Answered step by step

Verified Expert Solution

Question

1 Approved Answer

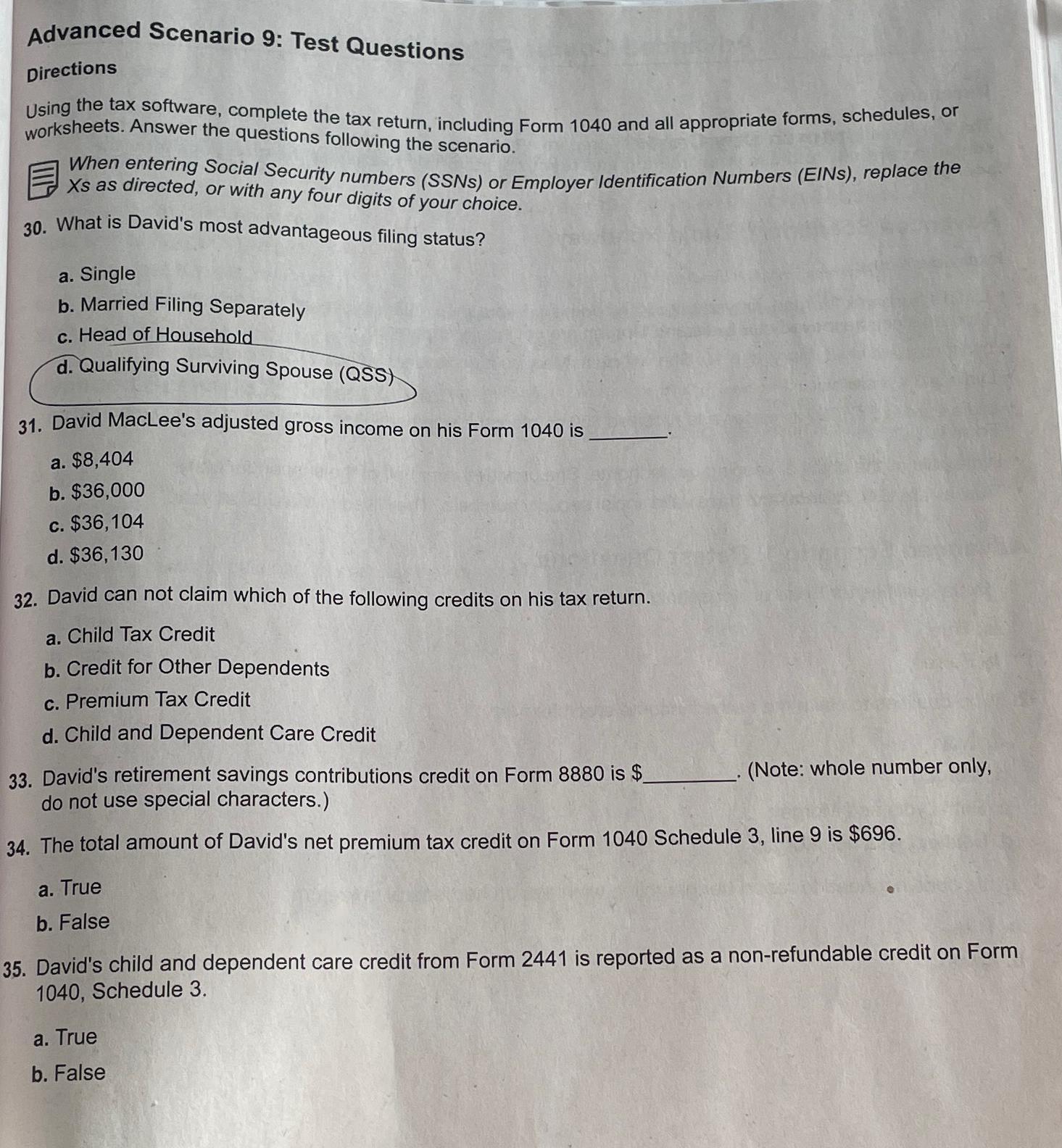

Advanced Scenario 9: Test Questions Directions worksheets. Answer the questions following the scenario. Using the tax software, complete the tax return, including Form 1040

Advanced Scenario 9: Test Questions Directions worksheets. Answer the questions following the scenario. Using the tax software, complete the tax return, including Form 1040 and all appropriate forms, schedules, or When entering Social Security numbers (SSNs) or Employer Identification Numbers (EINS), replace the Xs as directed, or with any four digits of your choice. 30. What is David's most advantageous filing status? a. Single b. Married Filing Separately c. Head of Household d. Qualifying Surviving Spouse (QSS) 31. David MacLee's adjusted gross income on his Form 1040 is a. $8,404 b. $36,000 c. $36,104 d. $36,130 32. David can not claim which of the following credits on his tax return. a. Child Tax Credit b. Credit for Other Dependents c. Premium Tax Credit d. Child and Dependent Care Credit 33. David's retirement savings contributions credit on Form 8880 is $ do not use special characters.) (Note: whole number only, 34. The total amount of David's net premium tax credit on Form 1040 Schedule 3, line 9 is $696. a. True b. False 35. David's child and dependent care credit from Form 2441 is reported as a non-refundable credit on Form 1040, Schedule 3. a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To provide a detailed answer for each question in the scenario 30 What is Davids most advantageous f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started