ado everything it is all one question I will give thumbs up

ado everything it is all one question I will give thumbs up

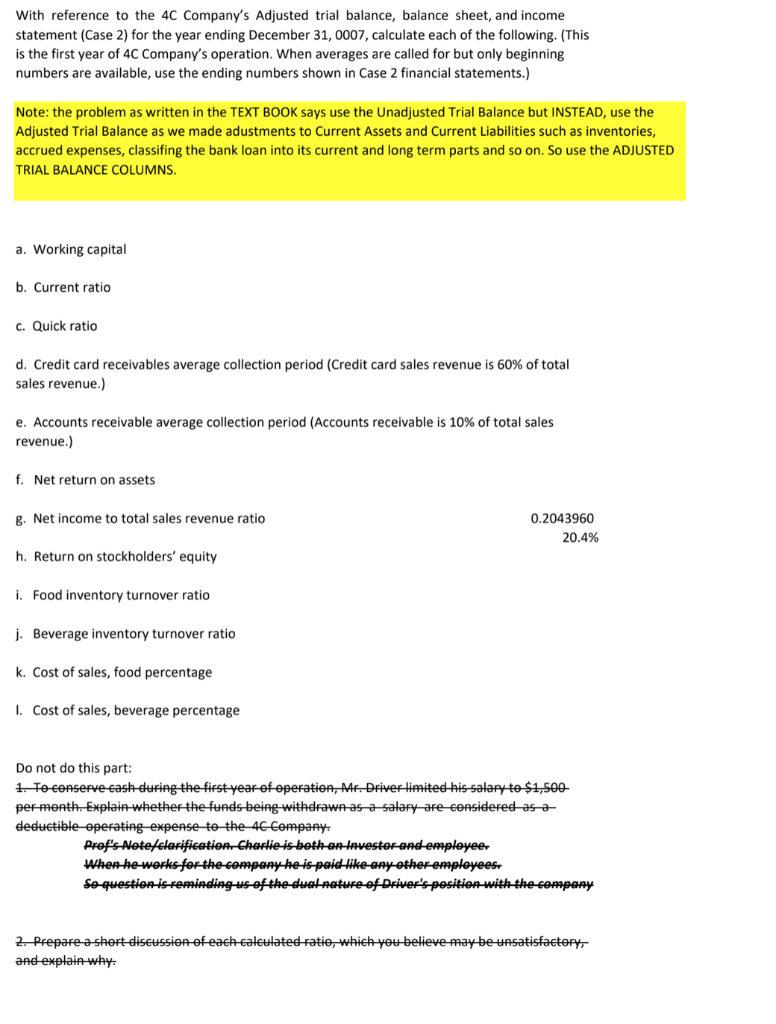

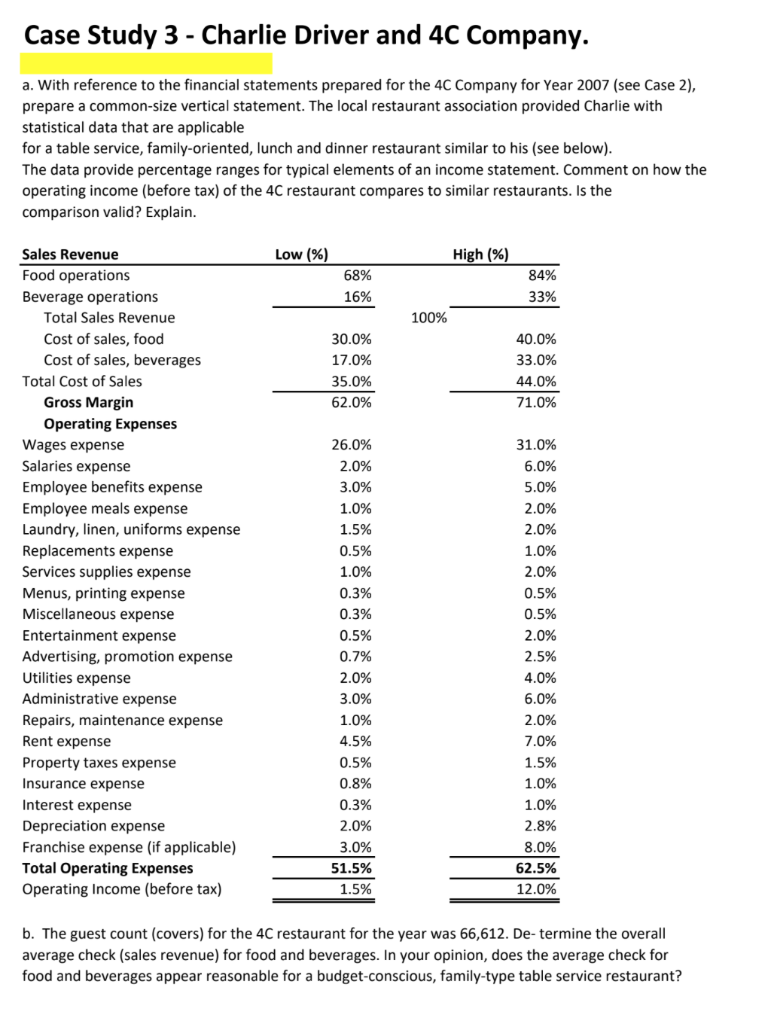

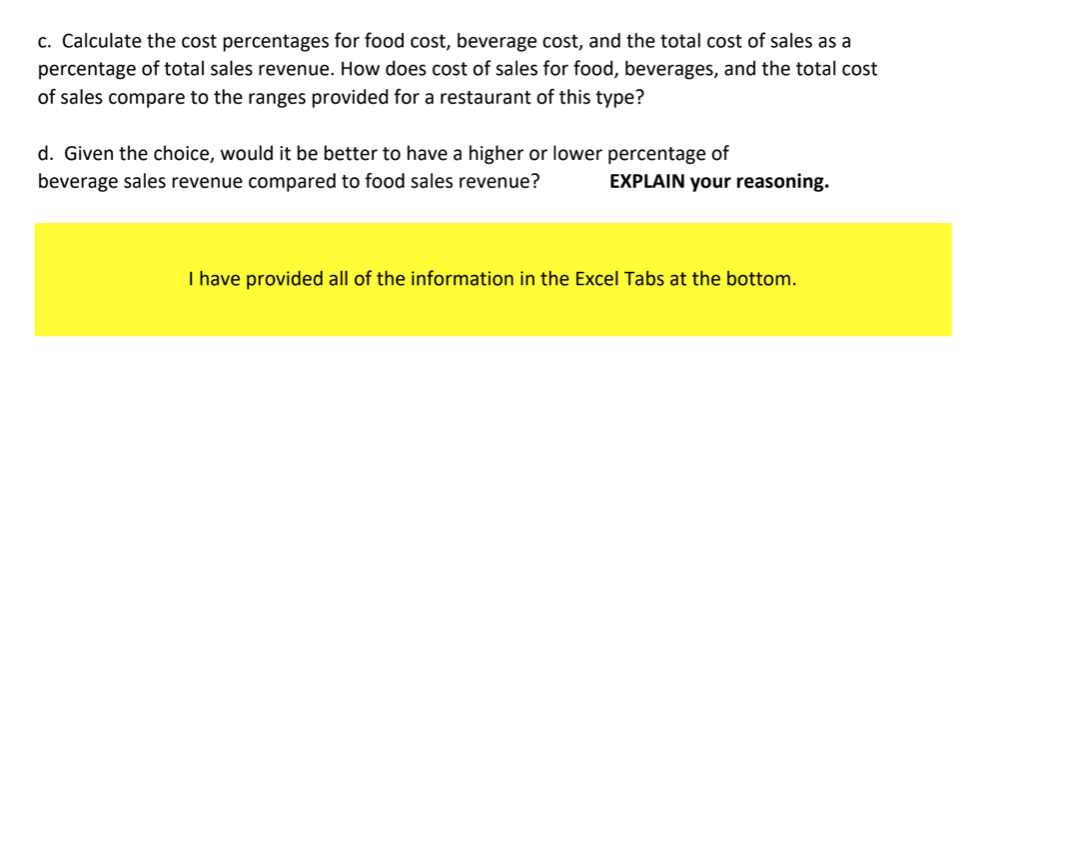

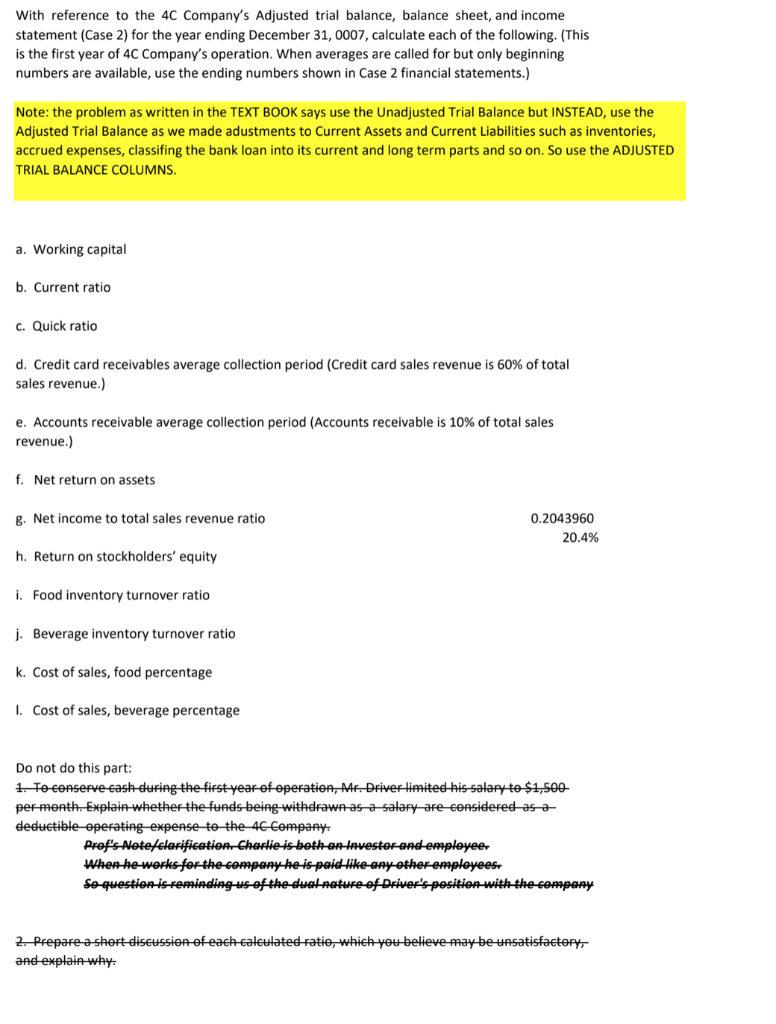

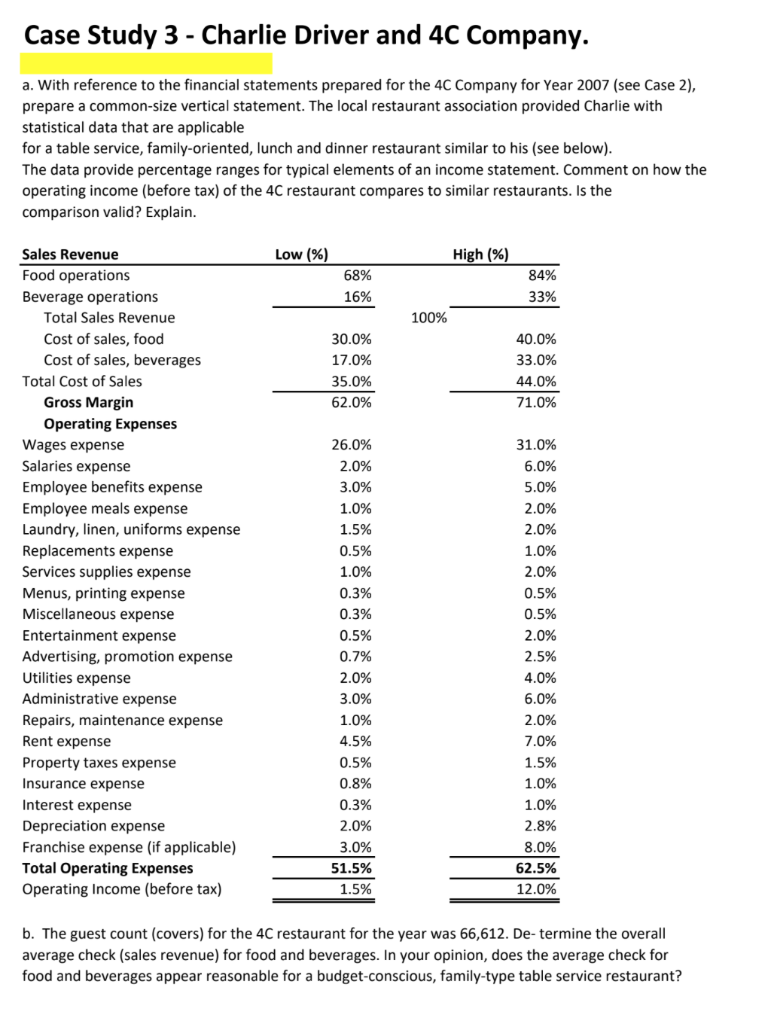

Case Study 3 - Charlie Driver and 4C Company. a. With reference to the financial statements prepared for the 4C Company for Year 2007 (see Case 2), prepare a common-size vertical statement. The local restaurant association provided Charlie with statistical data that are applicable for a table service, family-oriented, lunch and dinner restaurant similar to his (see below). The data provide percentage ranges for typical elements of an income statement. Comment on how the operating income (before tax) of the 4C restaurant compares to similar restaurants. Is the comparison valid? Explain. Low (%) High (%) 68% 84% 33% 16% 100% 30.0% 17.0% 35.0% 62.0% 40.0% 33.0% 44.0% 71.0% Sales Revenue Food operations Beverage operations Total Sales Revenue Cost of sales, food Cost of sales, beverages Total Cost of Sales Gross Margin Operating Expenses Wages expense Salaries expense Employee benefits expense Employee meals expense Laundry, linen, uniforms expense Replacements expense Services supplies expense Menus, printing expense Miscellaneous expense Entertainment expense Advertising, promotion expense Utilities expense Administrative expense Repairs, maintenance expense Rent expense Property taxes expense Insurance expense Interest expense Depreciation expense Franchise expense (if applicable) Total Operating Expenses Operating Income (before tax) 26.0% 2.0% 3.0% 1.0% 1.5% 0.5% 1.0% 0.3% 0.3% 0.5% 0.7% 2.0% 3.0% 1.0% 4.5% 0.5% 0.8% 0.3% 2.0% 3.0% 51.5% 1.5% 31.0% 6.0% 5.0% 2.0% 2.0% 1.0% 2.0% 0.5% 0.5% 2.0% 2.5% 4.0% 6.0% 2.0% 7.0% 1.5% 1.0% 1.0% 2.8% 8.0% 62.5% 12.0% b. The guest count (covers) for the 4C restaurant for the year was 66,612. Determine the overall average check (sales revenue) for food and beverages. In your opinion, does the average check for food and beverages appear reasonable for a budget-conscious, family-type table service restaurant? c. Calculate the cost percentages for food cost, beverage cost, and the total cost of sales as a percentage of total sales revenue. How does cost of sales for food, beverages, and the total cost of sales compare to the ranges provided for a restaurant of this type? d. Given the choice, would it be better to have a higher or lower percentage of beverage sales revenue compared to food sales revenue? EXPLAIN your reasoning. I have provided all of the information in the Excel Tabs at the bottom. With reference to the 4C Company's Adjusted trial balance, balance sheet, and income statement (Case 2) for the year ending December 31, 0007, calculate each of the following. (This is the first year of 4C Company's operation. When averages are called for but only beginning numbers are available, use the ending numbers shown in Case 2 financial statements.) Note: the problem as written in the TEXT BOOK says use the Unadjusted Trial Balance but INSTEAD, use the Adjusted Trial Balance as we made adustments to Current Assets and Current Liabilities such as inventories, accrued expenses, classifing the bank loan into its current and long term parts and so on. So use the ADJUSTED TRIAL BALANCE COLUMNS a. Working capital b. Current ratio c. Quick ratio d. Credit card receivables average collection period (Credit card sales revenue is 60% of total sales revenue.) e. Accounts receivable average collection period (Accounts receivable is 10% of total sales revenue.) f. Net return on assets g. Net income to total sales revenue ratio 0.2043960 20.4% h. Return on stockholders' equity i. Food inventory turnover ratio j. Beverage inventory turnover ratio k. Cost of sales, food percentage I. Cost of sales, beverage percentage Do not do this part: 1. To conserve cash during the first year of operation, Mr. Driver limited his salary to $1,500 per month. Explain whether the funds being withdrawn as a salary are considered as a deductible operating expense to the 46 Company Pref's Note/clarification Charlie is both an Investerend employee When he works for the company he is paid-like any other employees. Se question is remindings of the dual nature of Driver's position with the company 2. Prepare a short diseussion of each calculated ratie, which you believe may be unsatisfactory, and explain why: Case Study 3 - Charlie Driver and 4C Company. a. With reference to the financial statements prepared for the 4C Company for Year 2007 (see Case 2), prepare a common-size vertical statement. The local restaurant association provided Charlie with statistical data that are applicable for a table service, family-oriented, lunch and dinner restaurant similar to his (see below). The data provide percentage ranges for typical elements of an income statement. Comment on how the operating income (before tax) of the 4C restaurant compares to similar restaurants. Is the comparison valid? Explain. Low (%) High (%) 68% 84% 33% 16% 100% 30.0% 17.0% 35.0% 62.0% 40.0% 33.0% 44.0% 71.0% Sales Revenue Food operations Beverage operations Total Sales Revenue Cost of sales, food Cost of sales, beverages Total Cost of Sales Gross Margin Operating Expenses Wages expense Salaries expense Employee benefits expense Employee meals expense Laundry, linen, uniforms expense Replacements expense Services supplies expense Menus, printing expense Miscellaneous expense Entertainment expense Advertising, promotion expense Utilities expense Administrative expense Repairs, maintenance expense Rent expense Property taxes expense Insurance expense Interest expense Depreciation expense Franchise expense (if applicable) Total Operating Expenses Operating Income (before tax) 26.0% 2.0% 3.0% 1.0% 1.5% 0.5% 1.0% 0.3% 0.3% 0.5% 0.7% 2.0% 3.0% 1.0% 4.5% 0.5% 0.8% 0.3% 2.0% 3.0% 51.5% 1.5% 31.0% 6.0% 5.0% 2.0% 2.0% 1.0% 2.0% 0.5% 0.5% 2.0% 2.5% 4.0% 6.0% 2.0% 7.0% 1.5% 1.0% 1.0% 2.8% 8.0% 62.5% 12.0% b. The guest count (covers) for the 4C restaurant for the year was 66,612. Determine the overall average check (sales revenue) for food and beverages. In your opinion, does the average check for food and beverages appear reasonable for a budget-conscious, family-type table service restaurant? c. Calculate the cost percentages for food cost, beverage cost, and the total cost of sales as a percentage of total sales revenue. How does cost of sales for food, beverages, and the total cost of sales compare to the ranges provided for a restaurant of this type? d. Given the choice, would it be better to have a higher or lower percentage of beverage sales revenue compared to food sales revenue? EXPLAIN your reasoning. I have provided all of the information in the Excel Tabs at the bottom. With reference to the 4C Company's Adjusted trial balance, balance sheet, and income statement (Case 2) for the year ending December 31, 0007, calculate each of the following. (This is the first year of 4C Company's operation. When averages are called for but only beginning numbers are available, use the ending numbers shown in Case 2 financial statements.) Note: the problem as written in the TEXT BOOK says use the Unadjusted Trial Balance but INSTEAD, use the Adjusted Trial Balance as we made adustments to Current Assets and Current Liabilities such as inventories, accrued expenses, classifing the bank loan into its current and long term parts and so on. So use the ADJUSTED TRIAL BALANCE COLUMNS a. Working capital b. Current ratio c. Quick ratio d. Credit card receivables average collection period (Credit card sales revenue is 60% of total sales revenue.) e. Accounts receivable average collection period (Accounts receivable is 10% of total sales revenue.) f. Net return on assets g. Net income to total sales revenue ratio 0.2043960 20.4% h. Return on stockholders' equity i. Food inventory turnover ratio j. Beverage inventory turnover ratio k. Cost of sales, food percentage I. Cost of sales, beverage percentage Do not do this part: 1. To conserve cash during the first year of operation, Mr. Driver limited his salary to $1,500 per month. Explain whether the funds being withdrawn as a salary are considered as a deductible operating expense to the 46 Company Pref's Note/clarification Charlie is both an Investerend employee When he works for the company he is paid-like any other employees. Se question is remindings of the dual nature of Driver's position with the company 2. Prepare a short diseussion of each calculated ratie, which you believe may be unsatisfactory, and explain why

ado everything it is all one question I will give thumbs up

ado everything it is all one question I will give thumbs up