Answered step by step

Verified Expert Solution

Question

1 Approved Answer

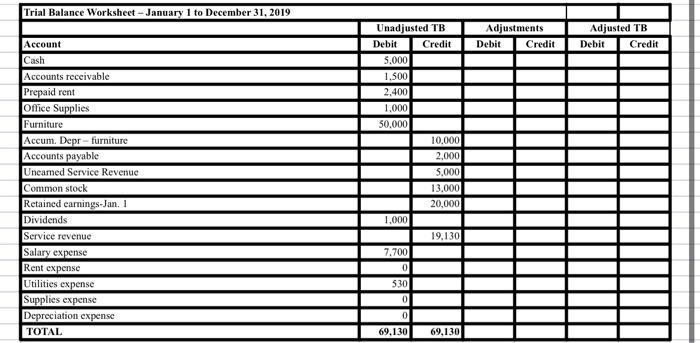

Adjustment data at December 31, 2019, include the following: a) On January 1, 2019 two years of rent was paid ($100 a month). b) The

| Adjustment data at December 31, 2019, include the following: | |||||||||||||||

| a) On January 1, 2019 two years of rent was paid ($100 a month). | |||||||||||||||

| b) The amount of Office Supplies left at December 31, 2019 is only $200. | |||||||||||||||

| c) The Furniture was purchased on January 1, 2017 and is expected to last 10 years. Yearly Depreciation Expense is $5,000 | |||||||||||||||

| d) A customer put $5,000 deposit down (in advance payments by the customer for the services to be received), and so far has only received 50% of the services. (50% of the obligations are fulfilled by the end of December 31,2019!) | |||||||||||||||

| Required: | |||||||||||||||

1: Prepare the Above Trial balance worksheet (be sure to include formulas to add/subtract cells across rows as well as to add cells down columns). | |||||||||||||||

| 2: In a separate tab: Create the Income Statement, Statement of Changes in Retained Earnings and Balance Sheet. Be sure to create formulas that link to cells in the Trial Balance worksheet. | |||||||||||||||

| 3: In a separate tab: prepare the closing entries. | |||||||||||||||

| 4: In a separate tab: prepare the post-closing trial balance | |||||||||||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started