Question

ADMINISTRATION On 15 May 2020, Lee, who operates his own business and who is not an SBE taxpayer, received an amended assessment dated 14

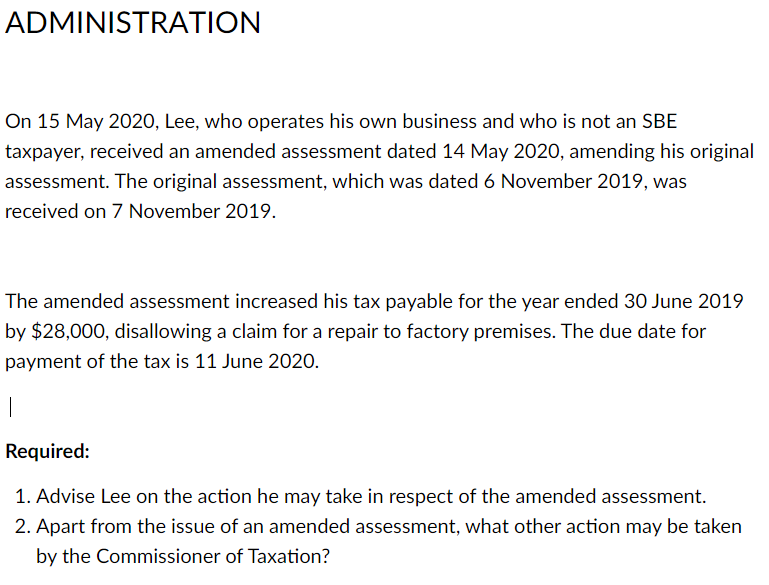

ADMINISTRATION On 15 May 2020, Lee, who operates his own business and who is not an SBE taxpayer, received an amended assessment dated 14 May 2020, amending his original assessment. The original assessment, which was dated 6 November 2019, was received on 7 November 2019. The amended assessment increased his tax payable for the year ended 30 June 2019 by $28,000, disallowing a claim for a repair to factory premises. The due date for payment of the tax is 11 June 2020. | Required: 1. Advise Lee on the action he may take in respect of the amended assessment. 2. Apart from the issue of an amended assessment, what other action may be taken by the Commissioner of Taxation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Advice for Lee 1 Review the Amended Assessment Carefully review the amended assessment and understan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App