Answered step by step

Verified Expert Solution

Question

1 Approved Answer

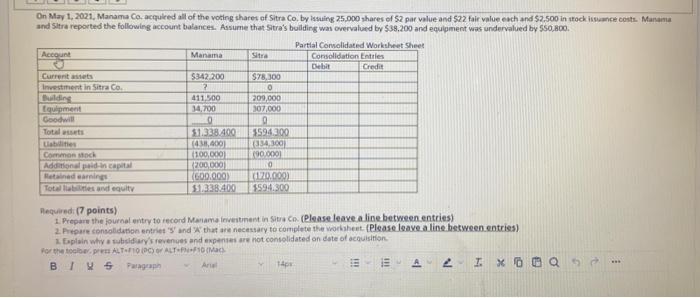

advance (Acc311) On May 1, 2021, Manama Co, acquired all of the voting shares of Sitra Co. by ling 25.000 shares of 52 par value

advance (Acc311)

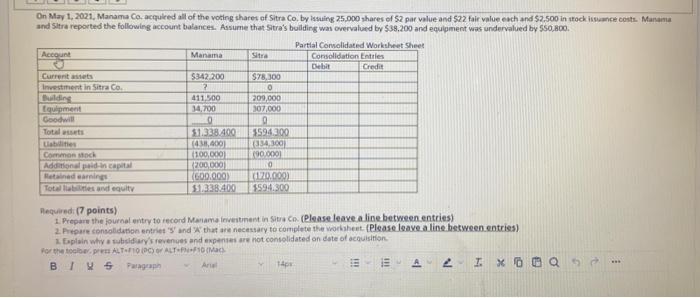

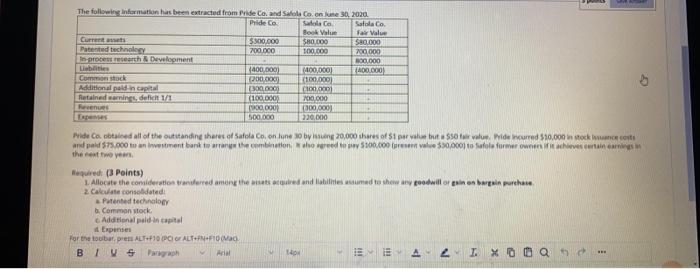

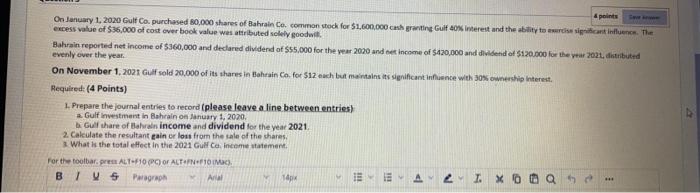

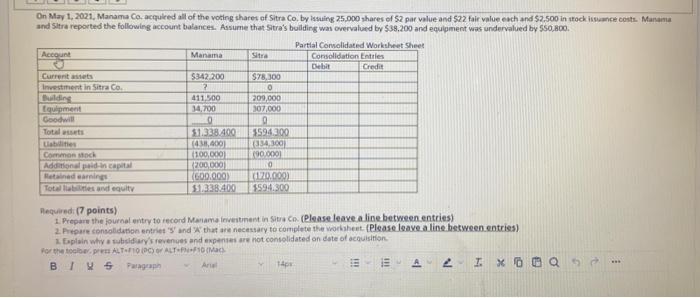

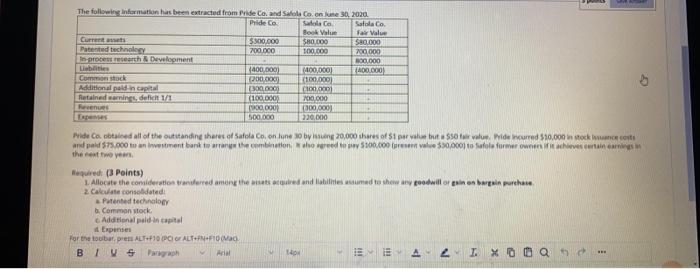

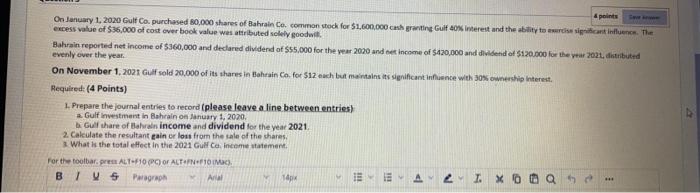

On May 1, 2021, Manama Co, acquired all of the voting shares of Sitra Co. by ling 25.000 shares of 52 par value and 522 Fair value each and $2.500 in stock ice costs. Manama and Sitra reported the following account balances. Assume that Stra's building was overvalued by $38.200 and equipment was undervalued by 550.800 Partial Comolidated Worksheet Sheet Account Manama Sitra Consolidation Entries Debat Credit Currents $342.200 $78,300 Investment in Sitraco 2 0 Building 411.500 209,000 Equipment 34,700 307,000 Goodwil O 0 Totalt 51.338.400 3594.300 431,400 3343001 Common och 100,000 100.000 Additional pidin Capital 2000001 0 Hatsinadaming (600.000) 170.000) Totalles and equity 51838.400 1594.300 Required: (7 points) 1. Prepare the journal entry to record Manama investment in StrCo. (Please leave a line between entries) 2. Prepare consolidation entries and that we necessary to complete the worksheet (Please leave a line between entries) 1. Explain why a subsidiary's revenues and expenses are not consolidated on date of acquisition For the term ALT 10 O ALTRO (Mac BIS Paragraph 14p 2 IX !!! il ch The following information has been extracted from Pride Coand Sole Coon kun 30, 2020 Pride Co ca Salolaco Book Value San Vale Crew $300,000 $80.000 S80,000 Patented technology 700.00 100,000 700.000 As process research & Development 300,000 400.000) (400,000 1400.000 Com shock 200.000 100.000) Additional pold in capital 1300.000 100,000 Retained nines, de 1/1 (100.000 700.000 Fenues 100.000 300.000 500.000 230,000 Pride Co. obtaiced all of the outstanding shares of Safola Co.online 30 by 20.000 ches of Spare but is $50 for value ide noured $10,000 in stock imance coti and paid $7.000 to an investment bank to the combination, howed to $100.000 reservalue 550,000 to Sole former own the certain the next two years Maquired Points) Allocate the concleration transferred among the secured and abilities and to thew av poodwill or pasien beresin purchase 2. Calculate consolidated Patented technology b. Common stock Additional puldan capital Expenses For the barres ALT+50 PC ALT-1000 B TVS Pangrah AA 12. IXO O Q & points On January 1, 2020 Gulf Co. purchased 80,000 shares of Bahrain Co. common stock for $1,600,000 cash granting Gulf Interest and the ability to design continence. The excess value of $36,000 of cost over book value was attributed solely goodwill Bahrain reported net income of $360,000 and declared dividend of $55,000 for the year 2020 and et income of $420,000 and dividend of $120,000 for the year 2021, distributed evenly over the year On November 1, 2021 Gulf sold 20,000 of its shares in Bahrain Co. for $12 auch but maintains its significant intan fence with 30% ownership Interest, Required: (4 Points) 1. Prepare the journal entries to record (please leave a line between entries) a Gulf investment in Bahrain on January 1, 2020, Gulf share of Bari income and dividend for the year 2021 2. Calculate the resultant gain or loss from the sale of the shares What is the total effect in the 2021 Gulf Ca Income statement For the toolbar.pe ALT-F100P) or ALTN10 MK), B TV5 Paragraph Anal Map IE A On May 1, 2021, Manama Co, acquired all of the voting shares of Sitra Co. by ling 25.000 shares of 52 par value and 522 Fair value each and $2.500 in stock ice costs. Manama and Sitra reported the following account balances. Assume that Stra's building was overvalued by $38.200 and equipment was undervalued by 550.800 Partial Comolidated Worksheet Sheet Account Manama Sitra Consolidation Entries Debat Credit Currents $342.200 $78,300 Investment in Sitraco 2 0 Building 411.500 209,000 Equipment 34,700 307,000 Goodwil O 0 Totalt 51.338.400 3594.300 431,400 3343001 Common och 100,000 100.000 Additional pidin Capital 2000001 0 Hatsinadaming (600.000) 170.000) Totalles and equity 51838.400 1594.300 Required: (7 points) 1. Prepare the journal entry to record Manama investment in StrCo. (Please leave a line between entries) 2. Prepare consolidation entries and that we necessary to complete the worksheet (Please leave a line between entries) 1. Explain why a subsidiary's revenues and expenses are not consolidated on date of acquisition For the term ALT 10 O ALTRO (Mac BIS Paragraph 14p 2 IX !!! il ch The following information has been extracted from Pride Coand Sole Coon kun 30, 2020 Pride Co ca Salolaco Book Value San Vale Crew $300,000 $80.000 S80,000 Patented technology 700.00 100,000 700.000 As process research & Development 300,000 400.000) (400,000 1400.000 Com shock 200.000 100.000) Additional pold in capital 1300.000 100,000 Retained nines, de 1/1 (100.000 700.000 Fenues 100.000 300.000 500.000 230,000 Pride Co. obtaiced all of the outstanding shares of Safola Co.online 30 by 20.000 ches of Spare but is $50 for value ide noured $10,000 in stock imance coti and paid $7.000 to an investment bank to the combination, howed to $100.000 reservalue 550,000 to Sole former own the certain the next two years Maquired Points) Allocate the concleration transferred among the secured and abilities and to thew av poodwill or pasien beresin purchase 2. Calculate consolidated Patented technology b. Common stock Additional puldan capital Expenses For the barres ALT+50 PC ALT-1000 B TVS Pangrah AA 12. IXO O Q & points On January 1, 2020 Gulf Co. purchased 80,000 shares of Bahrain Co. common stock for $1,600,000 cash granting Gulf Interest and the ability to design continence. The excess value of $36,000 of cost over book value was attributed solely goodwill Bahrain reported net income of $360,000 and declared dividend of $55,000 for the year 2020 and et income of $420,000 and dividend of $120,000 for the year 2021, distributed evenly over the year On November 1, 2021 Gulf sold 20,000 of its shares in Bahrain Co. for $12 auch but maintains its significant intan fence with 30% ownership Interest, Required: (4 Points) 1. Prepare the journal entries to record (please leave a line between entries) a Gulf investment in Bahrain on January 1, 2020, Gulf share of Bari income and dividend for the year 2021 2. Calculate the resultant gain or loss from the sale of the shares What is the total effect in the 2021 Gulf Ca Income statement For the toolbar.pe ALT-F100P) or ALTN10 MK), B TV5 Paragraph Anal Map IE A

On May 1, 2021, Manama Co, acquired all of the voting shares of Sitra Co. by ling 25.000 shares of 52 par value and 522 Fair value each and $2.500 in stock ice costs. Manama and Sitra reported the following account balances. Assume that Stra's building was overvalued by $38.200 and equipment was undervalued by 550.800 Partial Comolidated Worksheet Sheet Account Manama Sitra Consolidation Entries Debat Credit Currents $342.200 $78,300 Investment in Sitraco 2 0 Building 411.500 209,000 Equipment 34,700 307,000 Goodwil O 0 Totalt 51.338.400 3594.300 431,400 3343001 Common och 100,000 100.000 Additional pidin Capital 2000001 0 Hatsinadaming (600.000) 170.000) Totalles and equity 51838.400 1594.300 Required: (7 points) 1. Prepare the journal entry to record Manama investment in StrCo. (Please leave a line between entries) 2. Prepare consolidation entries and that we necessary to complete the worksheet (Please leave a line between entries) 1. Explain why a subsidiary's revenues and expenses are not consolidated on date of acquisition For the term ALT 10 O ALTRO (Mac BIS Paragraph 14p 2 IX !!! il ch The following information has been extracted from Pride Coand Sole Coon kun 30, 2020 Pride Co ca Salolaco Book Value San Vale Crew $300,000 $80.000 S80,000 Patented technology 700.00 100,000 700.000 As process research & Development 300,000 400.000) (400,000 1400.000 Com shock 200.000 100.000) Additional pold in capital 1300.000 100,000 Retained nines, de 1/1 (100.000 700.000 Fenues 100.000 300.000 500.000 230,000 Pride Co. obtaiced all of the outstanding shares of Safola Co.online 30 by 20.000 ches of Spare but is $50 for value ide noured $10,000 in stock imance coti and paid $7.000 to an investment bank to the combination, howed to $100.000 reservalue 550,000 to Sole former own the certain the next two years Maquired Points) Allocate the concleration transferred among the secured and abilities and to thew av poodwill or pasien beresin purchase 2. Calculate consolidated Patented technology b. Common stock Additional puldan capital Expenses For the barres ALT+50 PC ALT-1000 B TVS Pangrah AA 12. IXO O Q & points On January 1, 2020 Gulf Co. purchased 80,000 shares of Bahrain Co. common stock for $1,600,000 cash granting Gulf Interest and the ability to design continence. The excess value of $36,000 of cost over book value was attributed solely goodwill Bahrain reported net income of $360,000 and declared dividend of $55,000 for the year 2020 and et income of $420,000 and dividend of $120,000 for the year 2021, distributed evenly over the year On November 1, 2021 Gulf sold 20,000 of its shares in Bahrain Co. for $12 auch but maintains its significant intan fence with 30% ownership Interest, Required: (4 Points) 1. Prepare the journal entries to record (please leave a line between entries) a Gulf investment in Bahrain on January 1, 2020, Gulf share of Bari income and dividend for the year 2021 2. Calculate the resultant gain or loss from the sale of the shares What is the total effect in the 2021 Gulf Ca Income statement For the toolbar.pe ALT-F100P) or ALTN10 MK), B TV5 Paragraph Anal Map IE A On May 1, 2021, Manama Co, acquired all of the voting shares of Sitra Co. by ling 25.000 shares of 52 par value and 522 Fair value each and $2.500 in stock ice costs. Manama and Sitra reported the following account balances. Assume that Stra's building was overvalued by $38.200 and equipment was undervalued by 550.800 Partial Comolidated Worksheet Sheet Account Manama Sitra Consolidation Entries Debat Credit Currents $342.200 $78,300 Investment in Sitraco 2 0 Building 411.500 209,000 Equipment 34,700 307,000 Goodwil O 0 Totalt 51.338.400 3594.300 431,400 3343001 Common och 100,000 100.000 Additional pidin Capital 2000001 0 Hatsinadaming (600.000) 170.000) Totalles and equity 51838.400 1594.300 Required: (7 points) 1. Prepare the journal entry to record Manama investment in StrCo. (Please leave a line between entries) 2. Prepare consolidation entries and that we necessary to complete the worksheet (Please leave a line between entries) 1. Explain why a subsidiary's revenues and expenses are not consolidated on date of acquisition For the term ALT 10 O ALTRO (Mac BIS Paragraph 14p 2 IX !!! il ch The following information has been extracted from Pride Coand Sole Coon kun 30, 2020 Pride Co ca Salolaco Book Value San Vale Crew $300,000 $80.000 S80,000 Patented technology 700.00 100,000 700.000 As process research & Development 300,000 400.000) (400,000 1400.000 Com shock 200.000 100.000) Additional pold in capital 1300.000 100,000 Retained nines, de 1/1 (100.000 700.000 Fenues 100.000 300.000 500.000 230,000 Pride Co. obtaiced all of the outstanding shares of Safola Co.online 30 by 20.000 ches of Spare but is $50 for value ide noured $10,000 in stock imance coti and paid $7.000 to an investment bank to the combination, howed to $100.000 reservalue 550,000 to Sole former own the certain the next two years Maquired Points) Allocate the concleration transferred among the secured and abilities and to thew av poodwill or pasien beresin purchase 2. Calculate consolidated Patented technology b. Common stock Additional puldan capital Expenses For the barres ALT+50 PC ALT-1000 B TVS Pangrah AA 12. IXO O Q & points On January 1, 2020 Gulf Co. purchased 80,000 shares of Bahrain Co. common stock for $1,600,000 cash granting Gulf Interest and the ability to design continence. The excess value of $36,000 of cost over book value was attributed solely goodwill Bahrain reported net income of $360,000 and declared dividend of $55,000 for the year 2020 and et income of $420,000 and dividend of $120,000 for the year 2021, distributed evenly over the year On November 1, 2021 Gulf sold 20,000 of its shares in Bahrain Co. for $12 auch but maintains its significant intan fence with 30% ownership Interest, Required: (4 Points) 1. Prepare the journal entries to record (please leave a line between entries) a Gulf investment in Bahrain on January 1, 2020, Gulf share of Bari income and dividend for the year 2021 2. Calculate the resultant gain or loss from the sale of the shares What is the total effect in the 2021 Gulf Ca Income statement For the toolbar.pe ALT-F100P) or ALTN10 MK), B TV5 Paragraph Anal Map IE A

advance (Acc311)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started