Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adrian was awarded an academic scholarship to State University for the 2023-2024 academic year. He received $6,500 in August and $7,200 in December 2023.

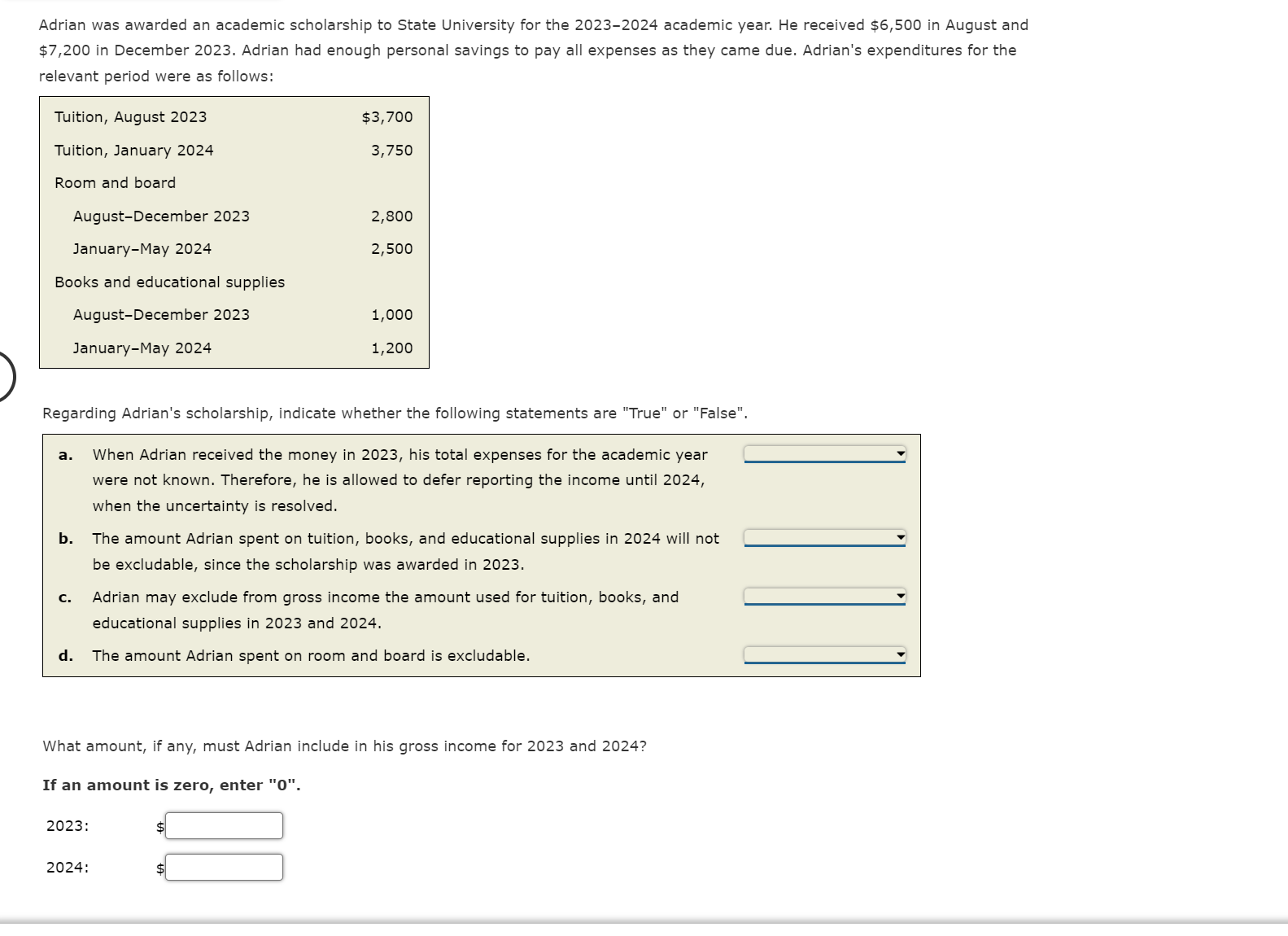

Adrian was awarded an academic scholarship to State University for the 2023-2024 academic year. He received $6,500 in August and $7,200 in December 2023. Adrian had enough personal savings to pay all expenses as they came due. Adrian's expenditures for the relevant period were as follows: Tuition, August 2023 Tuition, January 2024 $3,700 3,750 Room and board August-December 2023 2,800 January-May 2024 2,500 Books and educational supplies August-December 2023 1,000 January-May 2024 1,200 Regarding Adrian's scholarship, indicate whether the following statements are "True" or "False". a. When Adrian received the money in 2023, his total expenses for the academic year b. C. d. were not known. Therefore, he is allowed to defer reporting the income until 2024, when the uncertainty is resolved. The amount Adrian spent on tuition, books, and educational supplies in 2024 will not be excludable, since the scholarship was awarded in 2023. Adrian may exclude from gross income the amount used for tuition, books, and educational supplies in 2023 and 2024. The amount Adrian spent on room and board is excludable. What amount, if any, must Adrian include in his gross income for 2023 and 2024? If an amount is zero, enter "0". 2023: 2024:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started