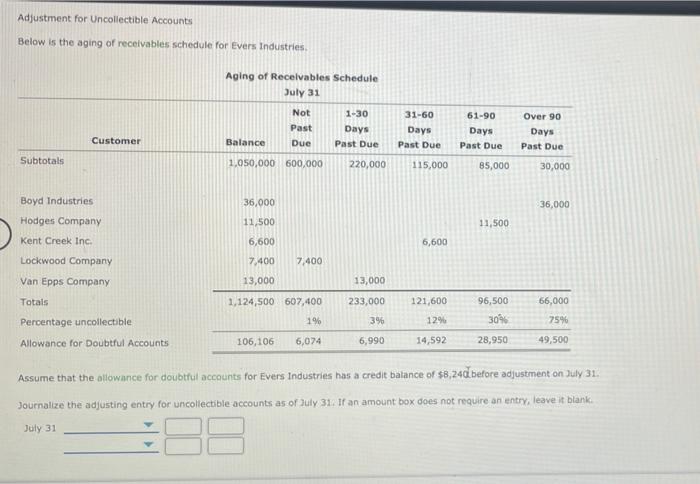

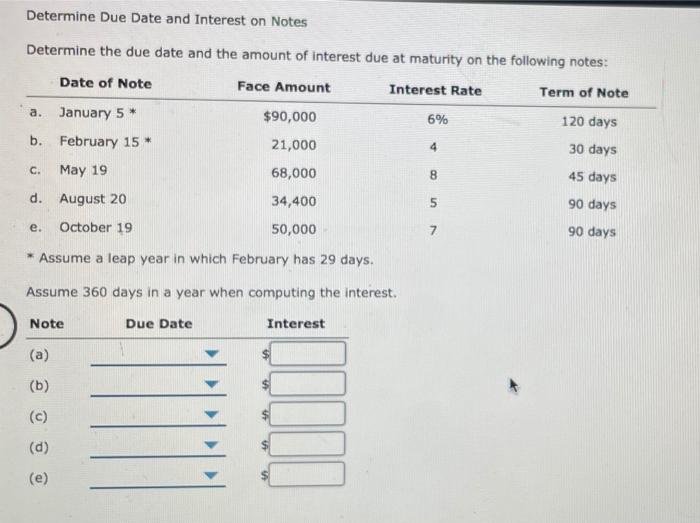

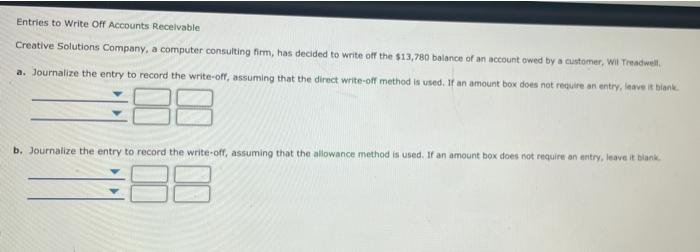

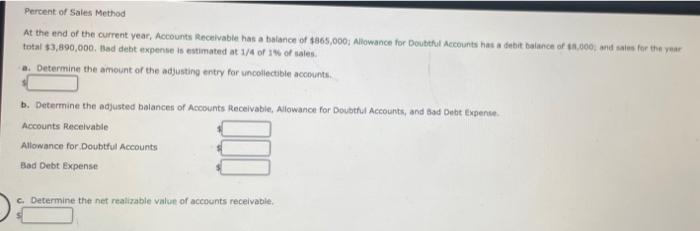

Adjustment for Uncollectible Accounts Below is the aging of receivables schedule for Evers Industries Aging of Receivables Schedule July 31 Not 1-30 Past Days Balance Due Past Due 1,050,000 600,000 220,000 31-60 Days Past Due 61-90 Days Past Due Over 90 Days Past Due Customer Subtotals 115,000 85,000 30,000 Boyd Industries 36,000 36,000 11,500 Hodges Company 11,500 Kent Creek Inc. 6,600 6,600 Lockwood Company 13,000 7.400 7,400 13,000 1,124,500 607,400 1% 233,000 Van Epps Company Totals Percentage uncollectible Allowance for Doubtful Accounts 96,500 121,600 12% 66,000 75% 3% 30 106,106 6,074 6,990 14,592 28,950 49,500 Assume that the allowance for doubtful accounts for Evers Industries has a credit balance of $8,240 before adjustment on July 31. Journalize the adjusting entry for uncollectible accounts as of July 31. If an amount box does not require an entry, leave it blank. July 31 Determine Due Date and Interest on Notes Determine the due date and the amount of interest due at maturity on the following notes: Date of Note Face Amount Interest Rate Term of Note a. January 5* $90,000 6% 120 days b. February 15* 21,000 30 days 4 C. May 19 68,000 8 45 days d. August 20 34,400 5 90 days e. October 19 50,000 7 90 days *Assume a leap year in which February has 29 days. Assume 360 days in a year when computing the interest. Note Due Date Interest (a) (b) bill (d) (e) Entries to Write Off Accounts Receivable Creative Solutions Company, a computer consulting firm, has decided to write of the $13,780 balance of an account owed by a customer, Wil Treadwell a. Journalize the entry to record the write-off, assuming that the direct write-off method is used. If an amount box does not require an entry, leave it hon b. Journalize the entry to record the write-off, assuming that the allowance method is used. If an amount box does not require an entry, leave it black Percent of Sales Method At the end of the current year, Accounts Receivable has a balance of $365,000; Allowance for Doubtful Accounts has a debit balance of 1,000, and is for the year total $3,890,000. tad de expense is estimated at 1/4 of 1 of sales Determine the amount of the adjusting entry for uncollectible account b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and tad Debe expense. Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c Determine the net realizable value of accounts receivable