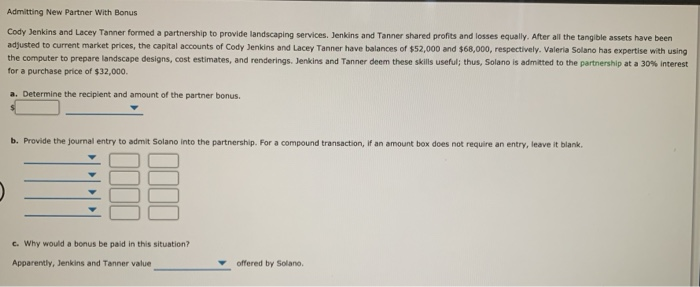

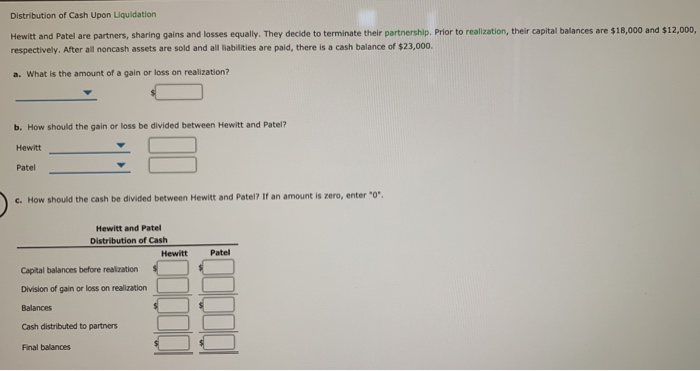

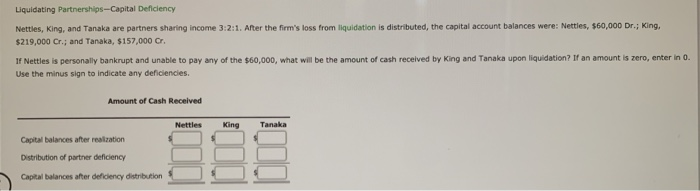

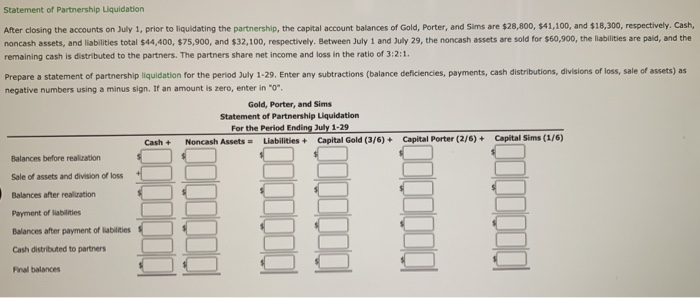

Admitting New Partner With Bonus Cody Jenkins and Lacey Tanner formed a partnership to provide landscaping services. Jenkins and Tanner shared profits and losses equally. After all the tangible assets have been adjusted to current market prices, the capital accounts of Cody Jenkins and Lacey Tanner have balances of $52,000 and $68,000, respectively. Valeria Solano has expertise with using the computer to prepare landscape designs, cost estimates, and renderings Jenkins and Tanner deem these skills useful; thus, Solano is admitted to the partnership at a 30% interest for a purchase price of $32,000 a. Determine the recipient and amount of the partner bonus. b. Provide the journal entry to admit Solano into the partnership. For a compound transaction, if an amount box does not require an entry, leave it blank. c. Why would a bonus be paid in this situation? Apparently, Jenkins and Tanner value offered by Solano Distribution of Cash Upon Liquidation Hewitt and Patel are partners, sharing gains and losses equally. They decide to terminate their partnership. Prior to realization, their capital balances are $18,000 and $12,000, respectively. After all noncash assets are sold and all liabilities are paid, there is a cash balance of $23,000. a. What is the amount of a gain or loss on realization? b. How should the gain or loss be divided between Hewitt and Patel Hewitt Patel c. How should the cash be divided between Hewitt and Patel? If an amount is zero, enter"0" Patel Hewitt and Patel Distribution of Cash Hewitt Capital balances before realization Division of gain or loss on realization Balances Cash distributed to partners Final balances Liquidating Partnerships--Capital Deficiency Nettles, King, and Tanaka are partners sharing income 3:2:1. After the firm's loss from liquidation is distributed, the capital account balances were: Netties, 560,000 Dr.; King, $219,000 Cr.; and Tanaka, $157,000 Cr. If Nettles is personally bankrupt and unable to pay any of the $60,000, what will be the amount of cash received by King and Tanaka upon liquidation? If an amount is zero, enter in 0. Use the minus sign to indicate any deficiencies Amount of Cash Received Nettles King Tanaka Capital balances after realization Distribution of partner deficiency Capital balances after deficiency distribution Statement of Partnership Liquidation After closing the accounts on July 1, prior to liquidating the partnership, the capital account balances of Gold, Porter, and Sims are $28,800, 541,100, and $18,300, respectively. Cash, noncash assets, and liabilities total $44,400, $75,900, and $32,100, respectively. Between July 1 and July 29, the noncash assets are sold for $60,900, the abilities are paid, and the remaining cash is distributed to the partners. The partners share net income and loss in the ratio of 3:2:1 Prepare a statement of partnership liquidation for the period July 1-29. Enter any subtractions (balance deficiencies, payments, cash distributions, divisions of loss, sale of assets) as negative numbers using a minus sign. If an amount is zero, enter in "O". Gold, Porter, and Sims Statement of Partnership Liquidation For the Period Ending July 1-29 Cash + Noncash Assets Liabilities + Capital Gold (3/6) + Capital Porter (2/6) + Capital Sims (1/6) Balances before realization Sale of assets and division of loss Balances after realization Payment of labs Chinito Dinin point | Balances after payment of liabilities Cash distributed to partners Fra balances