Answered step by step

Verified Expert Solution

Question

1 Approved Answer

adjusting journal & trial blance & closing entries for a merchandiser Slight, Inc. adjusts its accounts monthly, but performs closing entries annually on December 31.

adjusting journal & trial blance & closing entries for a merchandiser

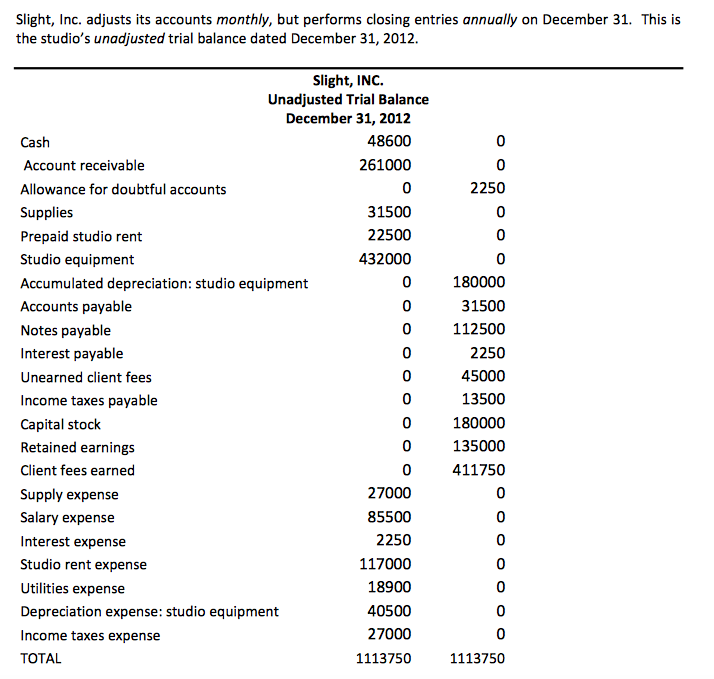

Slight, Inc. adjusts its accounts monthly, but performs closing entries annually on December 31. This is the studio's unadjusted trial balance dated December 31, 2012. Slight, INC. Unadjusted Trial Balance December 31, 2012 48600 Cash Account receivable 261000 2250 Allowance for doubtful accounts Supplies 31500 Prepaid studio rent 22500 432000 Studio equipment 180000 Accumulated depreciation: studio equipment Accounts payable 31500 o 112500 Notes payable Interest payable 2250 45000 Unearned client fees. 13500 Income taxes payable 180000 Capital stock 135000 Retained earnings Client fees earned 411750 Supply expense 27000 85500 Salary expense 2250 Interest expense Studio rent expense 117000 18900 Utilities expense 40500 Depreciation expense: studio equipment 27000 Income taxes expense 1113750 1113750 TOTAL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started