y5. If an amount box does not requitre an entiry, leave ik blankik. 2. Determine the revenues, expense, and net income of Crazy Mountain Outfitters Co. before the adjusting entries. Revenues Expenses Net income 3. Determine the revenues, expenses, and net income of Crazy Mountain Outfitters Co. after the adjusting entries. 4. Determine the effect of the adjusting entries on Retained Earnings. Retained Earnings by Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started