Advanced Accounting 421

Accounting Cycle

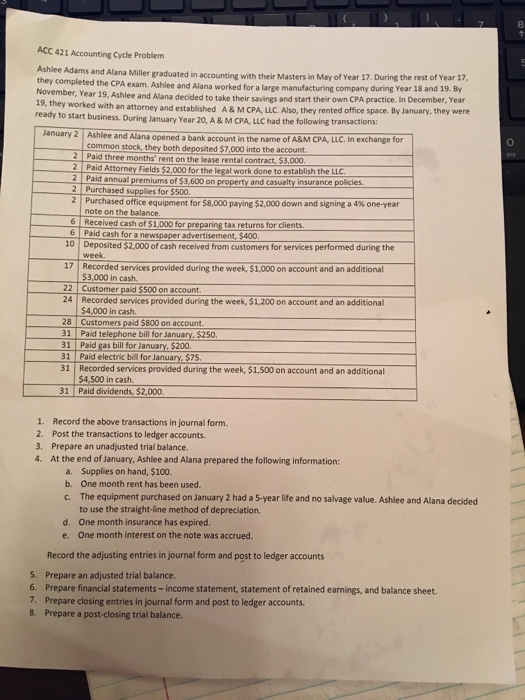

8 ACC 421 Accounting Cycle Problem Ashlee Adams and Alana Miller graduated in accounting with their Masters in May they completed the CPA exam. Ashlee and Alana worked November, 19, they worked with an attorney and esta ready to start business. During lanuary Ye of Year 17. During the rest of Year 17, e CPA exam. Ashlee and Alana worked for a large manufacturing company during Year 18 and 19. By Year 19, Ashlee and Alana decided to take their savings and start their own CPA practice. In December, Year blished A & M CPA, LLC. Also, they rented office space. By January, they were ar 20, A & MCPA, LLC had the following transactions January 2 Ashlee and Alana Ashlee and Alana opened a bank account in the name of A&M CPA, LLC. In exchange for common stock, they both deposited $7,000 into the account 2 Paid three months' rent on the lease 2 Paid Attorney F 2 Paid annual premiums of $3,600 on property and casuelty in 2 Purchased supplies for $500 2 Purchased office equipment for S8,000 paying $2,000 down and signing a 4% one-year rental contract, $3,000. d Attorney Fields $2,000 for the legal work done to establish the LLC and casualty insurance policies note on the balance 6 Received cash of $1,000 for preparing 6 Paid cash for a newspaper advertisement, $400 tax returns for clients 10 Deposited $2,000 of cash received from customers for services performed during the week. 1rdsice provded duringthe wek 17 Recorded services provided during the week, $1,000 on account and an additional $3,000 in cash. Customer paid $500 on account. 24 22 Recorded services provided during the week, $1,200 on account and an additional 54,000 in cash 28 Customers paid $800 on account 31 Paid telephone bill for January, $250 31 Paid gas bill for January, $200 31 Paid electric bill for January, $75 31 Recorded services provided during the week, $1,500 on account and an additional $4,500 in cash. 31 Paid diridends $2,000 1. 2. 3. 4. Record the above transactions in journal form. Post the transactions to ledger accounts. Prepare an unadjusted trial balance At the end of January, Ashlee and Alana prepared the following information a. b. C. Supplies on hand, $100. One month rent has been used The equipment purchased on January 2 had a 5-year life and no salvage value. Ashlee and Alana decided to use the straight-line method of depreciation One month insurance has expired One month interest on the note was accrued. d. e. Record the adjusting entries in journal form and post to ledger accounts 5. 6. 7. 8. Prepare an adjusted trial balance Prepare financial statements-income statement, statement of retained earnings, and balance sheet. Prepare closing entries in journal form and post to ledger accounts. Prepare a post-closing trial balance