Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Advance accounting. Plz fast Question Completion Status: Moving to another question will save this response. Question 1 of 5 >> Question 1 4 points Save

Advance accounting. Plz fast

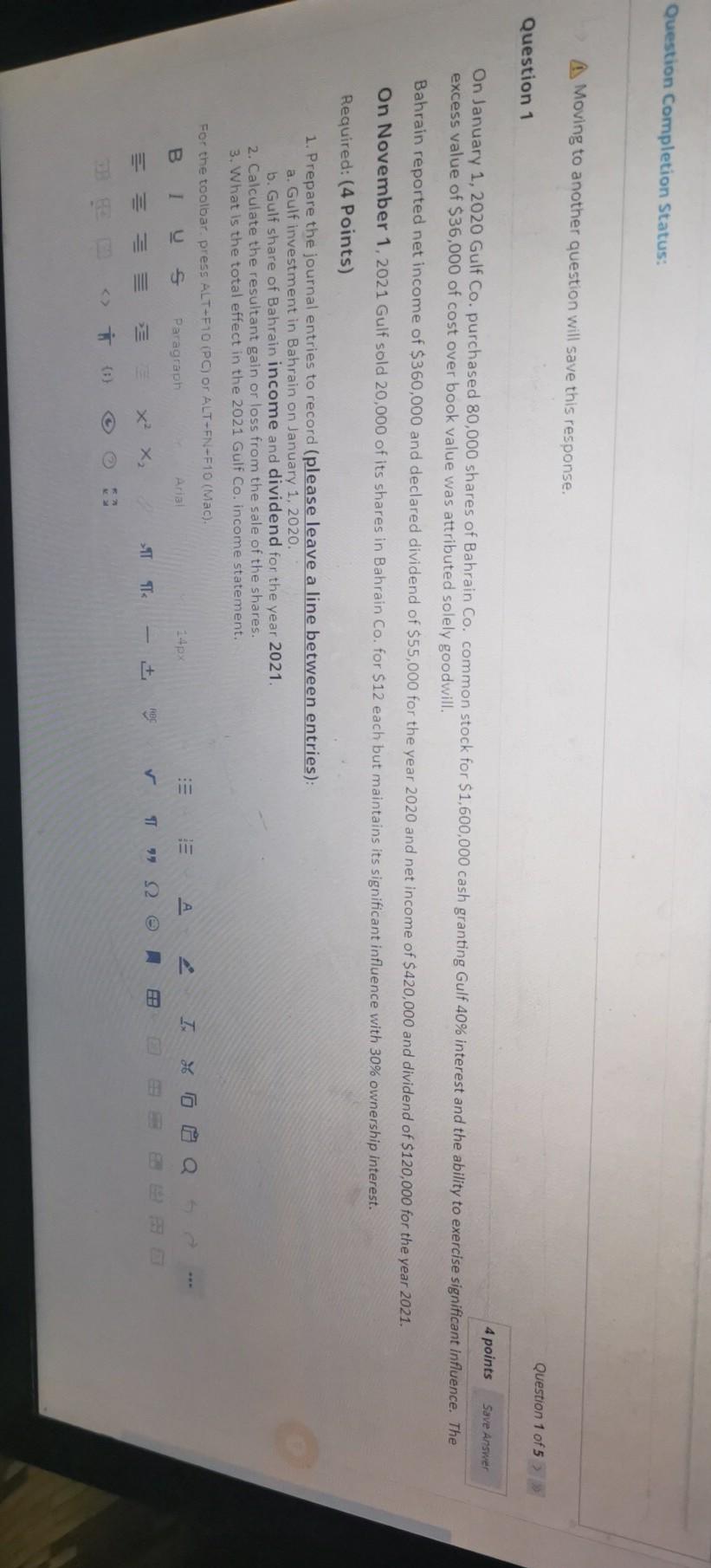

Question Completion Status: Moving to another question will save this response. Question 1 of 5 >> Question 1 4 points Save Answer On January 1, 2020 Gulf Co. purchased 80,000 shares of Bahrain Co. common stock for $1,600,000 cash granting Gulf 40% interest and the ability to exercise significant influence. The excess value of $36,000 of cost over book value was attributed solely goodwill. Bahrain reported net income of $360,000 and declared dividend of $55,000 for the year 2020 and net income of $420,000 and dividend of $120,000 for the year 2021. On November 1, 2021 Gulf sold 20,000 of its shares in Bahrain Co. for $12 each but maintains its significant influence with 30% ownership interest. Required: (4 Points) 1. Prepare the journal entries to record (please leave a line between entries): a. Gulf investment in Bahrain on January 1, 2020. b. Gulf share of Bahrain income and dividend for the year 2021 2. Calculate the resultant gain or loss from the sale of the shares. 3. What is the total effect in the 2021 Gulf Co. income statement. For the toolbar. press ALT-F10 (PC) or ALT-EN-F10 (Mac). B I Paragraph Aria a III b X X TTTT [+ 1 2 @ AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started