Answered step by step

Verified Expert Solution

Question

1 Approved Answer

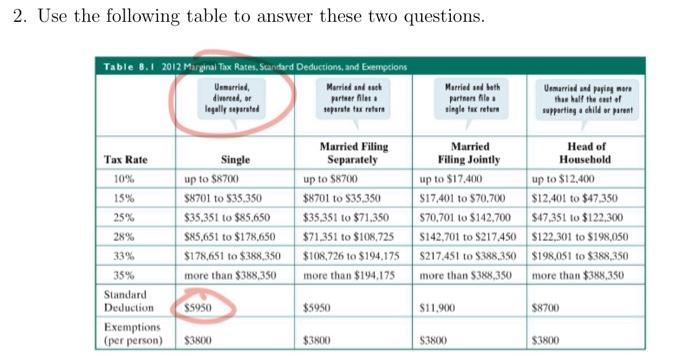

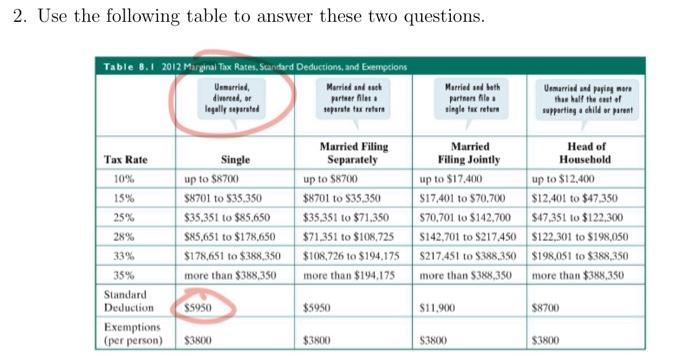

ADVANCED MATH EXPERT NEEDED ASAP with written work shown please 2. Use the following table to answer these two questions. Table 8.1 2012 Marginal Tax

ADVANCED MATH EXPERT NEEDED ASAP with written work shown please

2. Use the following table to answer these two questions. Table 8.1 2012 Marginal Tax Rates, Standard Deductions, and Exempcions Unmarried, divereed, or legally separated Married and ack partner files separate tax return Tax Rate 10% 15% 25% 28% 33% 35% Standard Deduction Single up to $8700 $8701 to $35.350 $35.351 to $85,650 $85,651 to $178,650 $178,651 to $388,350 more than $388,350 $5950 Exemptions (per person) $3800 Married Filing Separately up to $8700 $8701 to $35.350 $35,351 to $71,350 $71,351 to $108,725 $108,726 to $194,175 more than $194,175 $5950 $3800 Married and both partners file a single tax return Married Filing Jointly up to $17.400 $17,401 to $70,700 $70,701 to $142,700 $142,701 to $217,450 $217,451 to $388,350 more than $388,350 $11,900 $3800 Unmarried and paying more than half the cast of supporting a child or parent Head of Household up to $12,400 $12,401 to $47.350 $47,351 to $122,300 $122,301 to $198,050 $198,051 to $388,350 more than $388,350 $8700 $3800 (a) (5 points) What is the taxpayer's taxable income, assuming they take the standard deduction? (b) (5 points) What is the taxpayer's total income tax payment? 2. Use the following table to answer these two questions. Table 8.1 2012 Marginal Tax Rates, Standard Deductions, and Exempcions Unmarried, divereed, or legally separated Married and ack partner files separate tax return Tax Rate 10% 15% 25% 28% 33% 35% Standard Deduction Single up to $8700 $8701 to $35.350 $35.351 to $85,650 $85,651 to $178,650 $178,651 to $388,350 more than $388,350 $5950 Exemptions (per person) $3800 Married Filing Separately up to $8700 $8701 to $35.350 $35,351 to $71,350 $71,351 to $108,725 $108,726 to $194,175 more than $194,175 $5950 $3800 Married and both partners file a single tax return Married Filing Jointly up to $17.400 $17,401 to $70,700 $70,701 to $142,700 $142,701 to $217,450 $217,451 to $388,350 more than $388,350 $11,900 $3800 Unmarried and paying more than half the cast of supporting a child or parent Head of Household up to $12,400 $12,401 to $47.350 $47,351 to $122,300 $122,301 to $198,050 $198,051 to $388,350 more than $388,350 $8700 $3800 (a) (5 points) What is the taxpayer's taxable income, assuming they take the standard deduction? (b) (5 points) What is the taxpayer's total income tax payment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started