Question

Advanced Financial Accounting: C127: Translation Adjustment and Comprehensive Income: LO 125:- Analysis Dundee Company owns 100 percent of a subsidiary located in Ireland. The parent

Advanced Financial Accounting:

C127: Translation Adjustment and Comprehensive Income:

LO 125:-

Analysis

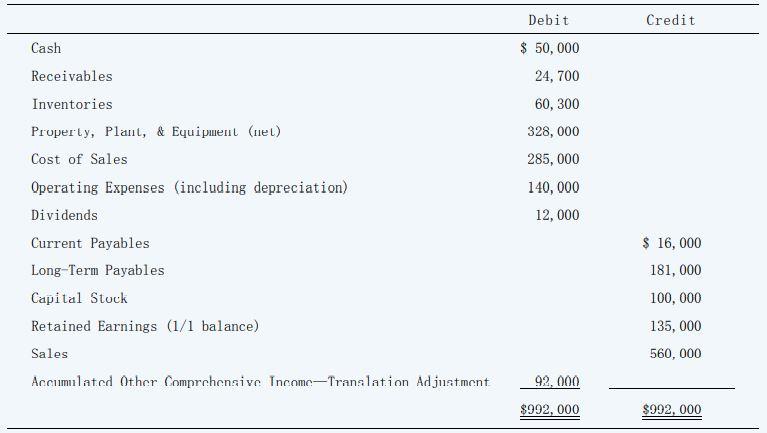

Dundee Company owns 100 percent of a subsidiary located in Ireland. The parent company uses the Euro as the subsidiarys functional currency. At the beginning of the year, the debit balance in the Accumulated Other Comprehensive IncomeTranslation Adjustment account, which was the only item in accumulated other comprehensive income, was $80,000. The subsidiarys translated trial balance at the end of the year is as follows:

Required:-

a. Prepare the subsidiarys income statement, ending in net income, for the year.

b. Prepare the subsidiarys statement of comprehensive income for the year.

c. Prepare a year-end balance sheet for the subsidiary.

d. ASC 220 allows for alternative operating statement displays of the other comprehensive income items. Discuss the major differences between the one-statement format of the income statement and comprehensive income versus the two-statement format of the income statement with a separate statement of comprehensive income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started