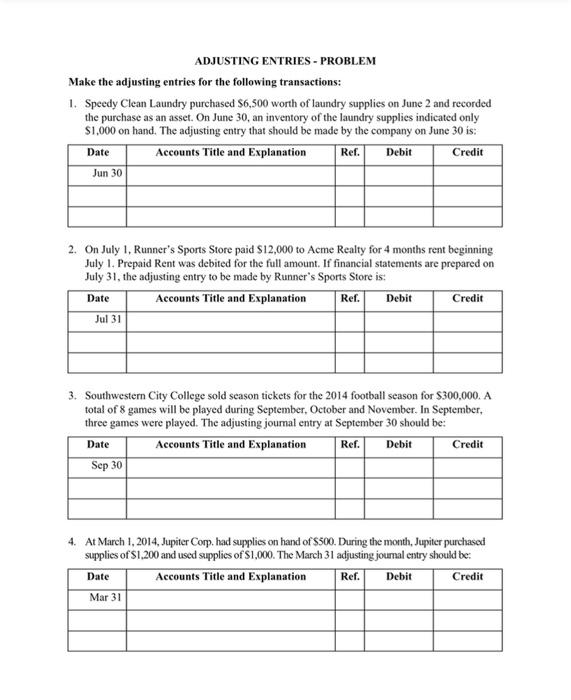

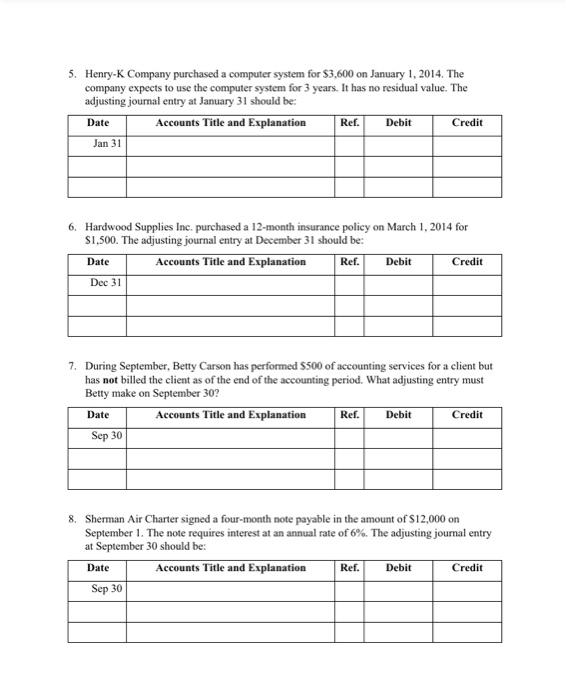

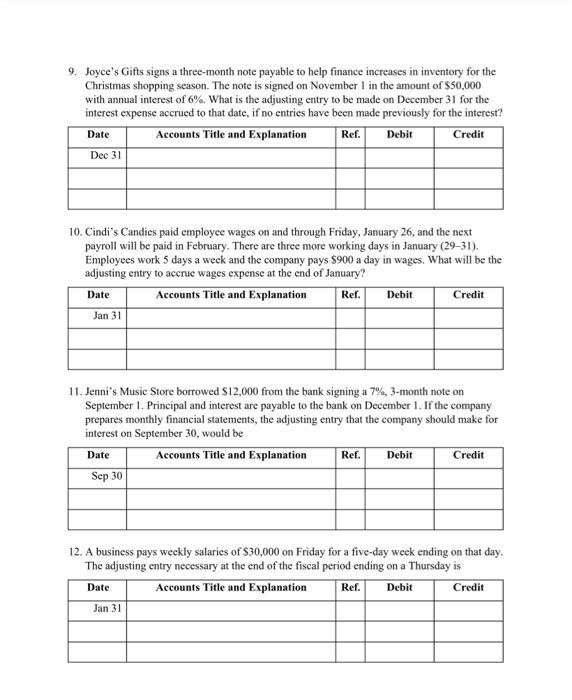

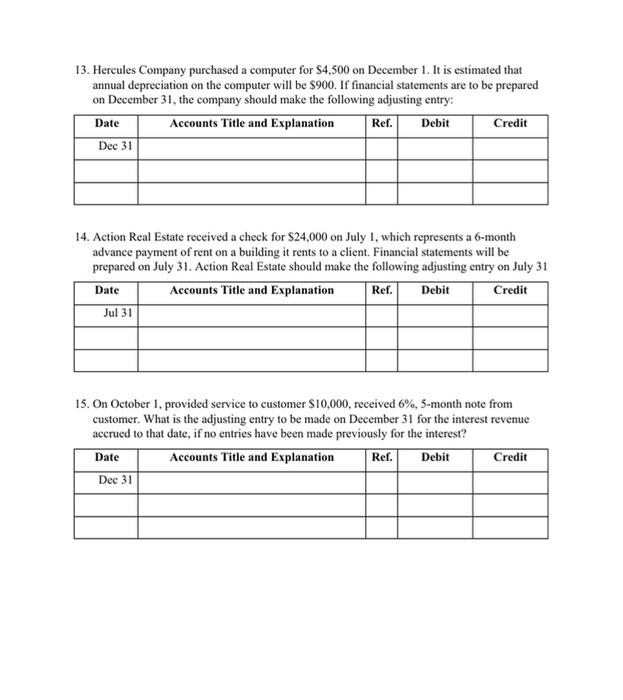

ADJUSTING ENTRIES - PROBLEM Make the adjusting entries for the following transactions: 1. Speedy Clean Laundry purchased $6,500 worth of laundry supplies on June 2 and recorded the purchase as an asset. On June 30, an inventory of the laundry supplies indicated only $1,000 on hand. The adjusting entry that should be made by the company on June 30 is: Date Accounts Title and Explanation Ref. Debit Credit Jun 30 2. On July 1, Runner's Sports Store paid $12,000 to Acme Realty for 4 months rent beginning July 1. Prepaid Rent was debited for the full amount. If financial statements are prepared on July 31, the adjusting entry to be made by Runner's Sports Store is: Date Accounts Title and Explanation Ref. Debit Credit Jul 31 3. Southwestern City College sold season tickets for the 2014 football season for $300,000. A total of 8 games will be played during September October and November. In September, three games were played. The adjusting journal entry at September 30 should be: Date Accounts Title and Explanation Ref. Debit Credit Sep 30 4. At March 1, 2014, Jupiter Corp. had supplies on hand of S500. During the month, Jupiter purchased supplies of S1,200 and used supplies of S1,000. The March 31 adjusting journal entry should be: Date Accounts Title and Explanation Ref. Debit Credit Mar 31 5. Henry-K Company purchased a computer system for $3,600 on January 1, 2014. The company expects to use the computer system for 3 years. It has no residual value. The 3 adjusting journal entry at January 31 should be: Date Accounts Title and Explanation Ref. Debit Credit Jan 31 6. Hardwood Supplies Inc. purchased a 12-month insurance policy on March 1, 2014 for $1,500. The adjusting journal entry at December 31 should be: Accounts Title and Explanation Dec 31 Date Ref. Debit Credit 7. During September, Betty Carson has performed $500 of accounting services for a client but has not billed the client as of the end of the accounting period. What adjusting entry must Betty make on September 30? Date Accounts Title and Explanation Ref. Debit Credit Sep 30 8. Sherman Air Charter signed a four-month note payable in the amount of $12,000 on September 1. The note requires interest at an annual rate of 6%. The adjusting journal entry at September 30 should be: Date Accounts Title and Explanation Ref. Debit Credit Sep 30 9. Joyce's Gifts signs a three-month note payable to help finance increases in inventory for the Christmas shopping season. The note is signed on November 1 in the amount of $50,000 with annual interest of 6%. What is the adjusting entry to be made on December 31 for the interest expense accrued to that date, if no entries have been made previously for the interest? Accounts Title and Explanation Ref. Debit Credit Date Dec 31 10. Cindi's Candies paid employee wages on and through Friday, January 26, and the next payroll will be paid in February. There are three more working days in January (29-31). Employees work 5 days a week and the company pays $900 a day in wages. What will be the adjusting entry to accrue wages expense at the end of January? Date Accounts Title and Explanation Rer. Debit Credit Jan 31 11. Jenni's Music Store borrowed $12,000 from the bank signing a 7%, 3-month note on September I. Principal and interest are payable to the bank on December 1. If the company prepares monthly financial statements, the adjusting entry that the company should make for interest on September 30, would be Date Accounts Title and Explanation Ref. Debit Credit Sep 30 12. A business pays weekly salaries of $30,000 on Friday for a five-day week ending on that day. The adjusting entry necessary at the end of the fiscal period ending on a Thursday is Date Accounts Title and Explanation Debit Credit Jan 31 Ref. 13. Hercules Company purchased a computer for $4.500 on December 1. It is estimated that annual depreciation on the computer will be $900. If financial statements are to be prepared on December 31, the company should make the following adjusting entry: Date Accounts Title and Explanation Ref. Debit Credit Dec 31 14. Action Real Estate received a check for $24,000 on July 1, which represents a 6-month advance payment of rent on a building it rents to a client. Financial statements will be prepared on July 31. Action Real Estate should make the following adjusting entry on July 31 Date Accounts Title and Explanation Ref. Debit Credit Jul 31 15. On October 1, provided service to customer S10,000, received 6%, 5-month note from customer. What is the adjusting entry to be made on December 31 for the interest revenue accrued to that date, if no entries have been made previously for the interest? Date Accounts Title and Explanation Ref. Debit Credit Dec 31