Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In Year 1, Katie began a new business, Beautiful Minds Inc, a calendar-year corporation that provides adventure travel team-building and performance improvement programs for

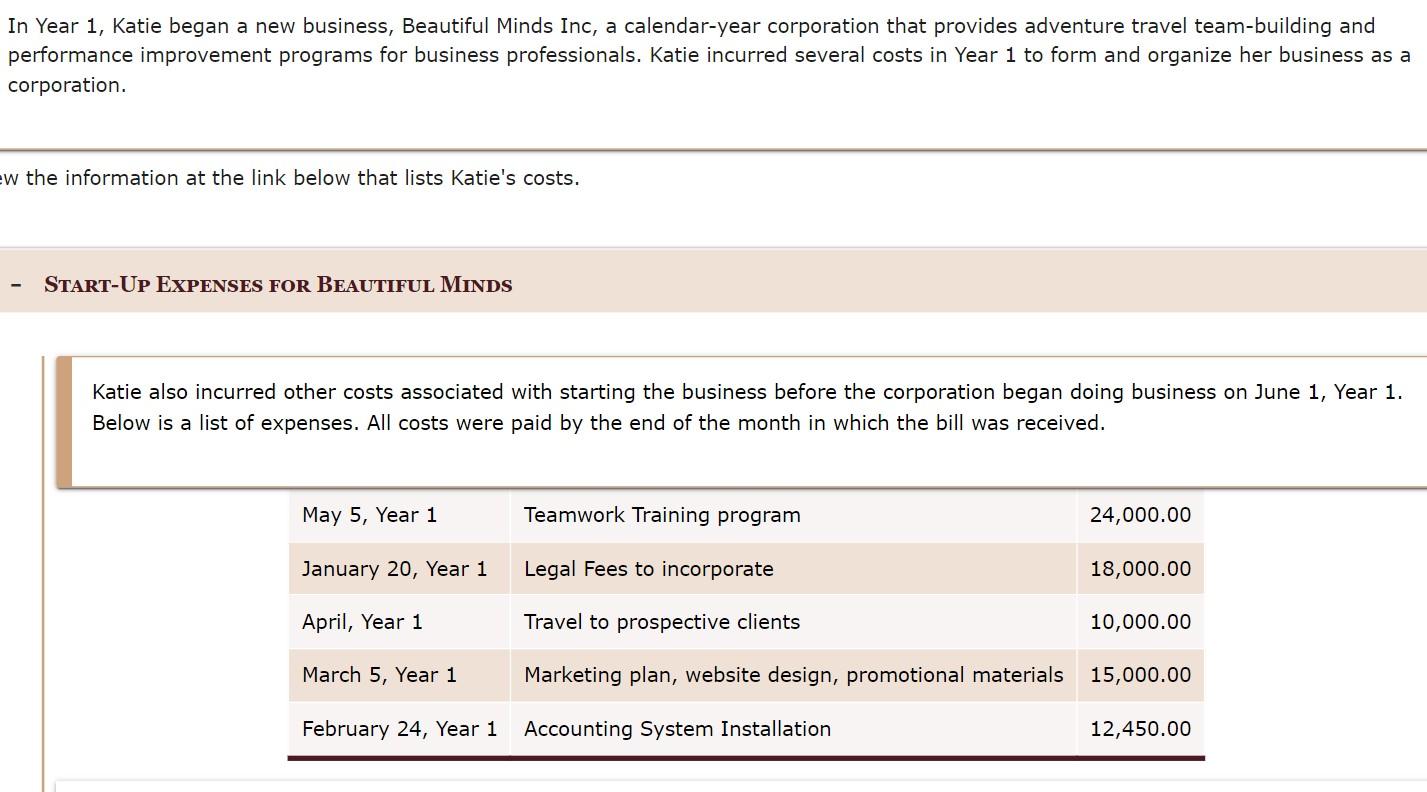

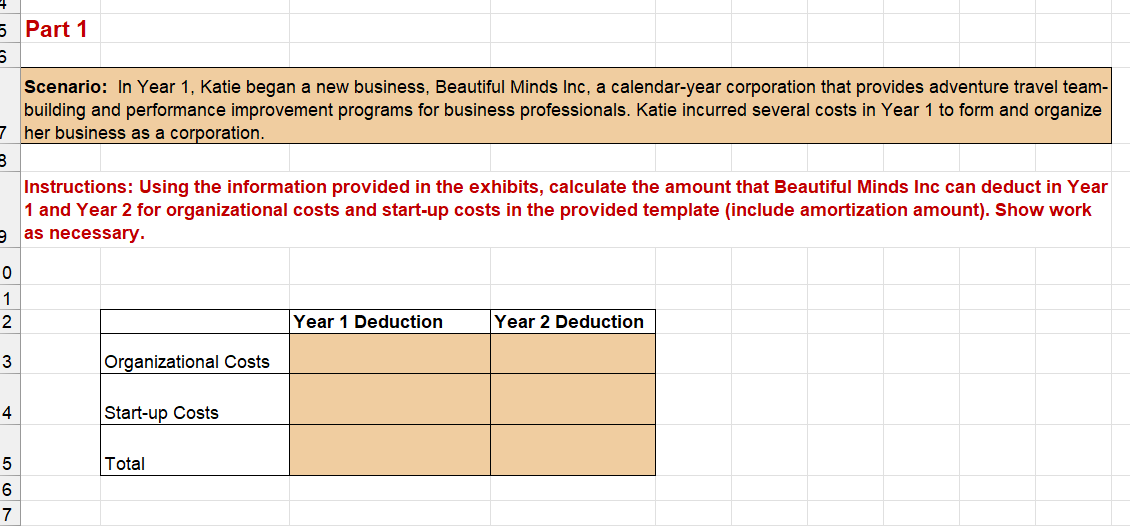

In Year 1, Katie began a new business, Beautiful Minds Inc, a calendar-year corporation that provides adventure travel team-building and performance improvement programs for business professionals. Katie incurred several costs in Year 1 to form and organize her business as a corporation. w the information at the link below that lists Katie's costs. START-UP EXPENSES FOR BEAUTIFUL MINDS Katie also incurred other costs associated with starting the business before the corporation began doing business on June 1, Year 1. Below is a list of expenses. All costs were paid by the end of the month in which the bill was received. May 5, Year 1 Teamwork Training program 24,000.00 January 20, Year 1 Legal Fees to incorporate 18,000.00 April, Year 1 Travel to prospective clients 10,000.00 March 5, Year 1 Marketing plan, website design, promotional materials 15,000.00 February 24, Year 1 Accounting System Installation 12,450.00 5 Part 1 5 Scenario: In Year 1, Katie began a new business, Beautiful Minds Inc, a calendar-year corporation that provides adventure travel team- building and performance improvement programs for business professionals. Katie incurred several costs in Year 1 to form and organize 7 her business as a corporation. Instructions: Using the information provided in the exhibits, calculate the amount that Beautiful Minds Inc can deduct in Year 1 and Year 2 for organizational costs and start-up costs in the provided template (include amortization amount). Show work 9 as necessary. 012 3 4 Year 1 Deduction Year 2 Deduction Organizational Costs 569 Start-up Costs Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started