Answered step by step

Verified Expert Solution

Question

1 Approved Answer

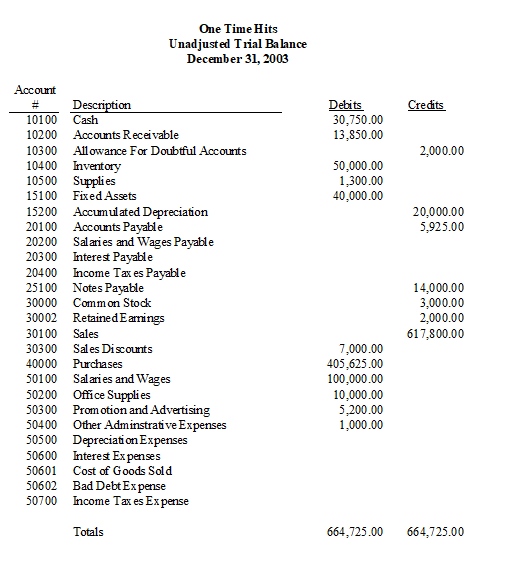

Adjusting Entries: Prepare the correct adjusting entries using the following information. The warehouse employees counted the ending inventory on hand at December 31, 2003. Their

Adjusting Entries: Prepare the correct adjusting entries using the following information.

- The warehouse employees counted the ending inventory on hand at December 31, 2003. Their ending inventory balance is $40,000. (Remember we are using the periodic inventory method.)

- The supplies department counted the supplies on hand. The balance of supplies at December 31 is $600.

- The note payable is due in 5 years and was initiated on April 1, 2003. The note payable requires annual interest payments of 10% payable on March 31 of each year. (Note: I used 275 days out of 365 to prorate the interest expense on the note payable)

- The company has estimated that bad debt expense is equal to one half of a percent (.005) of net sales (sales less sales discounts and returns) .

- December salaries and wages will be paid on January 5, 2004. December salaries and wages are $5,000.

- Two of the fixed assets have not been completely depreciated. These two items are a mainframe computer purchased for $20,000 in 2002 and a personal computer purchased in the current year on October 1, 2003 for $3,000. Computers are depreciated using the straight line method over 3 years. The salvage value is 0.

- The companys income tax rate is 15%. (For taxes most companies complete the other adjusting entries and then post them to the GL. Then prepare a preliminary income statement and calculate the taxes. Then they can make the adjusting entry for taxes and post to the general ledger)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started