Answered step by step

Verified Expert Solution

Question

1 Approved Answer

advance accounting Price Company acquired 100% of the common stock of Sale Company on December 31, 20X1, by issuing 26,000 shares of its $10 par

advance accounting

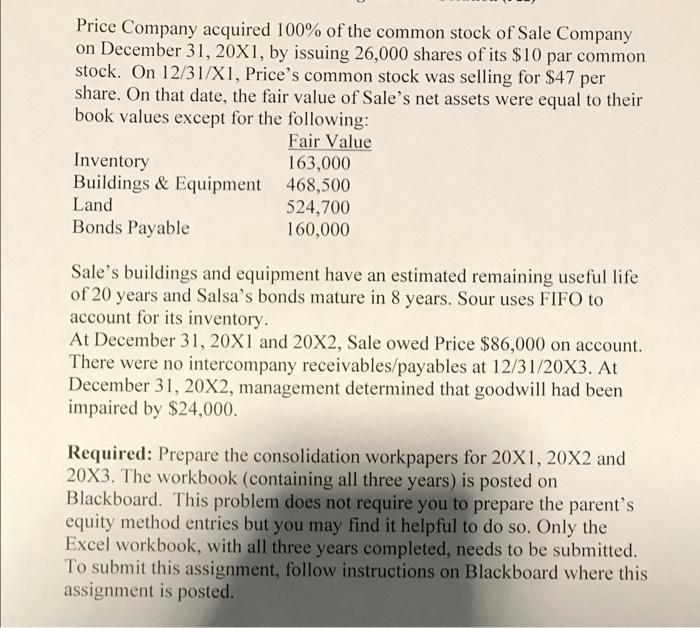

Price Company acquired 100% of the common stock of Sale Company on December 31, 20X1, by issuing 26,000 shares of its $10 par common stock. On 12/31/X1, Price's common stock was selling for $47 per share. On that date, the fair value of Sale's net assets were equal to their book values except for the following: Sale's buildings and equipment have an estimated remaining useful life of 20 years and Salsa's bonds mature in 8 years. Sour uses FIFO to account for its inventory. At December 31, 20X1 and 20X2, Sale owed Price $86,000 on account. There were no intercompany receivables/payables at 12/31/20X3. At December 31, 20X2, management determined that goodwill had been impaired by $24,000. Required: Prepare the consolidation workpapers for 20X1,20X2 and 203. The workbook (containing all three years) is posted on Blackboard. This problem does not require you to prepare the parent's equity method entries but you may find it helpful to do so. Only the Excel workbook, with all three years completed, needs to be submitted. To submit this assignment, follow instructions on Blackboard where this assignment is posted. Price Company acquired 100% of the common stock of Sale Company on December 31, 20X1, by issuing 26,000 shares of its $10 par common stock. On 12/31/X1, Price's common stock was selling for $47 per share. On that date, the fair value of Sale's net assets were equal to their book values except for the following: Sale's buildings and equipment have an estimated remaining useful life of 20 years and Salsa's bonds mature in 8 years. Sour uses FIFO to account for its inventory. At December 31, 20X1 and 20X2, Sale owed Price $86,000 on account. There were no intercompany receivables/payables at 12/31/20X3. At December 31, 20X2, management determined that goodwill had been impaired by $24,000. Required: Prepare the consolidation workpapers for 20X1,20X2 and 203. The workbook (containing all three years) is posted on Blackboard. This problem does not require you to prepare the parent's equity method entries but you may find it helpful to do so. Only the Excel workbook, with all three years completed, needs to be submitted. To submit this assignment, follow instructions on Blackboard where this assignment is posted Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started