adjusting journal entries please.

part two and three.

These are the first entries and I now need part 2 and 3.

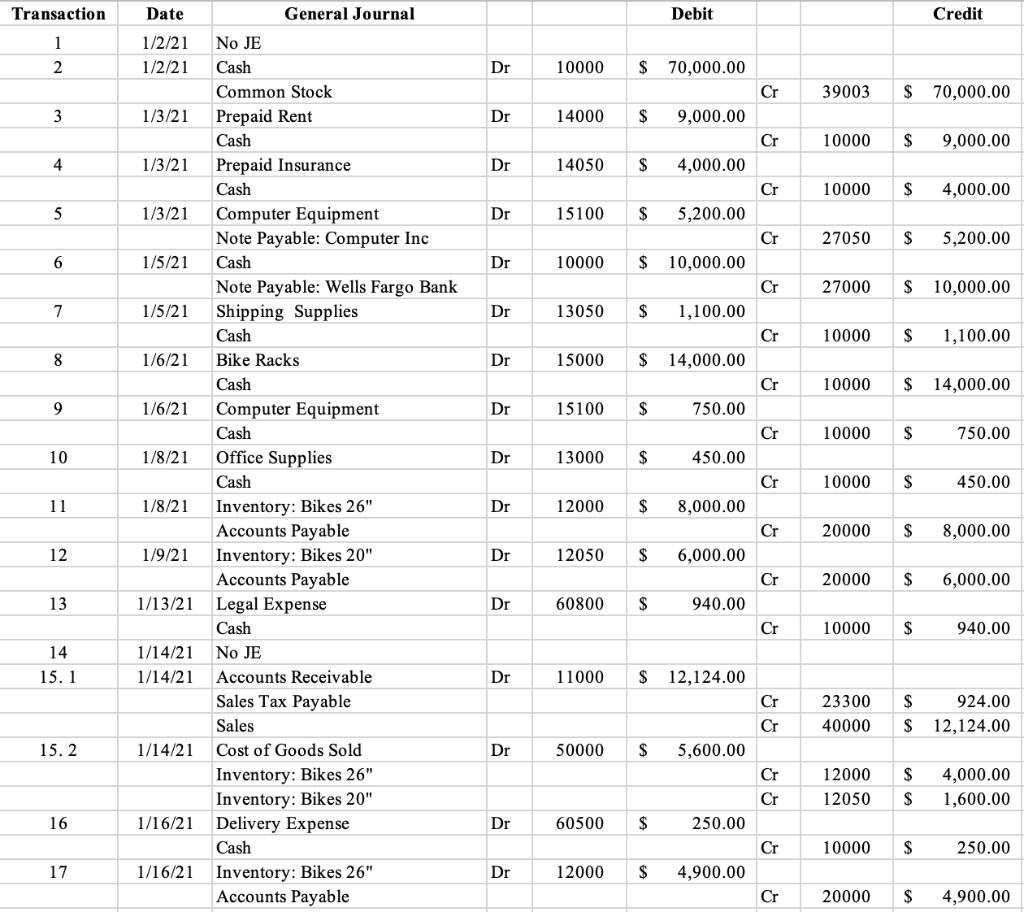

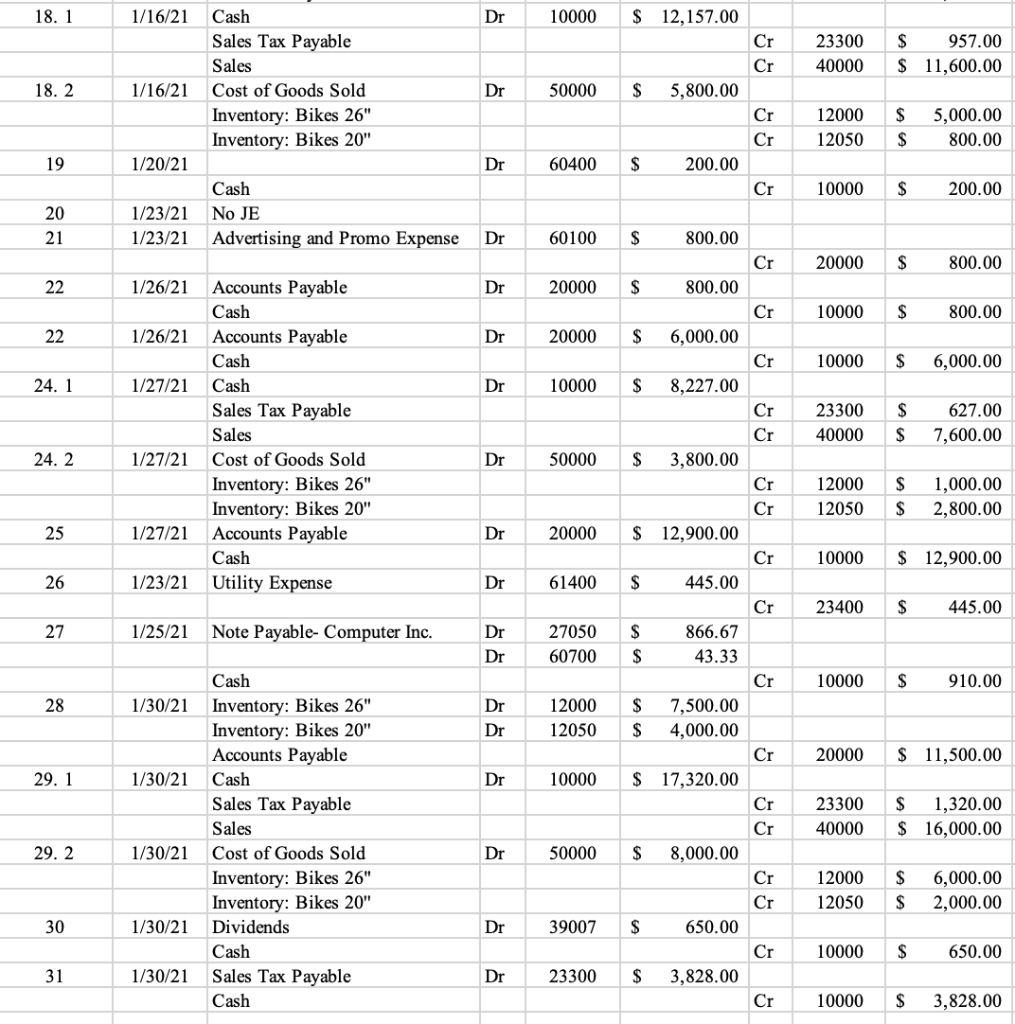

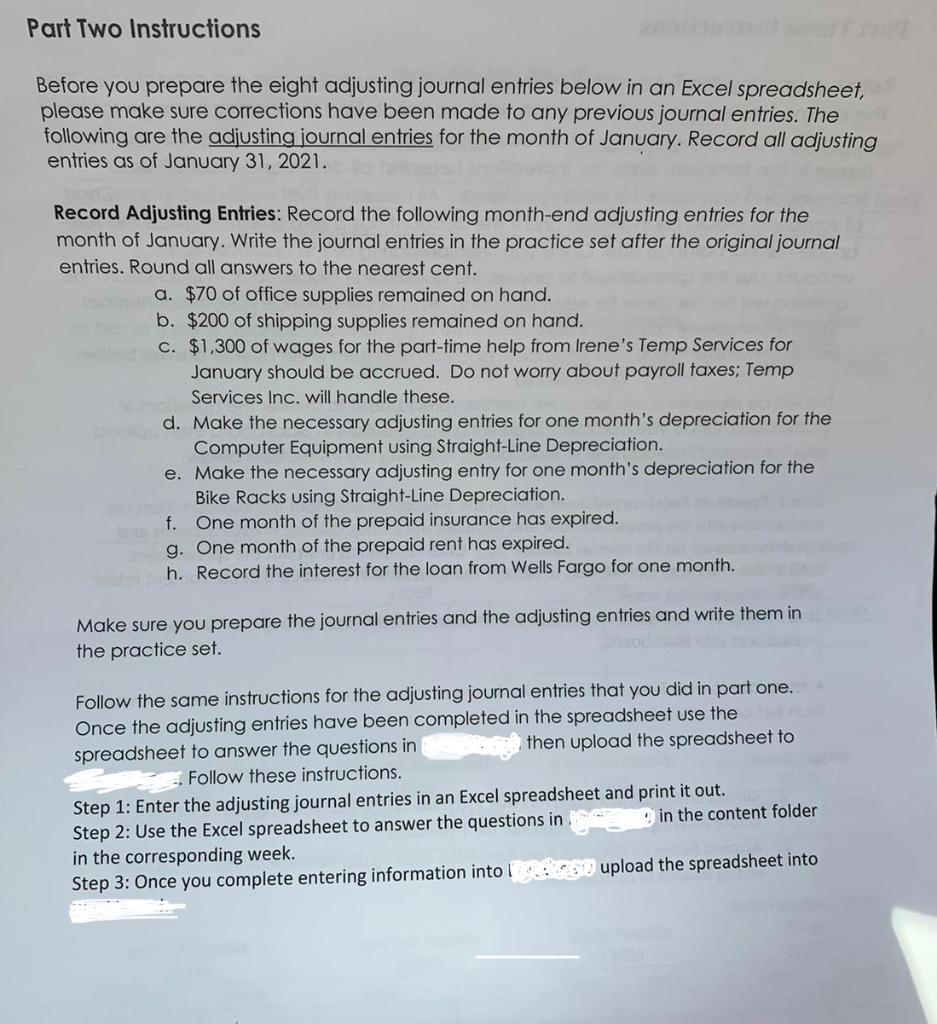

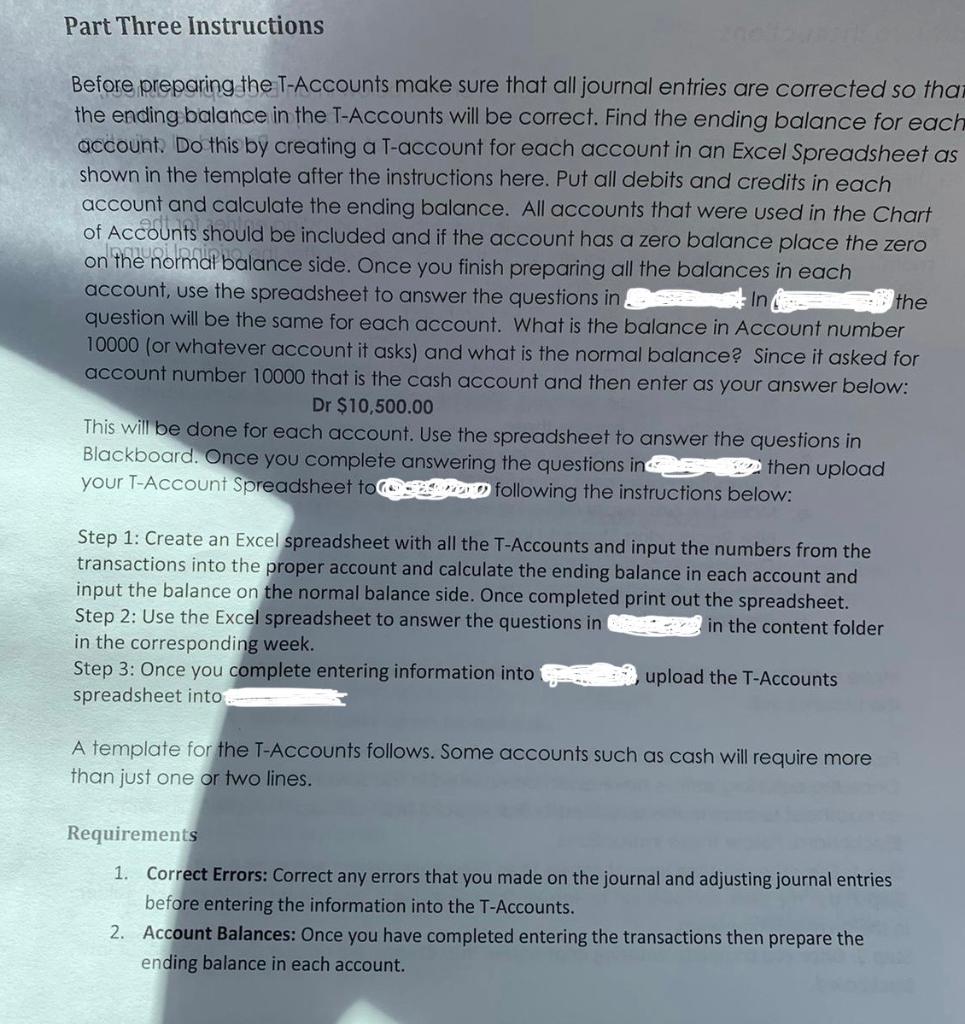

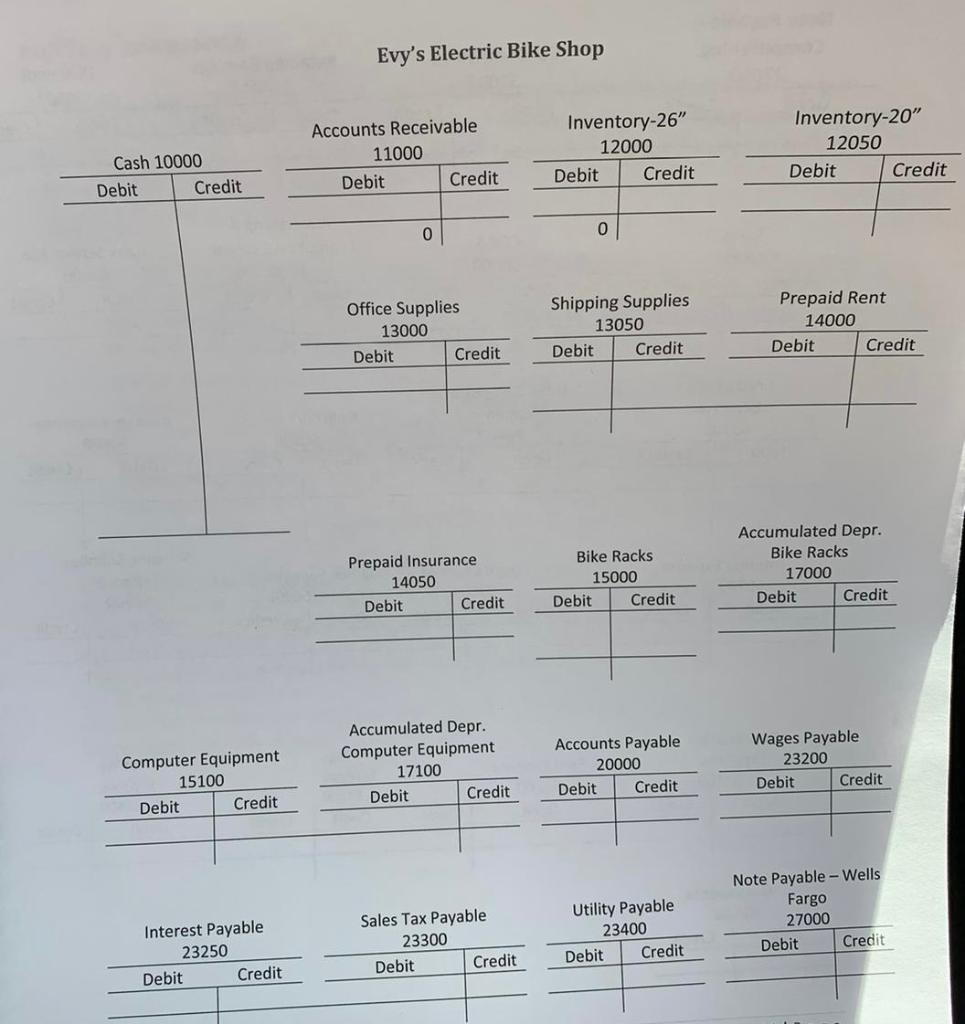

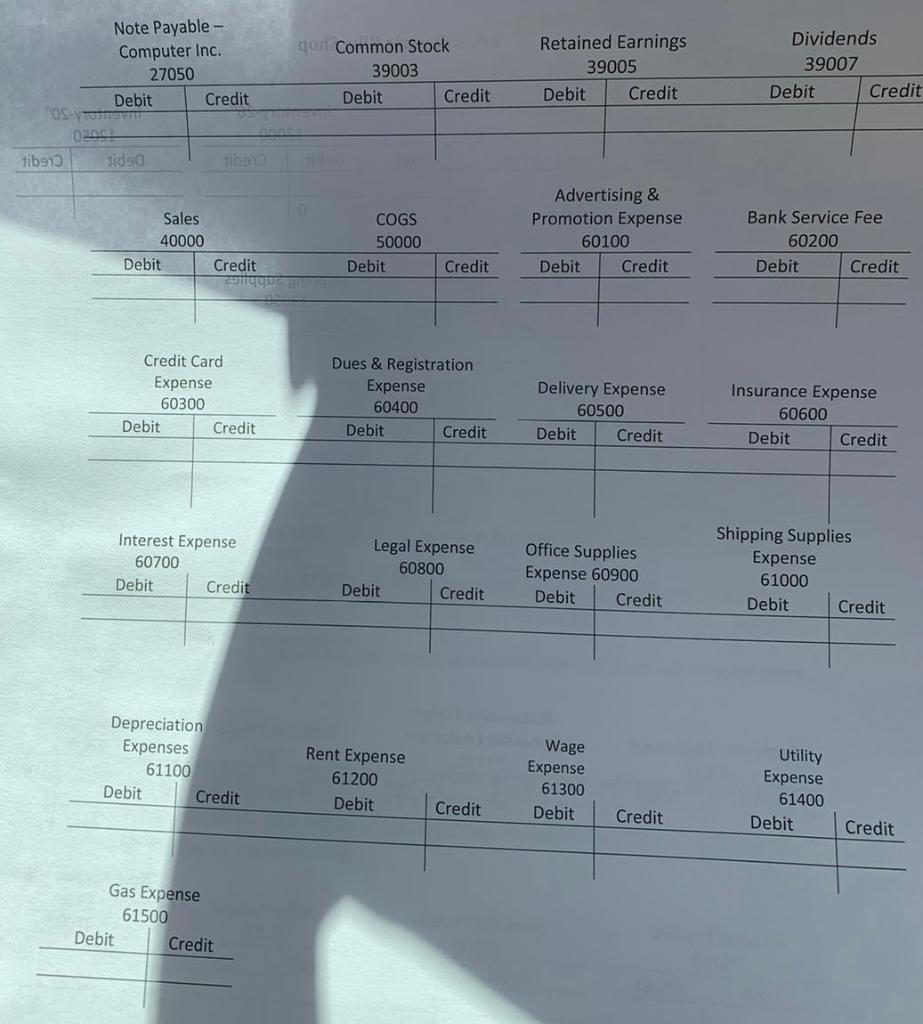

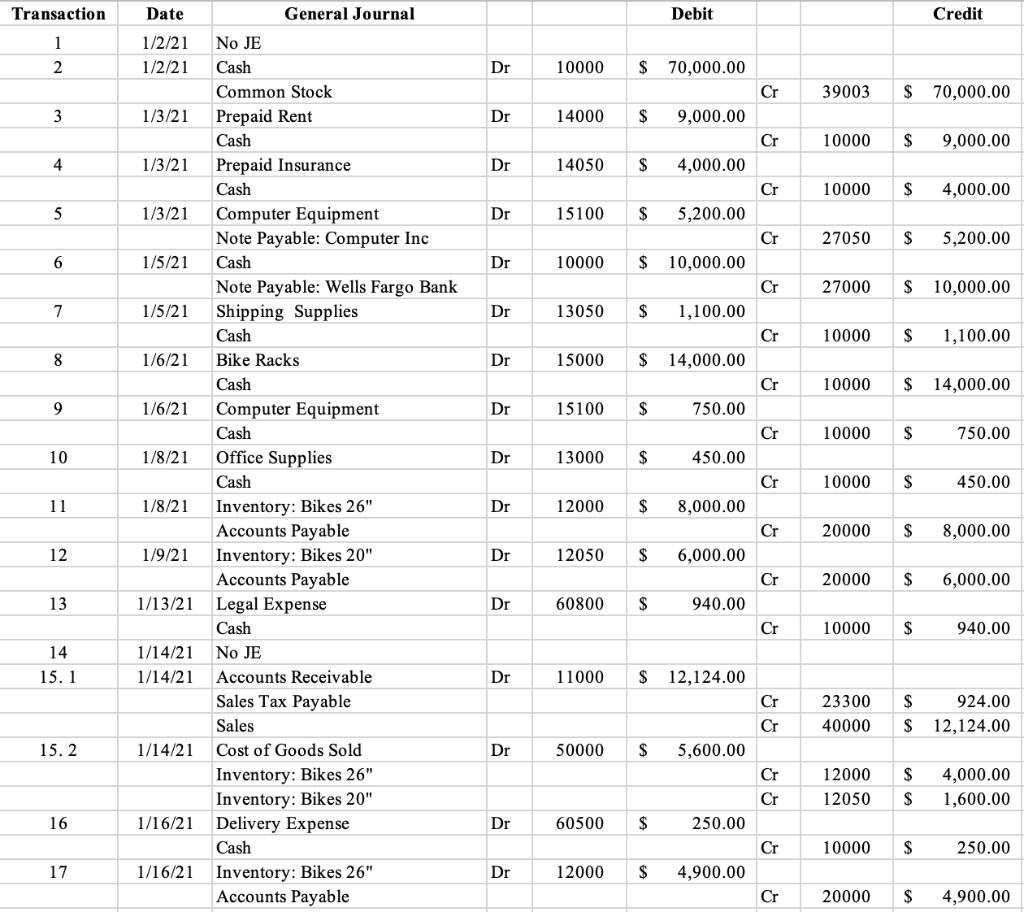

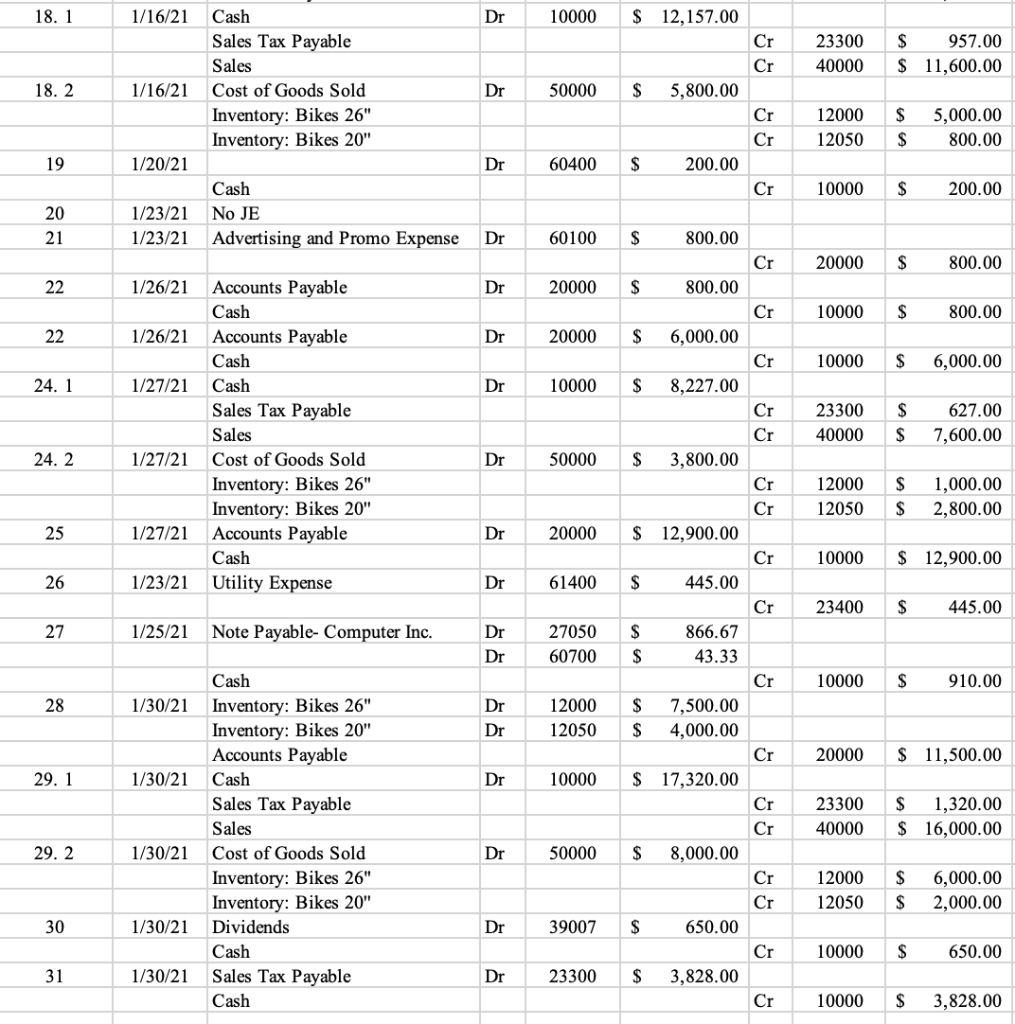

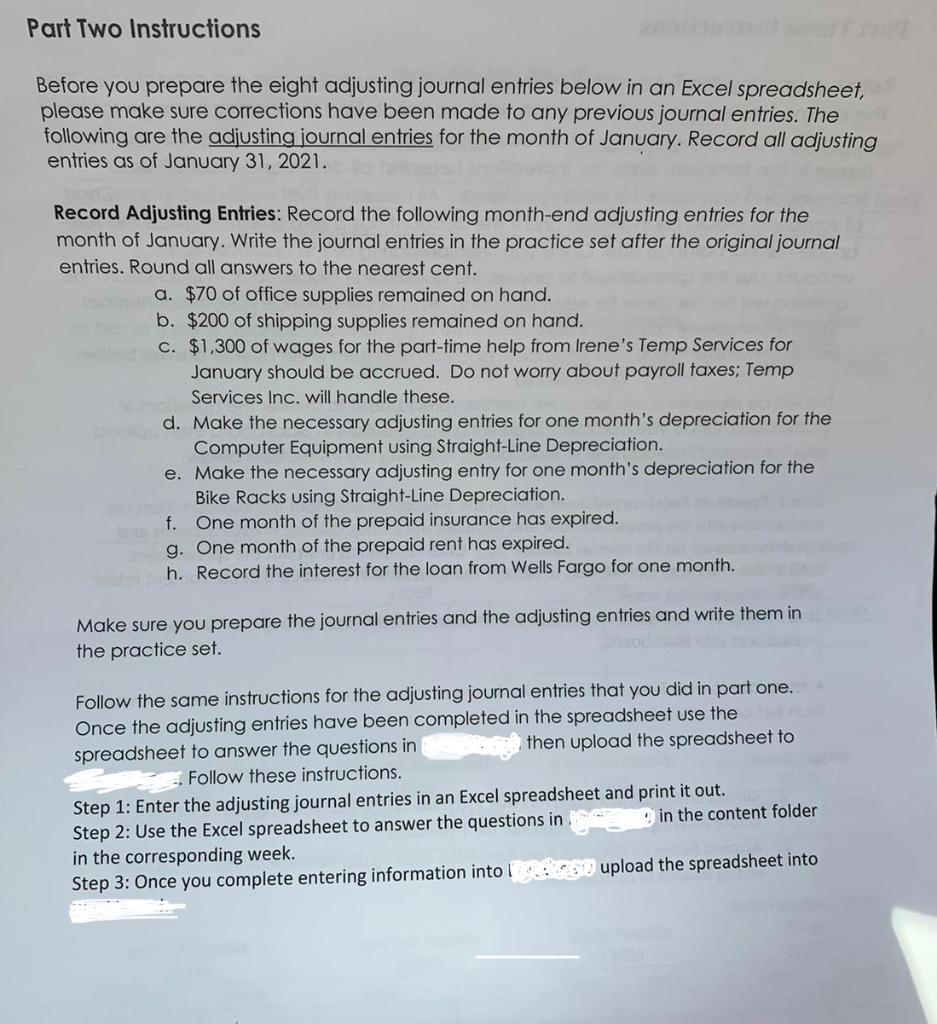

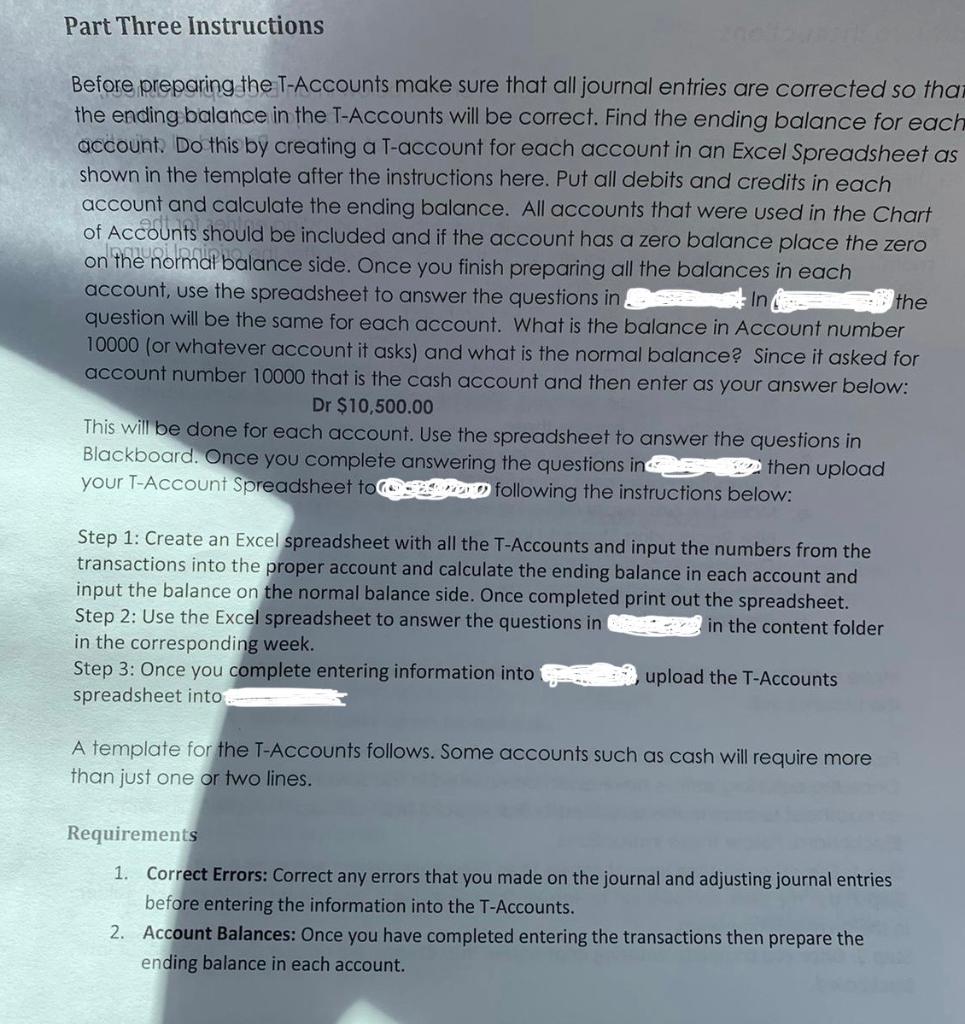

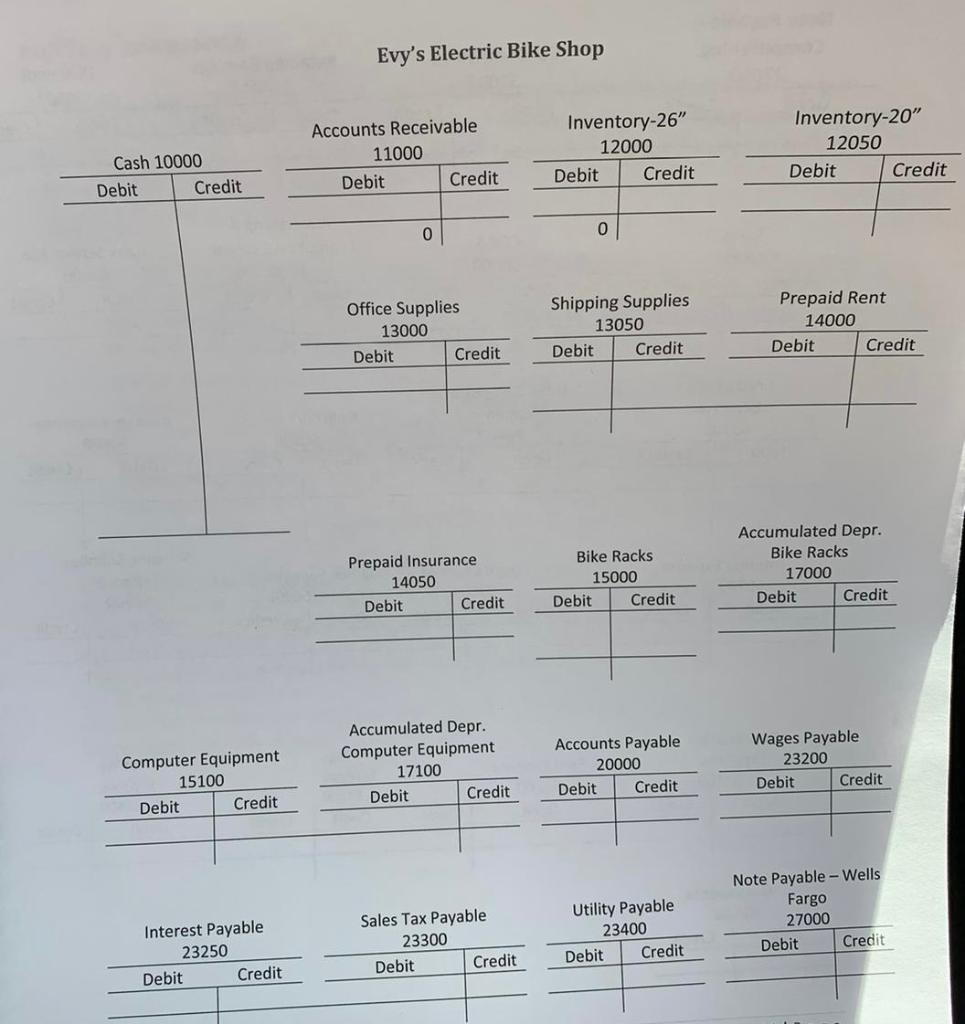

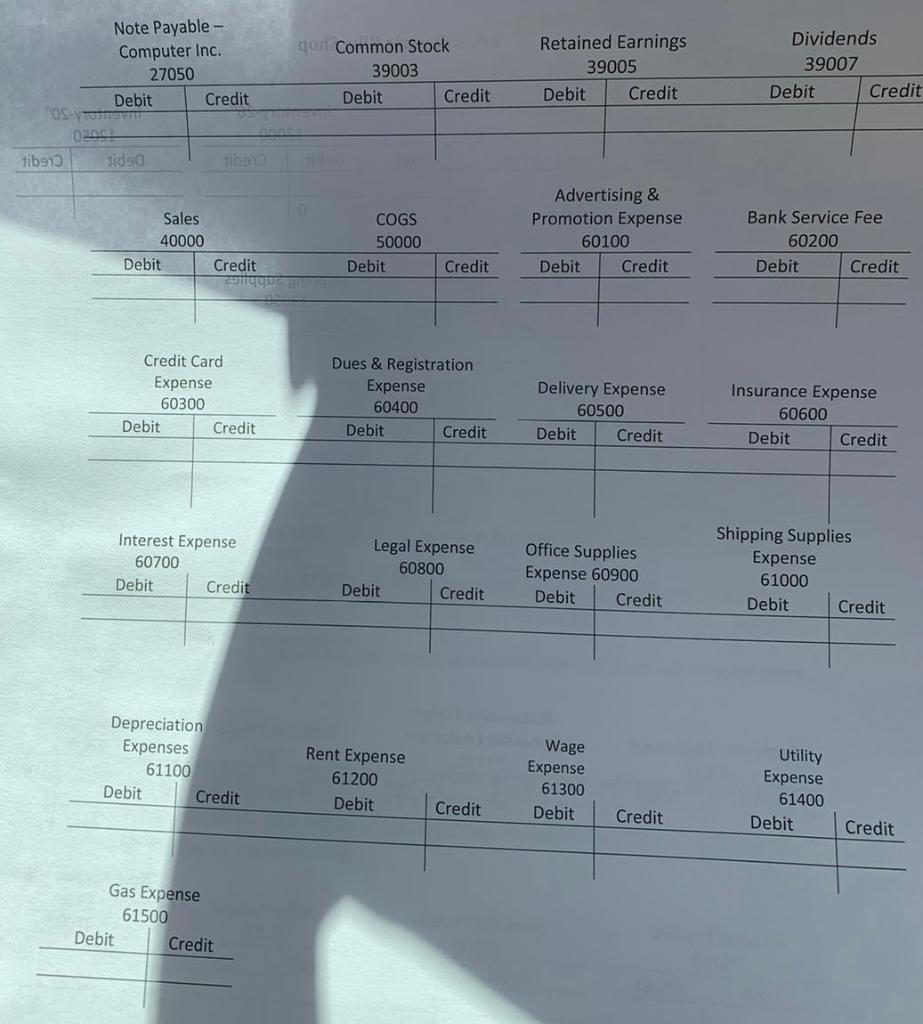

Transaction Debit Credit 1 2 Dr 10000 $ 70,000.00 Cr 39003 $ 70,000.00 3 Dr 14000 $ 9,000.00 Cr 10000 $ 9,000.00 4 Dr 14050 $ 4,000.00 Cr 10000 $ 4,000.00 5 Dr 15100 $ 5,200.00 Cr 27050 $ 5,200.00 6 Dr 10000 $ 10,000.00 Cr 27000 $ 10,000.00 7 Dr 13050 $ 1,100.00 Cr 10000 $ 1,100.00 oo 8 Date General Journal 1/2/21 NO JE 1/2/21 Cash Common Stock 1/3/21 Prepaid Rent Cash 1/3/21 Prepaid Insurance Cash 1/3/21 Computer Equipment Note Payable: Computer Inc 1/5/21 Cash Note Payable: Wells Fargo Bank 1/5/21 Shipping Supplies Cash 1/6/21 Bike Racks Cash 1/6/21 Computer Equipment Cash 1/8/21 Office Supplies Cash 1/8/21 Inventory: Bikes 26" Accounts Payable 1/9/21 Inventory: Bikes 20" Accounts Payable 1/13/21 Legal Expense Cash 1/14/21 NO JE 1/14/21 Accounts Receivable Sales Tax Payable Dr 15000 $ 14,000.00 Cr 10000 $ 14,000.00 9 Dr 15100 $ 750.00 Cr 10000 $ 750.00 10 Dr 13000 $ 450.00 Cr 10000 $ 450.00 11 Dr 12000 $ 8,000.00 Cr 20000 $ 8,000.00 12 Dr 12050 $ 6,000.00 Cr 20000 $ 6,000.00 13 Dr 60800 $ 940.00 Cr 10000 $ 940.00 14 15.1 Dr 11000 $ 12,124.00 Cr 23300 40000 $ 924.00 $ 12,124.00 Sales Cr 15.2 1/14/21 Dr 50000 $ 5,600.00 Cr Cr 12000 12050 $ $ 4,000.00 1,600.00 16 1/16/21 Cost of Goods Sold Inventory: Bikes 26" Inventory: Bikes 20" Delivery Expense Cash Inventory: Bikes 26" Accounts Payable Dr 60500 $ 250.00 Cr 10000 $ 250.00 17 1/16/21 Dr 12000 $ 4,900.00 Cr 20000 $ 4,900.00 18. 1 1/16/21 Dr 10000 $ 12,157.00 Cr Cr 23300 40000 $ 957.00 $ 11,600.00 Cash Sales Tax Payable Sales Cost of Goods Sold Inventory: Bikes 26" Inventory: Bikes 20" 18. 2 1/16/21 Dr 50000 $ 5,800.00 Cr Cr 12000 12050 $ $ 5,000.00 800.00 19 1/20/21 Dr 60400 $ 200.00 Cr 10000 $ 200.00 20 21 1/23/21 1/23/21 Cash NO JE Advertising and Promo Expense Dr 60100 $ 800.00 Cr 20000 $ 800.00 22 1/26/21 Dr 20000 $ 800.00 Cr 10000 $ 800.00 22 1/26/21 Dr 20000 $ 6,000.00 Cr 10000 $ 6,000.00 24. 1 1/27/21 Dr 10000 $ 8,227.00 Accounts Payable Cash Accounts Payable Cash Cash Sales Tax Payable Sales Cost of Goods Sold Inventory: Bikes 26" Inventory: Bikes 20" Accounts Payable Cash Utility Expense Cr Cr 23300 40000 $ $ 627.00 7,600.00 24. 2 1/27/21 Dr 50000 $ 3,800.00 Cr Cr 12000 12050 $ $ 1,000.00 2,800.00 25 1/27/21 Dr 20000 $ 12,900.00 Cr 10000 $ 12,900.00 26 1/23/21 Dr 61400 $ 445.00 Cr 23400 $ 445.00 27 1/25/21 Note Payable- Computer Inc. Dr 27050 60700 $ $ 866.67 43.33 Dr Cr 10000 $ 910.00 28 1/30/21 Dr 12000 12050 $ $ 7,500.00 4,000.00 Dr Cr 20000 $ 11,500.00 29. 1 1/30/21 Dr 10000 $ 17,320.00 Cr Cr 23300 40000 $ 1,320.00 $ 16,000.00 Cash Inventory: Bikes 26" Inventory: Bikes 20" Accounts Payable Cash Sales Tax Payable Sales Cost of Goods Sold Inventory: Bikes 26" Inventory: Bikes 20" Dividends Cash Sales Tax Payable Cash 29. 2 1/30/21 Dr 50000 $ 8,000.00 $ Cr Cr 12000 12050 6,000.00 2,000.00 $ 30 1/30/21 Dr 39007 $ 650.00 Cr 10000 $ 650.00 31 1/30/21 Dr 23300 $ 3,828.00 Cr 10000 $ 3,828.00 Part Two Instructions Before you prepare the eight adjusting journal entries below in an Excel spreadsheet, please make sure corrections have been made to any previous journal entries. The following are the adjusting journal entries for the month of January. Record all adjusting entries as of January 31, 2021. Record Adjusting Entries: Record the following month-end adjusting entries for the month of January. Write the journal entries in the practice set after the original journal entries. Round all answers to the nearest cent. a. $70 of office supplies remained on hand. b. $200 of shipping supplies remained on hand. c. $1,300 of wages for the part-time help from Irene's Temp Services for January should be accrued. Do not worry about payroll taxes; Temp Services Inc. will handle these. d. Make the necessary adjusting entries for one month's depreciation for the Computer Equipment using Straight-Line Depreciation. e. Make the necessary adjusting entry for one month's depreciation for the Bike Racks using Straight-Line Depreciation. f. One month of the prepaid insurance has expired. g. One month of the prepaid rent has expired. h. Record the interest for the loan from Wells Fargo for one month. Make sure you prepare the journal entries and the adjusting entries and write them in the practice set. Follow the same instructions for the adjusting journal entries that you did in part one. Once the adjusting entries have been completed in the spreadsheet use the spreadsheet to answer the questions in then upload the spreadsheet to Follow these instructions. Step 1: Enter the adjusting journal entries in an Excel spreadsheet and print it out. Step 2: Use the Excel spreadsheet to answer the questions in in the content folder in the corresponding week. Step 3: Once you complete entering information into upload the spreadsheet into Part Three Instructions Before preparing the T-Accounts make sure that all journal entries are corrected so than the ending balance in the T-Accounts will be correct. Find the ending balance for each account. Do this by creating a T-account for each account in an Excel Spreadsheet as shown in the template after the instructions here. Put all debits and credits in each account and calculate the ending balance. All accounts that were used in the Chart of Accounts should be included and if the account has a zero balance place the zero voi poi on the normal balance side. Once you finish preparing all the balances in each account, use the spreadsheet to answer the questions in Sinthe question will be the same for each account. What is the balance in Account number 10000 (or whatever account it asks) and what is the normal balance? Since it asked for account number 10000 that is the cash account and then enter as your answer below: Dr $10,500.00 This will be done for each account. Use the spreadsheet to answer the questions in Blackboard. Once you complete answering the questions in then upload your T-Account Spreadsheet to following the instructions below: Step 1: Create an Excel spreadsheet with all the T-Accounts and input the numbers from the transactions into the proper account and calculate the ending balance in each account and input the balance on the normal balance side. Once completed print out the spreadsheet. Step 2: Use the Excel spreadsheet to answer the questions in in the content folder in the corresponding week. Step 3: Once you complete entering information into upload the T-Accounts spreadsheet into A template for the T-Accounts follows. Some accounts such as cash will require more than just one or two lines. Requirements 1. Correct Errors: Correct any errors that you made on the journal and adjusting journal entries before entering the information into the T-Accounts. 2. Account Balances: Once you have completed entering the transactions then prepare the ending balance in each account. Evy's Electric Bike Shop Inventory-26" 12000 Debit Credit Accounts Receivable 11000 Debit Credit Inventory-20" 12050 Debit Credit Cash 10000 Debit Credit 0 0 Office Supplies 13000 Debit Credit Shipping Supplies 13050 Debit Credit Prepaid Rent 14000 Debit Credit Prepaid Insurance 14050 Debit Credit Bike Racks 15000 Debit Credit Accumulated Depr. Bike Racks 17000 Debit Credit Computer Equipment 15100 Debit Credit Accumulated Depr. Computer Equipment 17100 Debit Accounts Payable 20000 Debit Credit Wages Payable 23200 Debit Credit Credit Sales Tax Payable 23300 Debit Credit Interest Payable 23250 Debit Credit Note Payable-Wells Fargo 27000 Debit Credit Utility Payable 23400 Debit Credit Note Payable - Computer Inc. 27050 Debit Credit OST OSAC Jib913 sids qol Common Stock 39003 Debit Credit Retained Earnings 39005 Debit Credit Dividends 39007 Debit Credit Sales 40000 Debit COGS 50000 Debit Advertising & Promotion Expense 60100 Debit Credit Bank Service Fee 60200 Debit Credit Credit coucou Credit Credit Card Expense 60300 Debit Credit Dues & Registration Expense 60400 Debit Credit Delivery Expense 60500 Debit Credit Insurance Expense 60600 Debit Credit Interest Expense 60700 Debit Credit Legal Expense 60800 Debit Credit Office Supplies Expense 60900 Debit Credit Shipping Supplies Expense 61000 Debit Credit Wage Depreciation Expenses 61100 Debit Credit Rent Expense 61200 Debit Expense 61300 Debit Utility Expense 61400 Debit Credit Credit Credit Gas Expense 61500 Debit Credit