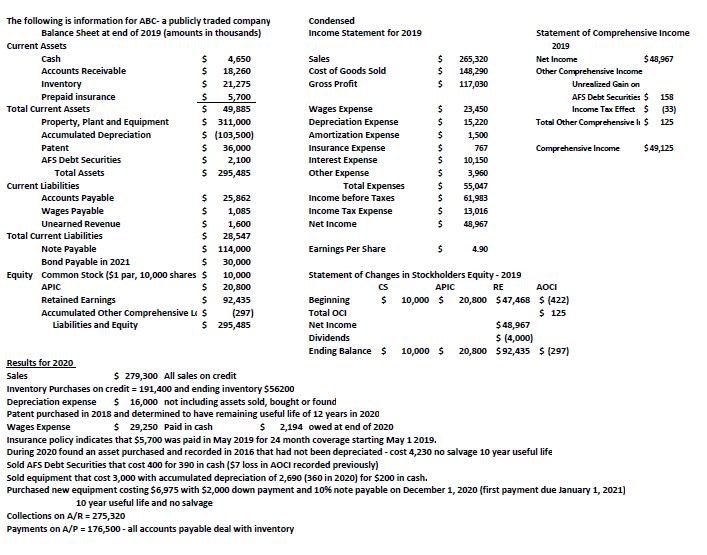

The following is information for ABC- a publicly traded company Balance Sheet at end of 2019 (amounts in thousands) Condensed Income Statement for 2019

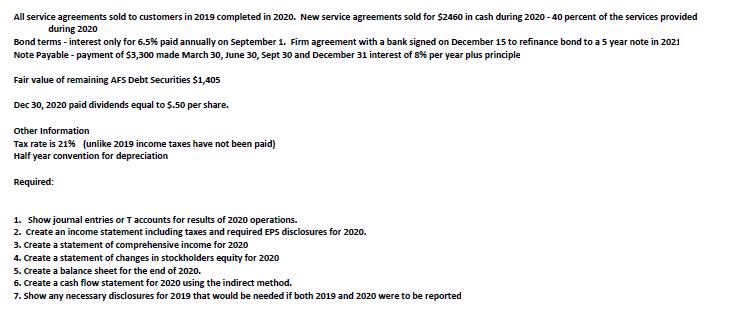

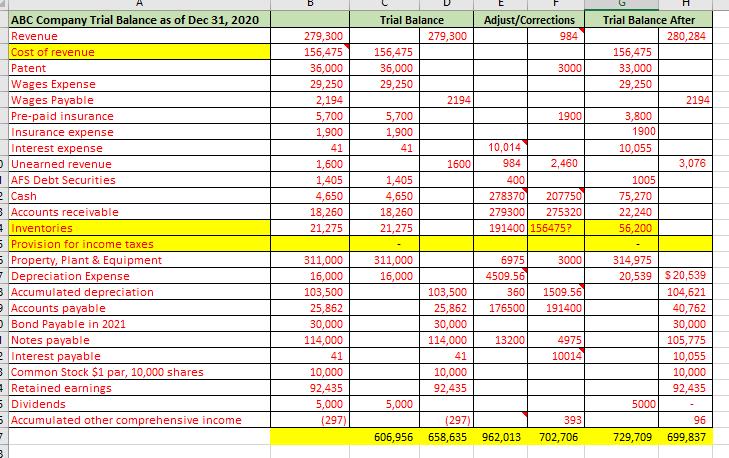

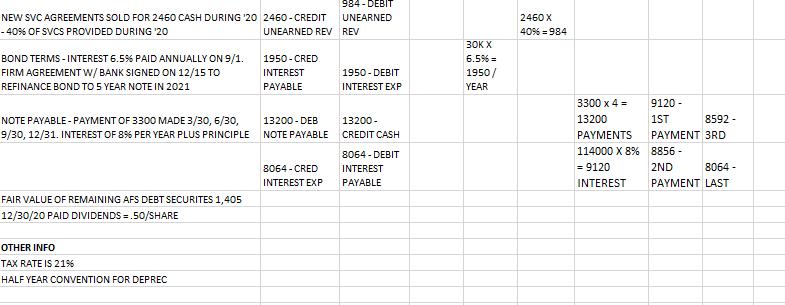

The following is information for ABC- a publicly traded company Balance Sheet at end of 2019 (amounts in thousands) Condensed Income Statement for 2019 Statement of Comprehensive Income Current Assets 2019 Cash Sales 265,320 $48,967 4,650 18,260 21,275 Net Income Accounts Receivable Cost of Goods Sold 148,290 Other Comprehensive Income Unrealized Gain on Gross Profit Inventory Prepaid insurance Total Current Assets 117,030 AFS Debt Securities $ 5,700 49,885 158 Income Tax Effect S wages Expense Depreciation Expense Amortization Expense 23,450 (33) Property, Plant and Equipment Accumulated Depreciation $ 311,000 $ (103,500) 15,220 Total Other Comprehensive li $ 125 1,500 Patent Comprehensive Income $49,125 36,000 2,100 $ 295,485 Insurance Expense Interest Expense Other Expense 767 AFS Debt Securities 10,150 Total Assets 3,960 Current Liabilities Total Expenses Income before Taxes 55,047 61,983 Accounts Payable 25,862 Wages Payable 1,085 Income Tax Expense 13,016 Unearned Revenue 48,967 1,600 28,547 $ 114,000 Net Income Total Current Liabilities Earnings Per Share Note Payable Bond Payable in 2021 4.90 30,000 Equity Common Stock ($1 par, 10,000 shares $ Statement of Changes in Stockholders Equity - 2019 10,000 20,800 92,435 (297) $ 295,485 APIC CS APIC RE AOCI 20,800 $47,468 $ (422) $ 125 Beginning Retained Earnings Accumulated Other Comprehensive Le S Liabilities and Equity 10,000 $ Total OCI $48,967 $ (4,000) 20,800 $92,435 $ (297) Net Income Dividends Ending Balance 10,000 $ Results for 2020 Sales $ 279,300 All sales on credit Inventory Purchases on credit = 191,400 and ending inventory $56200 Depreciation expense Patent purchased in 2018 and determined to have remaining useful life of 12 years in 2020 $ 16,000 not including assets sold, bought or found $ 29,250 Paid in cash 2,194 owed at end of 2020 wages Expense Insurance policy indicates that $5,700 was paid in May 2019 for 24 month coverage starting May 12019. During 2020 found an asset purchased and recorded in 2016 that had not been depreciated - cost 4,230 no salvage 10 year useful life Sold AFS Debt Securities that cost 400 for 390 in cash ($7 loss in AOCI recorded previously) Sold equipment that cost 3,000 with accumulated depreciation of 2,690 (360 in 2020) for $200 in cash. Purchased new equipment costing $6,975 with $2,000 down payment and 10% note payable on December 1, 2020 (first payment due January 1, 2021) 10 year useful life and no salvage Collections on A/R = 275,320 Payments on A/P = 176,500 - all accounts payable deal with inventory All service agreements sold to customers in 2019 completed in 2020. New service agreements sold for $2460 in cash during 2020 - 40 percent of the services provided during 2020 Bond terms - interest only for 6.5% paid annually on September 1. Firm agreement with a bank signed on December 15 to refinance bond to a 5 year note in 2021 Note Payable - payment of $3,300 made March 30, June 30, Sept 30 and December 31 interest of 8% per year plus principle Fair value of remaining AFS Debt securities $1,405 Dec 30, 2020 paid dividends equal to S.50 per share. Other Information Tax rate is 21% (unlike 2019 income taxes have not been paid) Half year convention for depreciation Required: 1. Show journal entries or Taccounts for results of 2020 operations. 2. Create an income statement including taxes and required EPS disclosures for 2020. 3. Create a statement of comprehensive income for 2020 4. Create a statement of changes in stockholders equity for 2020 5. Create a balance sheet for the end of 2020. 6. Create a cash flow statement for 2020 using the indirect method. 7. Show any necessary disclosures for 2019 that would be needed if both 2019 and 2020 were to be reported ABC Company Trial Balance as of Dec 31, 2020 Trial Balance Adjust/Corrections Trial Balance After Revenue 279,300 279,300 984 280,284 Cost of revenue 156,475 156,475 156,475 Patent 36,000 29,250 2,194 36,000 3000 33,000 Wages Expense Wages Payable Pre-paid insurance 29,250 29,250 2194 2194 5,700 5,700 1900 3,800 1,900 1900 Insurance expense Interest expense OUnearned revenue 1AFS Debt Securities 2 Cash 8 Accounts receivable 4Inventories 5 Provision for income taxes 5 Property, Plant & Equipment 7Depreciation Expense B Accumulated depreciation e Accounts payable O Bond Payable in 2021 1 Notes payable e Interest payable 8Common Stock $1 par, 10,000 shares a Retained earnings 5 Dividends 5 Accumulated other comprehensive income 1,900 41 41 10,014 10,055 1,600 1600 984 2,460 3,076 1,405 1,405 400 1005 4,650 4,650 278370 207750 75,270 18,260 21,275 22,240 56,200 18,260 279300 275320 21,275 191400 156475? 311,000 311,000 6975 3000 314,975 16,000 16,000 4509.56 20,539 $ 20,539 103,500 103,500 360 1509.56 104,621 25,862 30,000 25,862 176500 191400 40,762 30,000 30,000 114,000 114,000 13200 4975 105,775 41 41 10014 10,055 10,000 10,000 10,000 92,435 5,000 92,435 92,435 5,000 5000 (297) (297) 393 96 606,956 658,635 962,013 702,706 729,709 699,837 Results for 2020 Sales 279,300 COGS = 21275 + 191400 - 56200 = 156475? INV PURCHASES ON CREDIT = 191,400 ENDING INV 56200 191400 - AP 191400 - INV DEPRECIATION EXP 16000 16000 STARTING DEP EXP PATENT PURCHASED '18 USEFUL LIFE 12 YEARS IN 2020 3000-Debit 3000 - CREDIT DEPREC 36000/12 PATENT EXPENSE = 3000 WAGES EXP 29250 - PAID IN CASH. 2194 OWED AT END OF 2020 2194 - 29250-WAGES WAGES EXP 29250-CASH PAYABLE 237.50/M INSURANCE 5700 - PD IN 2019 FOR 24 MON COVERAGE STARTING 5/1/19 1900 - 1900-CR PPD ONTH X 8 INSURANCE EXP INS MONTHS 423/YEAR DURING 2020, FOUND ASSET PURCHASED AND RECORDED IN '16 THAT WAS NOT DEPRECIATED - COST 4230 NO SALVAGE, 10 YEAR USEFUL LIFE X3+ 1480.50 - 211.50 1480.50 - DEB (HALF YR CONV) CRED ACC DEP EXPENSE DEPR EXPENSE 400-DEBIT 400 - SOLD AFS DEBT SEC THAT COST 400 FOR 290 CASH ($7 LOSS IN AOCI PREV RECORDED) DEBT SEC CREDIT (7)- CRED AOCI 390-DEB CASH AFS AOCI 360- SOLD EQUIP THAT COST 3000 W/ ACC DEPREC 2,690 (360 200-DEBIT IN 2020) FOR 200 CASH 3000 - CREDIT DEBIT ACC CASH EQUIP DEPREC 6975/10 YEARS=69 7.50/YEAR /2 HALF 41.46 - PURCHASED NEW EQUIP COSTING 6975 WITH 2000 41.46 - DEBIT CREDIT YR DOWN PAYMENT AND 10% NOTE PAYABLE ON 12/1/20 (FIRST PAYMENT DUE 1/1/21) INTEREST INTEREST CONVEN - EXPENSE PAYABLE 348.75 4975 X 10% /12 MONTHS =41.46 INTEREST DEC '20 348.75/ 12 MONTHS = 29.06 - CRED 29.06 FOR 29.06 - DEB ACC DEPR DEC 10 YEAR USEFUL LIFE NO SALVAGE DEPR EXPENSE EXPENSE DEPREC 4975- CREDIT 6975 - DEBIT NOTE PAYABLE PLANT, EQUIP A/R 275320 CREDIT AR DEBIT CASH A/P PAYMENTS 176500 DEBIT AP CREDIT CASH ALL SVC AGREEMENTS TO CUSTOMERS IN '19 COMPLETED 984- CREDIT IN'20. REV 2460 - DEBIT CASH 984 - DEBIT NEW SVC AGREEMENTS SOLD FOR 2460 CASH DURING '20 2460 - CREDIT UNEARNED 2460 X -40% OF SVCS PROVIDED DURING '20 UNEARNED REV REV 40% = 984 30K X BOND TERMS - INTEREST 6.5% PAID ANNUALLY ON 9/1. FIRM AGREEMENT w/BANK SIGNED ON 12/15 TO REFINANCE BOND TO 5 YEAR NOTE IN 2021 1950 - CRED 6.5% = INTEREST 1950 - DEBIT 1950/ PAYABLE INTEREST EXP YEAR 3300 x 4 = 9120 - 13200 1ST 8592 - NOTE PAYABLE - PAYMENT OF 3300 MADE 3/30, 6/30, 9/30, 12/31. INTEREST OF 8% PER YEAR PLUS PRINCIPLE NOTE PAYABLE CREDIT CASH 13200 - DEB 13200 - PAYMENTS PAYMENT 3RD 114000 X 8% 8856 - 8064 - DEBIT 8064 - CRED INTEREST = 9120 2ND 8064 - INTEREST EXP PAYABLE INTEREST PAYMENT LAST FAIR VALUE OF REMAINING AFS DEBT SECURITES 1,405 12/30/20 PAID DIVIDENDS =.50/SHARE OTHER INFO TAX RATE IS 21% HALF YEAR CONVENTION FOR DEPREC

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

LLE Show entre for rest of 2020 Operativ F Account Sa...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started