Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adjusting entry for accrued fees At the end of the current year, $ 1 7 , 9 5 0 of fees have been earned but

Adjusting entry for accrued fees

At the end of the current year, $ of fees have been earned but have not been billed to clients.

a Journalize the adjusting entry to record the accrued fees. If an amount box does not require an entry, leave it blank.

Adjusting entries for accrued salaries

Stenberg Realty pays weekly salaries of $ on Friday for a fiveday workweek ending on that day.

a Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Monday. If an amount box does not require an entry,

leave it blank.

b Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Thursday. If an amount box does not require an entry,

leave it blank.

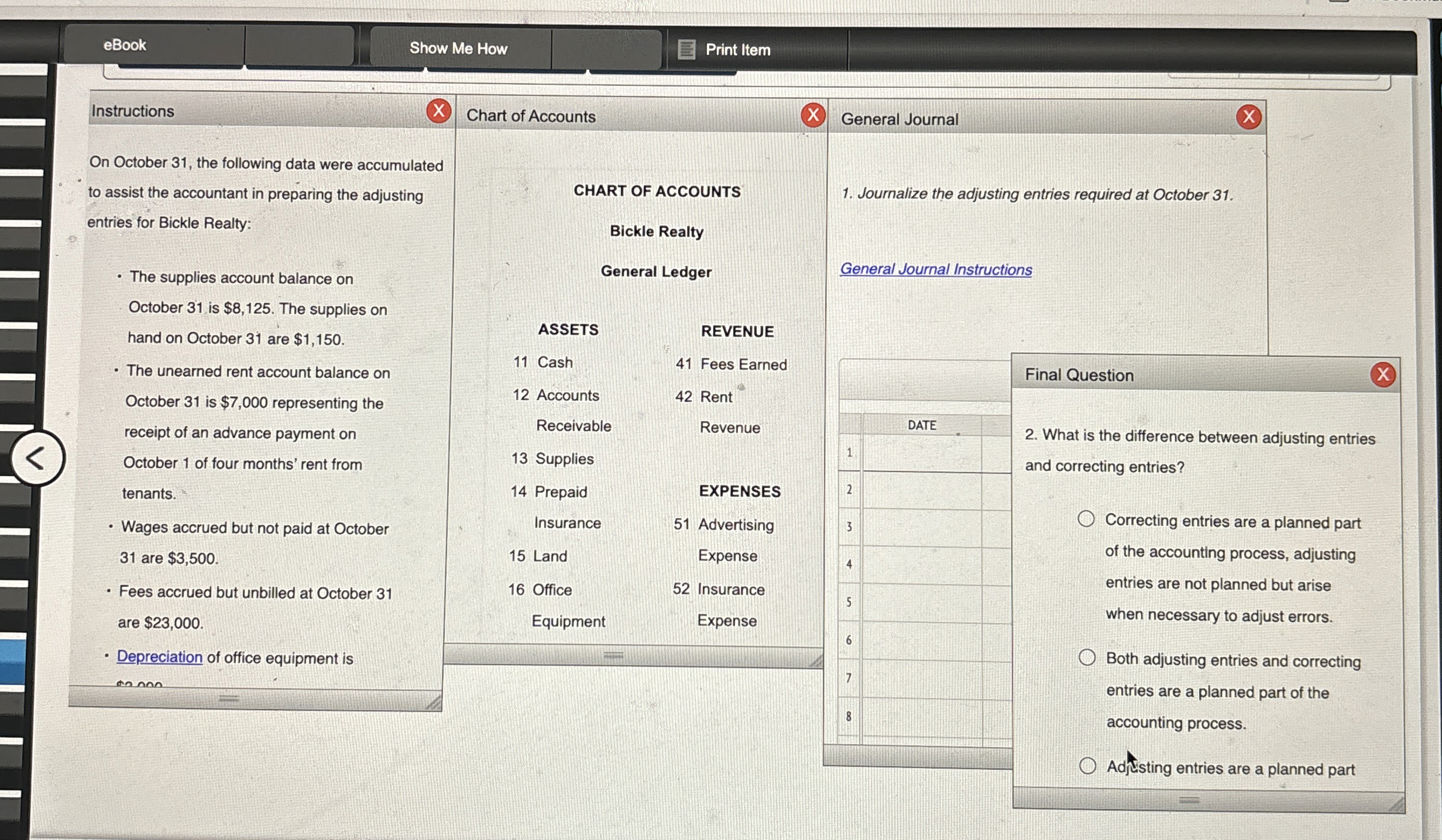

Instructions

On October the following data were accumulated

to assist the accountant in preparing the adjusting

entries for Bickle Realty:

The supplies account balance on

October is $ The supplies on

hand on October are $

The unearned rent account balance on

October is $ representing the

receipt of an advance payment on

October of four months' rent from

tenants.

Wages accrued but not paid at October

are $

Fees accrued but unbilled at October

are $

Depreciation of office equipment is

CHART OF ACCOUNTS

Bickle Realty

General Ledger

ASSETS

Cash

Accounts

Receivable

Supplies

Prepaid

Insurance

Land

Office

Equipment

Fees Earned

Rent

on ann

Chart of Accounts

Journalize the adjusting entries required at October

General Journal Instructions

Final Question

What is the difference between adjusting entries

and correcting entries?

Correcting entries are a planned part

of the accounting process, adjusting

entries are not planned but arise

when necessary to adjust errors.

Both adjusting entries and correcting

entries are a planned part of the

accounting process.

Adsisting entries are a planned part

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started