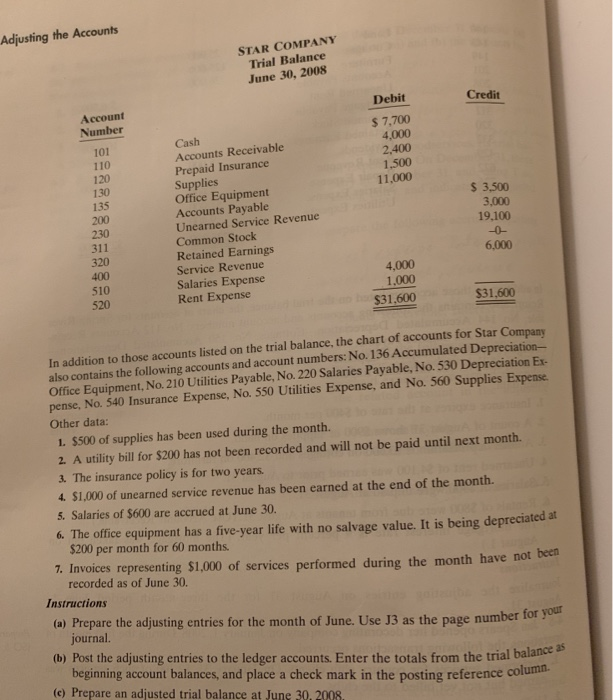

Adjusting the Accounts STAR COMPANY Trial Balance June 30, 2008 Debit Credit Account Number $ 7,700 4,000 2,400 1,500 11,000 101 110 120 130 135 200 230 311 320 400 Cash Accounts Receivable Prepaid Insurance Supplies Office Equipment Accounts Payable Unearned Service Revenue Common Stock Retained Earnings Service Revenue Salaries Expense Rent Expense $ 3,500 3,000 19,100 6,000 4,000 1,000 $31.600 510 520 S31,600 In addition to those accounts listed on the trial balance, the chart of accounts for Star Com also contains the following accounts and account numbers: No. 136 Accumulated Depreciation Office Equipment, No. 210 Utilities Payable, No. 220 Salaries Payable, No. 530 Depreciation pany Ex pense., No. 540 Insurance Expense, No. 550 Utilities Expense, and No. 560 Supplies Expense Other data: 1. $500 of supplies has been used during the month. 2. A utility bill for $200 has not been recorded and will not be paid until next month. 3. The insurance policy is for two years $1,000 of unearned service revenue has been earned at the end of the month. 5. Salaries of $600 are accrued at June 30. 6. The office equipment has a five-year life with no salvage value. It is being depreciated at $200 per month for 60 months 7. Invoices representing $1,000 of services performed during the month have not been recorded as of June 30. Instructions (a) Prepare the adjusting entries for the month of June. Use 13 as the page number for journal (b) Post the adjusting entries to the ledger accounts. Enter the totals from the trial balance s beginning account balances, and place a check mark in the posting reference column. (c) Prepare an adjusted trial balance at June 30,2008. Adjusting the Accounts STAR COMPANY Trial Balance June 30, 2008 Debit Credit Account Number $ 7,700 4,000 2,400 1,500 11,000 101 110 120 130 135 200 230 311 320 400 Cash Accounts Receivable Prepaid Insurance Supplies Office Equipment Accounts Payable Unearned Service Revenue Common Stock Retained Earnings Service Revenue Salaries Expense Rent Expense $ 3,500 3,000 19,100 6,000 4,000 1,000 $31.600 510 520 S31,600 In addition to those accounts listed on the trial balance, the chart of accounts for Star Com also contains the following accounts and account numbers: No. 136 Accumulated Depreciation Office Equipment, No. 210 Utilities Payable, No. 220 Salaries Payable, No. 530 Depreciation pany Ex pense., No. 540 Insurance Expense, No. 550 Utilities Expense, and No. 560 Supplies Expense Other data: 1. $500 of supplies has been used during the month. 2. A utility bill for $200 has not been recorded and will not be paid until next month. 3. The insurance policy is for two years $1,000 of unearned service revenue has been earned at the end of the month. 5. Salaries of $600 are accrued at June 30. 6. The office equipment has a five-year life with no salvage value. It is being depreciated at $200 per month for 60 months 7. Invoices representing $1,000 of services performed during the month have not been recorded as of June 30. Instructions (a) Prepare the adjusting entries for the month of June. Use 13 as the page number for journal (b) Post the adjusting entries to the ledger accounts. Enter the totals from the trial balance s beginning account balances, and place a check mark in the posting reference column. (c) Prepare an adjusted trial balance at June 30,2008