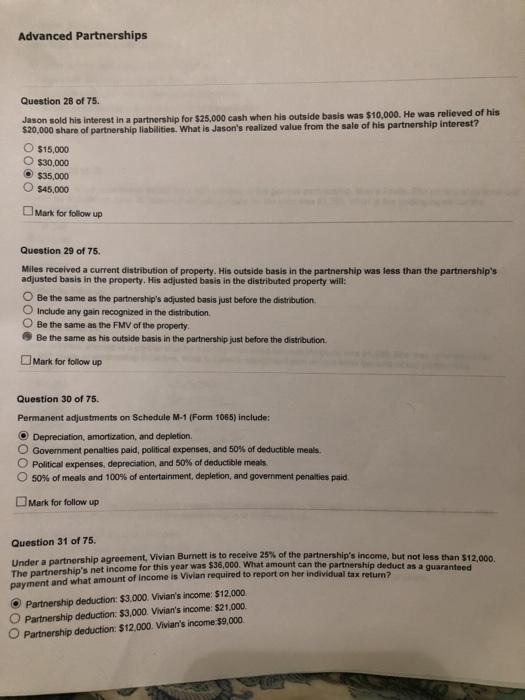

Advanced Partnerships Question 28 of 75. Jason sold his interest in a partnership for $25,000 cash when his outside basis was $10,000. He was relieved of his 520,000 share of partnership liabilities. What is Jason's realized value from the sale of his partnership Interest? O $15,000 O $30,000 $35,000 O $45.000 Mark for follow up Question 29 of 75. Miles received a current distribution of property. His outside basis in the partnership was less than the partnership's adjusted basis in the property. His adjusted basis in the distributed property will: O Be the same as the partnership's adjusted basis just before the distribution O Include any gain recognized in the distribution O Be the same as the FMV of the property. Be the same as his outside basis in the partnership just before the distribution Mark for follow up Question 30 of 75. Permanent adjustments on Schedule M-1 (Form 1065) include: Depreciation, amortization, and depletion O Government penalties paid, political expenses, and 50% of deductible meals. O Political expenses, depreciation, and 50% of deductible meals O 50% of meals and 100% of entertainment depletion, and government penalties paid. Mark for follow up Question 31 of 75. Haderpartnership agreement, Vivian Burnett is to receive 25% of the partnership's income, but not less than $12.00 The murdership's net income for this year was $36,000. What amount can the partnership deduct as a quarante payment and what amount of income is Vivian required to report on her individual tax return? Partnership deduction: $3.000. Vivian's income: $12,000. O Partnership deduction: $3,000. Vivian's income: $21.000 O Partnership deduction: $12,000 Vivian's income $9,000 Advanced Partnerships Question 28 of 75. Jason sold his interest in a partnership for $25,000 cash when his outside basis was $10,000. He was relieved of his 520,000 share of partnership liabilities. What is Jason's realized value from the sale of his partnership Interest? O $15,000 O $30,000 $35,000 O $45.000 Mark for follow up Question 29 of 75. Miles received a current distribution of property. His outside basis in the partnership was less than the partnership's adjusted basis in the property. His adjusted basis in the distributed property will: O Be the same as the partnership's adjusted basis just before the distribution O Include any gain recognized in the distribution O Be the same as the FMV of the property. Be the same as his outside basis in the partnership just before the distribution Mark for follow up Question 30 of 75. Permanent adjustments on Schedule M-1 (Form 1065) include: Depreciation, amortization, and depletion O Government penalties paid, political expenses, and 50% of deductible meals. O Political expenses, depreciation, and 50% of deductible meals O 50% of meals and 100% of entertainment depletion, and government penalties paid. Mark for follow up Question 31 of 75. Haderpartnership agreement, Vivian Burnett is to receive 25% of the partnership's income, but not less than $12.00 The murdership's net income for this year was $36,000. What amount can the partnership deduct as a quarante payment and what amount of income is Vivian required to report on her individual tax return? Partnership deduction: $3.000. Vivian's income: $12,000. O Partnership deduction: $3,000. Vivian's income: $21.000 O Partnership deduction: $12,000 Vivian's income $9,000