Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Advance financial Pasha Corporation acquired 60 percent of Sam Enterprises on June 1, 2005. At that date, Sam had inventory with a market value $80,000

Advance financial

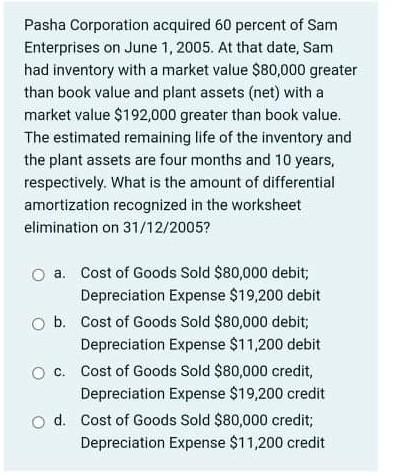

Pasha Corporation acquired 60 percent of Sam Enterprises on June 1, 2005. At that date, Sam had inventory with a market value $80,000 greater than book value and plant assets (net) with a market value $192,000 greater than book value. The estimated remaining life of the inventory and the plant assets are four months and 10 years, respectively. What is the amount of differential amortization recognized in the worksheet elimination on 31/12/2005? a. Cost of Goods Sold $80,000 debit; Depreciation Expense $19,200 debit b. Cost of Goods Sold $80,000 debit; Depreciation Expense $11,200 debit Oc. Cost of Goods Sold $80,000 credit, Depreciation Expense $19,200 credit O d. Cost of Goods Sold $80,000 credit; Depreciation Expense $11,200 credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started