Question

Adjustments Flood Relief Inc. prepares monthly financial statements and therefore adjusts its accounts at the end of every month. The following information is available for

Adjustments

Flood Relief Inc. prepares monthly financial statements and therefore adjusts its accounts at the end of every month. The following information is available for June 2017:

Required:

1. For each of the following situations, identify and analyze the adjustment necessary on June 30, 2017. Do not round intermediate calculations. If required, round your final answers to the nearest dollar.

a. Flood received a $10,000, 4%, two-year note receivable from a customer for services rendered. The principal and interest are due on June 1, 2019. Flood expects to be able to collect the note and interest in full at that time. Assume a 360-day year.

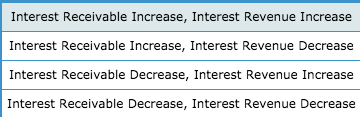

How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign.

b. Office supplies totaling $5,600 were purchased during the month. The asset account Supplies is increased whenever a purchase is made. A count in the storeroom on June 30, 2017, indicates that supplies on hand amount to $507. The supplies on hand at the beginning of the month total $475.

How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign.

c. The company purchased machines last year for $170,000. The machines are expected to be used for four years and have an estimated salvage value of $2,000. Use straight line method of depreciation.

How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Remember: if a contra account is increased, it will have the effect of decreasing the corresponding financial statement item.?

d. On June 1, the company paid $4,650 for rent for June, July, and August and increased the asset Prepaid Rent. It did not have a balance on June 1.?

How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign.?

e. The company operates seven days per week with a weekly payroll of $7,000. Wage earners are paid every Sunday. The last day of the month is Friday, June 30.?

How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign.?

f. Based on its income for the month, Flood estimates that federal income taxes for June amount to $2,900.?

How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign.?

2. Assume that Flood Relief reports net income of $35,000 before any of the adjustments. What net income will Flood Relief report for June??

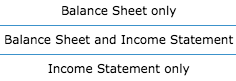

Activity Accounts Statement(s)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started