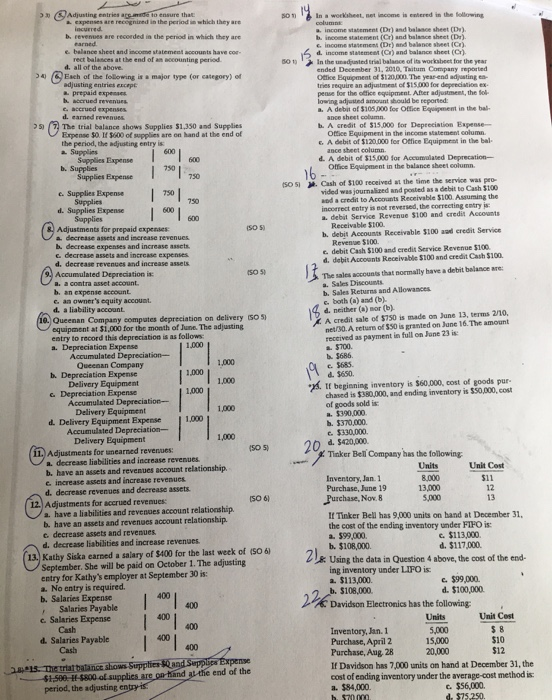

Adjustments for prepaid expenses SOM In a worksheet net income is entered in the following column income meat (D) and balance sheet (D) b. income statement (C) and balance sheet Dr. income tamen (Dr) and balance sheet(). d. income statement (C) and balance sheet (C) 50 In the adjusted trial balance of its ended December 31. Toitu reported Ottice require an adjustment of $15.000 for depreciation ex pens for the lowing adjusted amount should be reported equipment. After adjustment, the fol A debit of 105.poo for Office Equipment in the bal ance sheet colum. 1. Acredit of $15.000 for Depreciation Expense- Ottice Equipment in the income statement column 6. A debit of $120.000 for Office Equipment in the bal ance sheet column d. A debit of $15.000 for Accumulated Deprecation- Office Equipment in the balance sheel column. 16 ISO SI Cash of $100 received at the time the service was pro vided was journalized and posted as a debitte Cash $100 wod a credit to Accounts Receivable $100. Asuming the incorrect entry is not reversed the correcting entry is: a. debit Service Revenue $100 and credit Accounts Receivable 5100 h. debit Accounts Receivable 3100 ad credit Service Revenue $100 c. debit Cash $100 and credit Service Revenue $100 d. debit Accounts Receivable $100 and credit Cash $100 The sales accounts that normally have a debit balance : - Sales Discounts b. Sales Returns and Allowances both (a) and (b) d. neither (a) mor (b). X A credit sale of 5750 is made on June 13, terms 2/10, net/30. A return of $50 is granted on June 16. The amount received as payment in full on June 23 is $686 d. 3650 3. If beginning inventory is $60,000, cost of goods pur- chased is $380,000 and ending inventory is $50,000, cost of goods soldi $390,000 h. $370.000 c. $330.000 18 Adjusting entries and to ensure that expenses are recognised in the period in which they are incurred . revenues are recorded in the period in which they are earned balance sheet and income statement accounts have cor rect balances at the end of an accounting period d. all of the above 34 Each of the following 3 is a major type (or category) of adjusting entries ccp . prepaid expenses wered revenues e accrued expenses d. earned rewings 25 The trial balance shows Supplies $1,350 and Supplies Expense 0.17 3600 of supplies are on hand at the end of the period, the adjusting entry is a Supplies 600 Supplies Expense 600 . Supplies Supplies Expense 750 c. Supplies Expense | 750 Supplies 750 d. Supplies Expense 600 Supplies 600 ISO 5 a decrease assets and increase revenues b. decrease expenses and increase assets. decrease assets and increase expenses d. decrease revenues and increase assets Accumulated Depreciation is: ISO 50 a. a contra asset account b. an expense account & an owner's equity account d. a liability account 10. Queenan Company computes depreciation on delivery (505) equipment at $1,000 for the month of June. The adjusting entry to record this depreciation is as follows: a. Depreciation Expense 1.000 Accumulated Depreciation Queenan Company 1.000 b. Depreciation Expense 1.000 1.000 Delivery Equipment Depreciation Expense 1,000 Accumulated Depreciation- Delivery Equipment 1,000 d. Delivery Equipment Expense 1.000 Accumulated Depreciation- 000 Delivery Equipment 11. Adjustments for unearned revenues: (505) A. decrease liabilities and increase revenues b. have an assets and revenues account relationship increase assets and increase revenues d. decrease revenues and decrease assets. ISO 61 12. Adjustments for accrued revenues a. have a liabilities and revenues account relationship b. have an assets and revenues account relationship. c decrease assets and revenues. d. decrease liabilities and increase revenues. 13. Kathy Siska earned a salary of $400 for the last week of (SO 6) September. She will be paid on October 1. The adjusting entry for Kathy's employer at September 30 is: a. No entry is required. b. Salaries Expense 400 1 Salaries Payable 400 c. Salaries Expense 400 Cash 400 d. Salaries Payable Cash 400 2015. The trial balance shows Supplies and Supplies Expense $1,500.-#-6800 of supplies are on Hand at the end of the period, the adjusting entry is 3700 5685 1 1 19 1100 20. d. 5420,000 Tinker Bell Company has the following Units Unit Cost Inventory, Jan. 1 8.000 $11 Purchase, June 19 13,000 12 Purchase, Nov. 8 5.000 13 If Tinker Bell has 9,000 units on hand at December 31 the cost of the ending inventory under FIFO is: a. 399,000 $113,000 b. $108,000 d. $117.000 21x Using the data in Question above, the cost of the end- ing inventory under LIFO is: a. $113,000 b. $108,000 c. $99.000 d. $100,000 - 22 Davidson Electronics has the following: 400 - Units Unit Cost Inventory, Jan. 1 5,000 $8 Purchase, April 2 15,000 $10 Purchase, Aug 28 20,000 $12 If Davidson has 7.000 units on hand at December 31, the cost of coding inventory under the average-cost method is a. $84,000 c. $56,000 hun men $75.250