Answered step by step

Verified Expert Solution

Question

1 Approved Answer

advanced financial mathematics Newt & Co. own non-divided paying Orange stock with the continuous compounded risk-free interest rate at 4%. The price of the stock

advanced financial mathematics

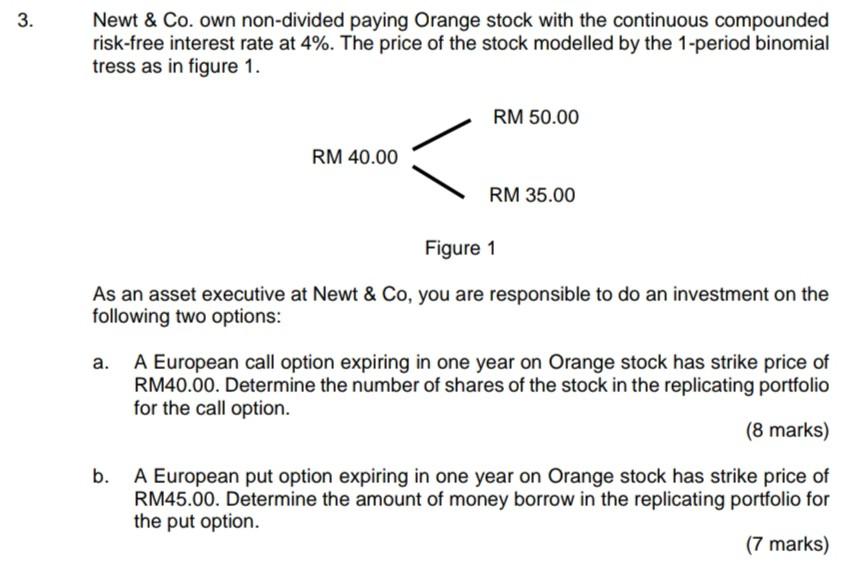

Newt \& Co. own non-divided paying Orange stock with the continuous compounded risk-free interest rate at 4%. The price of the stock modelled by the 1-period binomial tress as in figure 1. As an asset executive at Newt \& Co, you are responsible to do an investment on the following two options: a. A European call option expiring in one year on Orange stock has strike price of RM40.00. Determine the number of shares of the stock in the replicating portfolio for the call option. (8 marks) b. A European put option expiring in one year on Orange stock has strike price of RM45.00. Determine the amount of money borrow in the replicating portfolio for the put option. (7 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started