Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me answer these questions. Thank you very much! Malright, a limited liability company, has an accounting year end of 31 October. The accountant

Please help me answer these questions. Thank you very much!

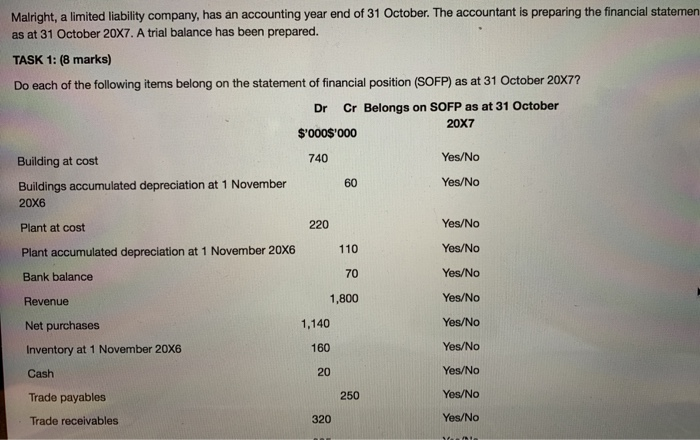

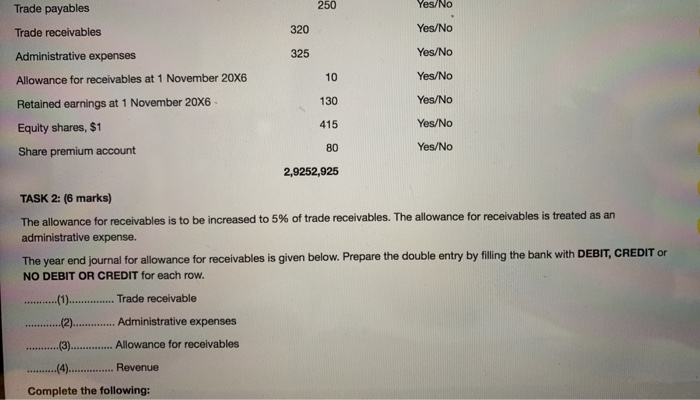

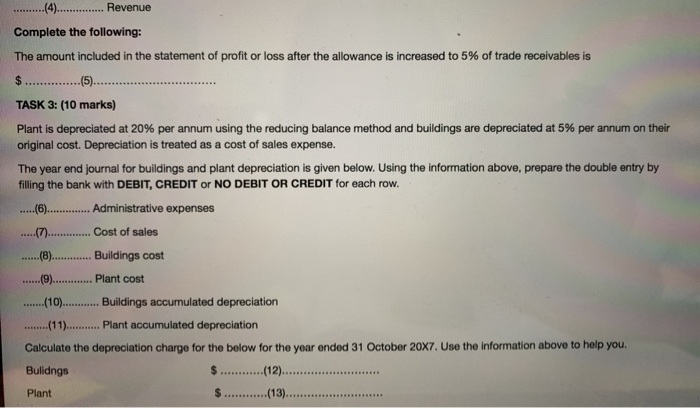

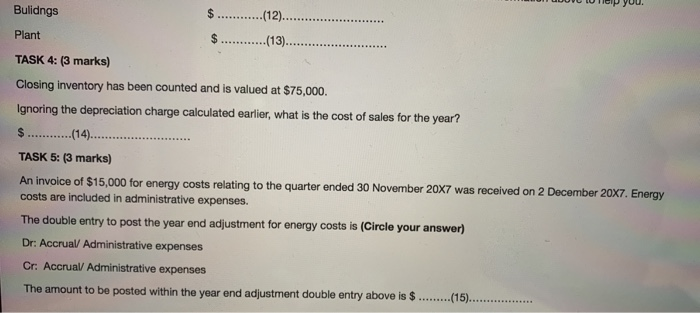

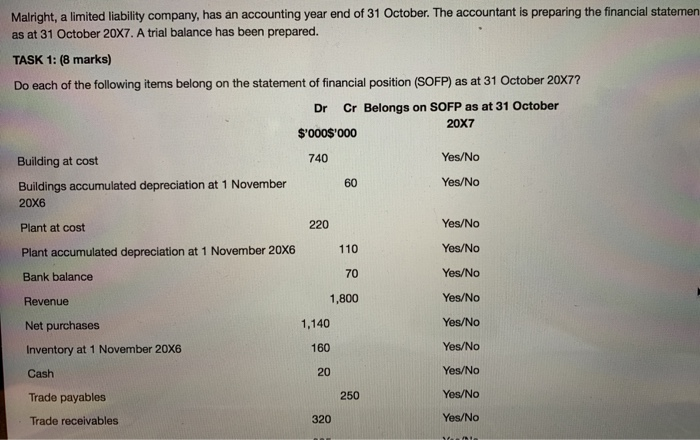

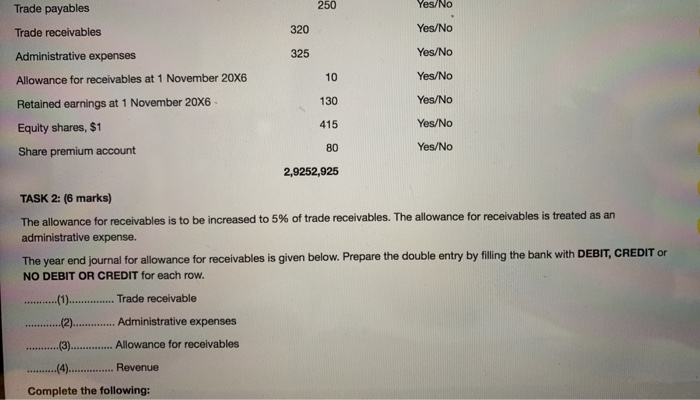

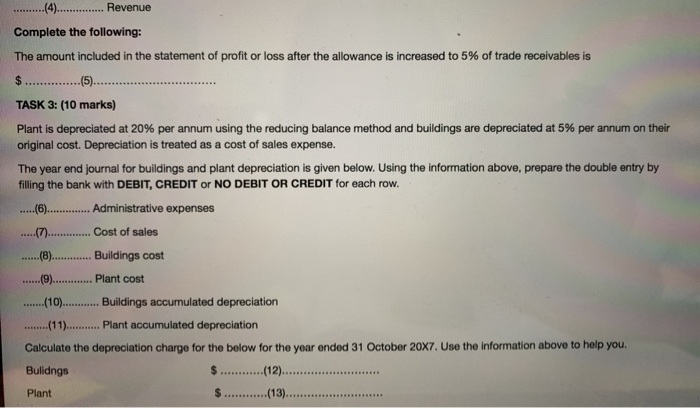

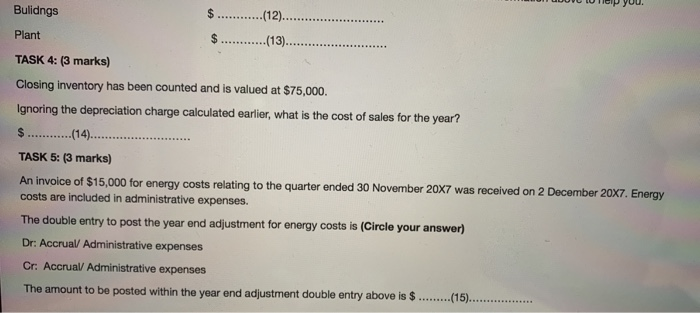

Malright, a limited liability company, has an accounting year end of 31 October. The accountant is preparing the financial statemen as at 31 October 20X7. A trial balance has been prepared. TASK 1: (8 marks) Do each of the following items belong on the statement of financial position (SOFP) as at 31 October 20X7? Cr Belongs on SOFP as at 31 October 20X7 $'000$'000 Building at cost 740 Yes/No Buildings accumulated depreciation at 1 November 60 Yes/No 20X6 Dr Plant at cost 220 Yes/No Plant accumulated depreciation at 1 November 20X6 110 Yes/No Bank balance 70 Yes/No Revenue 1,800 Yes/No 1,140 Yes/No Net purchases Inventory at 1 November 20X6 160 Yes/No Cash 20 Yes/No Trade payables 250 Yes/No Trade receivables 320 Yes/No Trade payables 250 Yes/No Trade receivables 320 Yes/No Administrative expenses 325 Yes/No Allowance for receivables at 1 November 20X6 10 Yes/No Retained earnings at 1 November 20X6 130 Yes/No Equity shares, $1 415 Yes/No Share premium account 80 Yes/No 2,9252,925 TASK 2: (6 marks) The allowance for receivables is to be increased to 5% of trade receivables. The allowance for receivables is treated as an administrative expense. The year end journal for allowance for receivables is given below. Prepare the double entry by filling the bank with DEBIT, CREDIT or NO DEBIT OR CREDIT for each row. .(1).. ..... Trade receivable Administrative expenses Allowance for receivables Revenue +++++ Complete the following: .(4) Revenue Complete the following: The amount included in the statement of profit or loss after the allowance is increased to 5% of trade receivables is $ (5). TASK 3: (10 marks) Plant is depreciated at 20% per annum using the reducing balance method and buildings are depreciated at 5% per annum on their original cost. Depreciation is treated as a cost of sales expense. The year end journal for buildings and plant depreciation is given below. Using the information above, prepare the double entry by filling the bank with DEBIT, CREDIT or NO DEBIT OR CREDIT for each row. (6)........... Administrative expenses Cost of sales Buildings cost ...(8) ).......... Plant cost (10) Buildings accumulated depreciation (11). ........ Plant accumulated depreciation Calculate the depreciation charge for the below for the year ended 31 October 20x7. Use the information above to help you. Bulidngs (12).. Plant (13) Bulidngs $ (12). Plant .(13) TASK 4: (3 marks) Closing inventory has been counted and is valued at $75,000 Ignoring the depreciation charge calculated earlier, what is the cost of sales for the year? $............(14).............. TASK 5: (3 marks) An invoice of $15,000 for energy costs relating to the quarter ended 30 November 20X7 was received on 2 December 20x7. Energy costs are included in administrative expenses. The double entry to post the year end adjustment for energy costs is (Circle your answer) Dr: Accrual Administrative expenses Cr: Accrual Administrative expenses The amount to be posted within the year end adjustment double entry above is $.........(15)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started