Question

ADJUSTMENTS: for the month of August. a. the business rents an office at a monthly rate of $1,600; on August 1, four months rent was

ADJUSTMENTS: for the month of August.

a. the business rents an office at a monthly rate of $1,600; on August 1, four months rent was paid in advance.

b. Office supplies on hand at August 31 amounted to $200.

c. The office equipment was purchased on August 1 and is being depreciated over an estimated useful life of 10 years.

d. No interest has yet been paid on the note payable. Accrued interest at August 31 amounts to $100.

e. Salaries earned by the office staff but not yet paid amounted to $470 at August 31.

f. Many clients are asked to make an advance payment for the legal services to be rendered in future months. During August, $3,450 of these advances were earned by the business.

g. Some clients are not billed until all services relating to their matter have been rendered. As of August 31, services priced at $1,140 had been rendered to these clients but had not yet been recorded in the accounting records.

INSTRUCTIONS:

1. PREPARE THE ADJUSTING ENTRIES

2. PREPARE AN INCOME STATEMENT & A BALANCE SHEET FOR THE MONTH ENDED AUGUST 31. (You may want to prepare a Statement of Retained Earnings, it will help prove Equity.)

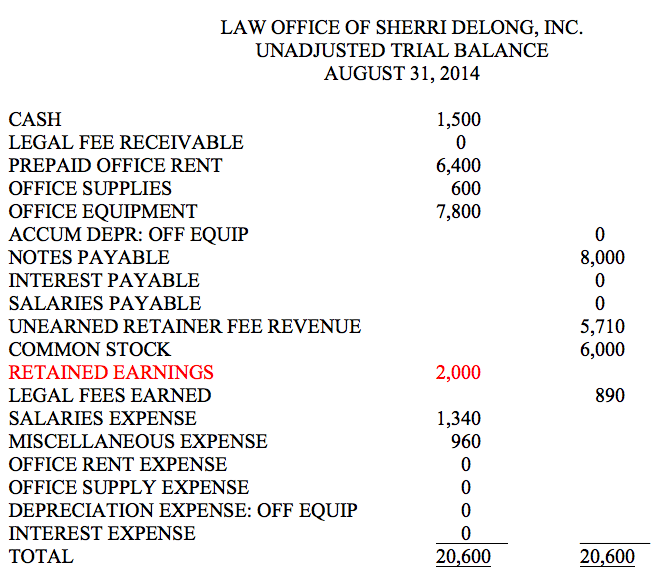

LAW OFFICE OF SHERRI DELONG, INC. UNADJUSTED TRIAL BALANCE AUGUST 31,2014 CASH LEGAL FEE RECEIVABLE PREPAID OFFICE RENT OFFICE SUPPLIES OFFICE EQUIPMENT ACCUM DEPR: OFF EQUIP NOTES PAYABLE INTEREST PAYABLE SALARIES PAYABLE UNEARNED RETAINER FEE REVENUE COMMON STOCK RETAINED EARNINGS LEGAL FEES EARNED SALARIES EXPENSE MISCELLANEOUS EXPENSE OFFICE RENT EXPENSE OFFICE SUPPLY EXPENSE DEPRECIATION EXPENSE: OFF EQUIP INTEREST EXPENSE TOTAL 1,500 6,400 600 7,800 8,000 5,710 6,000 6 2 0 2,000 890 1,340 960 9 20,600 20,600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started