Answered step by step

Verified Expert Solution

Question

1 Approved Answer

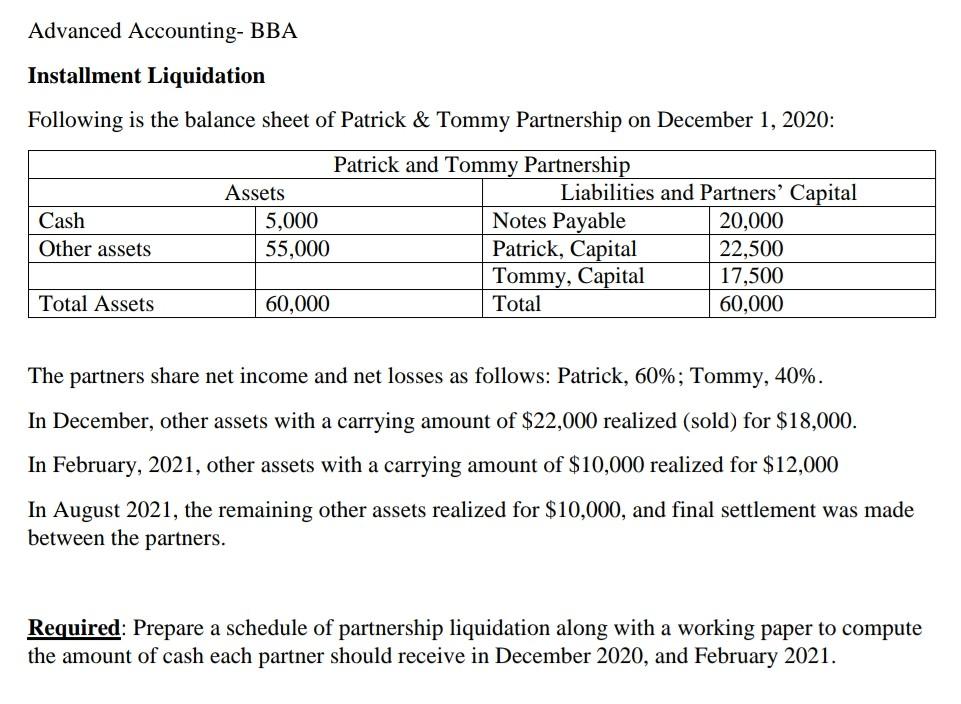

Advanced Accounting- BBA Installment Liquidation Following is the balance sheet of Patrick & Tommy Partnership on December 1, 2020: Cash Other assets Patrick and Tommy

Advanced Accounting- BBA Installment Liquidation Following is the balance sheet of Patrick & Tommy Partnership on December 1, 2020: Cash Other assets Patrick and Tommy Partnership Assets Liabilities and Partners' Capital 5,000 Notes Payable 20,000 55,000 Patrick, Capital 22,500 Tommy, Capital 17,500 60,000 Total 60,000 Total Assets The partners share net income and net losses as follows: Patrick, 60%; Tommy, 40%. In December, other assets with a carrying amount of $22,000 realized (sold) for $18,000. In February, 2021, other assets with a carrying amount of $10,000 realized for $12,000 In August 2021, the remaining other assets realized for $10,000, and final settlement was made between the partners. Required: Prepare a schedule of partnership liquidation along with a working paper to compute the amount of cash each partner should receive in December 2020, and February 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started