Answered step by step

Verified Expert Solution

Question

1 Approved Answer

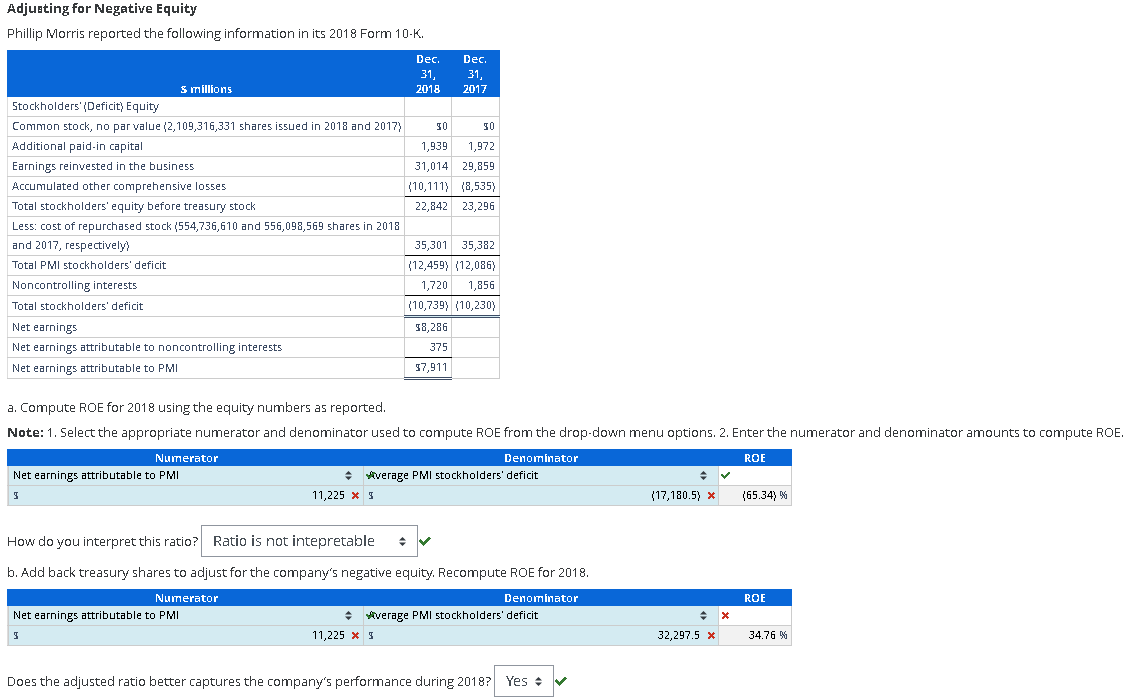

Adjusting for Negative Equity Phillip Morris reported the following information in its 2 0 1 8 Form 1 0 - K . $ millions Dec.

Adjusting for Negative Equity

Phillip Morris reported the following information in its Form K

$ millions Dec. Dec.

Stockholders' Deficit Equity

Common stock, no par value shares issued in and $ $

Additional paidin capital

Earnings reinvested in the business

Accumulated other comprehensive losses

Total stockholders' equity before treasury stock

Less: cost of repurchased stock and shares in

and respectively

Total PMI stockholders' deficit

Noncontrolling interests

Total stockholders' deficit

Net earnings $

Net earnings attributable to noncontrolling interests

Net earnings attributable to PMI $

a Compute ROE for using the equity numbers as reported.

Note: Select the appropriate numerator and denominator used to compute ROE from the dropdown menu options. Enter the numerator and denominator amounts to compute ROE.

Numerator Denominator ROE

Answer

Net earnings attributable to PMI

Answer

Average PMI stockholders' deficit

Answer

Answer

How do you interpret this ratio? Answer

Ratio is not intepretable

b Add back treasury shares to adjust for the companys negative equity. Recompute ROE for

Numerator Denominator ROE

Answer

Net earnings attributable to PMI

Answer

Average PMI stockholders' deficit

Answer

Answer

Does the adjusted ratio better captures the companys performance during Answer

YesAdjutting for Negative Equity

Phillip Morris reported the following information in its Form

a Compute ROE for using the equity numbers as reported.

Note: Select the appropriate numerator and denominator used to compute ROE from the dropdown menu options. Enter the numerator and denominator amounts to compute ROE.

How do you interpret this ratio?

b Add back treasury shares to adjust for the company's negative equity. Recompute ROE for

Does the adjusted ratio better captures the company's performance during

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started