ADVANCED MACROECONOMICS

The question is assigned below as a,b,c,d?

link is https://www.rug.nl/ggdc/productivity/pwt/

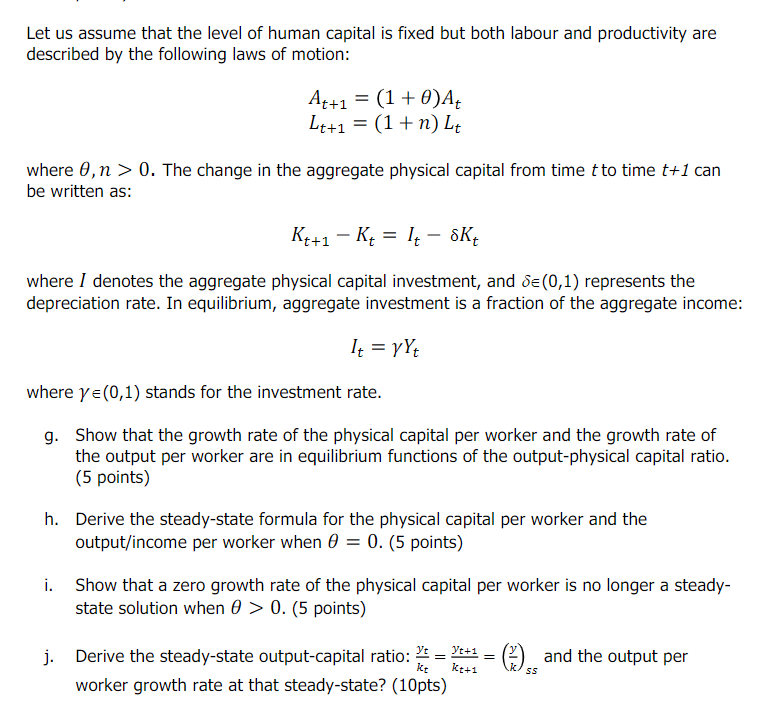

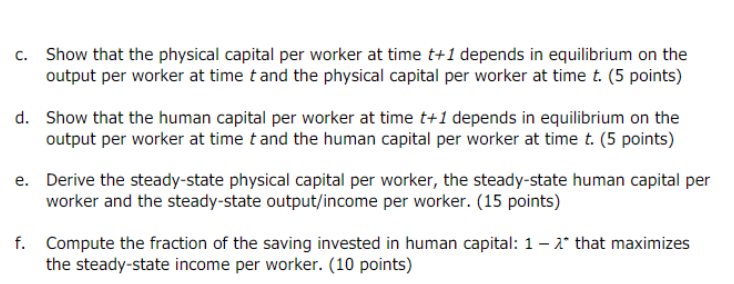

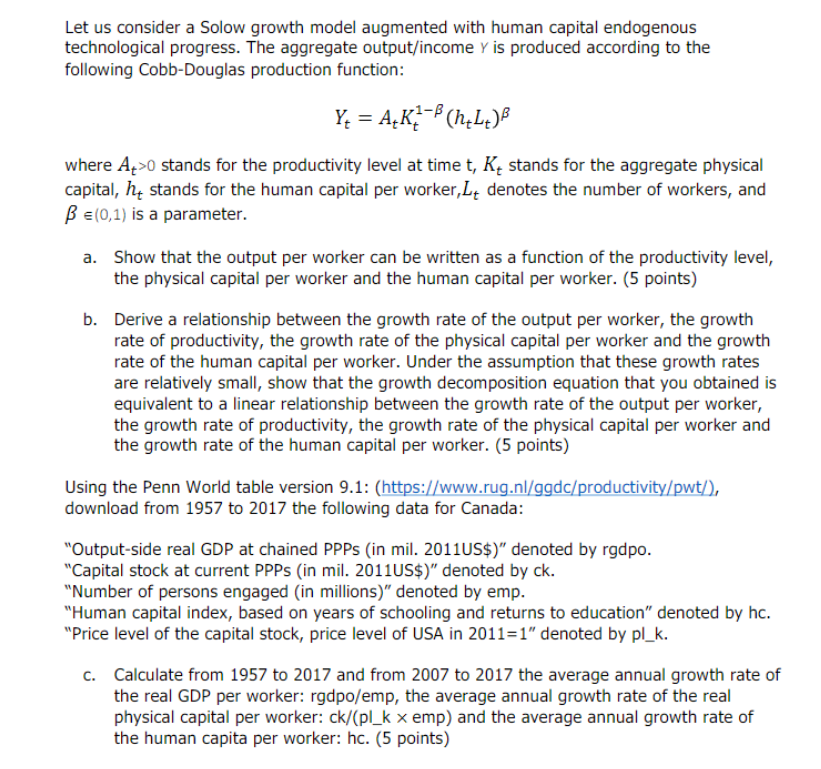

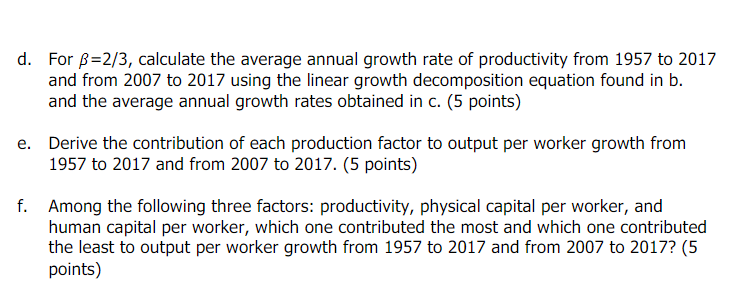

Let us assume that the level of human capital is xed but both labour and productivity are described by the following laws of motion: At+1 = (1 + EFL: Lt+1 = (1 + 7'1th where 9,11 2:- 0. The change in the aggregate physical capital from time tto time t+1 can be written as: Kt+1 _ Kt = It _ 5K: where l denotes the aggregate physical capital investment, and 5e ((1,1) represents the depreciation rate. In equilibrium, aggregate investment is a fraction of the aggregate income: It=}'}'i: where ye ([1,1] stands for the investment rate. g. Show that the growth rate of the physical capital per worker and the growth rate of the output per worker are in equilibrium functions of the output-physical capital ratio. (5 points] Derive the steadv-state formula for the physical capital per worker and the outpug'income per worker when 3 = D. (5 points) Show that a zero growth rate of the phvsical capital per worker is no longer a steady- state solution when 3 3;. D. [5 points) Derive the steady-state output-capital ratio: E = \"+1 = (a and the output per 55' 5!: kr+1 worker growth rate at that steadv-state? {10pts} Let us consider a Solow growth model augmented with human capital accumulation. The aggregate outputjincome 'r' is produced according to the following production function: r. = Amos\"'3 where some stands for the productivity level, K stands for the aggregate physical capital, r'. denotes the number of workers, H represents the aggregate stock of human capital and a, B Emil are parameters. Let us assume that the number of workers grows at a constant rate lav-i]: Lt+1 = (1 + 1014: The law of motions for the aggregate physical capital and aggregate human capital from time tto time Hi can be written as: Kt+l = I115 + (1 _ (Wit HITFl = If + (1 _6) HI? where if denotes the aggregate investment in physical capital, If denotes the aggregate investment in human capital and E(0,1) represents the depreciation rate. Let us assume that the aggregate consumption can be dened as follows: Ct = (1 _ rs where y denotes the marginal propensity to save. Let us assume that a faction Aefd) of the aggregate saving is invested into physical capital and a faction 1 .1 is invested into human capital. a. Write-down the production function in per worker units. (5 points) b. Write-down the goods' market equilibrium condition and show that it is equivalent to the equality between aggregate saving and aggregate investment. (5 points) Show that the physical capital per worker at time t+1 depends in equilibrium on the output per worker at time tend the physical capital per worker at time t. (5 points] Show that the human capital per worker at time t+1 depends in equilibrium on the output per worker at time tend the human capital per worker at time t. (5 points} Derive the steady-state physical capital per worker, the steady-state human capital per worker and the steady-state outputfinoome per worker. {15 points} Compute the fraction of the saving invested in human capital: 1 A' that maximizes the steady-state income per worker. {10 points} Let us consider a Solow growth model augmented with human capital endogenous technological progress. The aggregate outputfincome r is produced according to the following Cobb-Douglas production function: r, = AtKi'iwo where Atso stands for the productivity level at time t, Kt stands for the aggregate physical capital, ht stands for the human capital per worker,Lt denotes the number of workers, and ,8 elm} is a parameter. a. Show that the output per worker can be written as a function of the productivity level, the physical capital per worker and the human capital per worker. (5 points} b. Derive a relationship between the growth rate of the output per worker, the growth rate of productivity, the growth rate of the physical capital per worker and the growth rate of the human capital per worker. Under the assumption that these growth rates are relatively small, show that the growth decomposition equation that you obtained is equivalent to a linear relationship between the growth rate of the output per worker, the growth rate of productivity, the growth rate of the physical capital per worker and the growth rate of the human capital per worker. (5 points} Using the Penn World table version I0.1: [httpswwwmugnl[ggdggproductiv'gyipwy], download from 195? to 201? the following data for Canada: \"Output-side real GDP at chained PPPs [in mil. 2011US$)" denoted by rgdpo. \"Capital stock at current PPPs (in mil. 2011US$}" denoted by ck. \"Number of persons engaged [in millions)" denoted by emp. \"Human capital index, based on years of schooling and returns to education" denoted by hc. \"Price level of the capital stock, price level of USA in 2011:1' denoted by pl_k. c. Calculate from 195? to 201? and from 200? to 201? the average annual growth rate of the real GDP per worker: rgdpoiemp, the average annual growth rate of the real physical capilal per worker: ck}(pl_k x amp} and the average annual growth rate of the human capita per worker: he. (5 points) d. For ,0=2f3, calculate the average annual growth rate of productivity from 195? to 201? and from 200? to 201? using the linear growth decomposition equation found in b. and the average annual growth rates obtained in c. (5 points) e. Derive the contribution of each production factor to output per worker growth from 195? to 201? and from 200? to 201?. (5 points} f. Among the following three factors: productivity, physical capital per worker, and human capital per worker, which one contributed the most and which one contributed the least to output per worker growth from 195? to 201? and from 200? to 201?? {5 points)