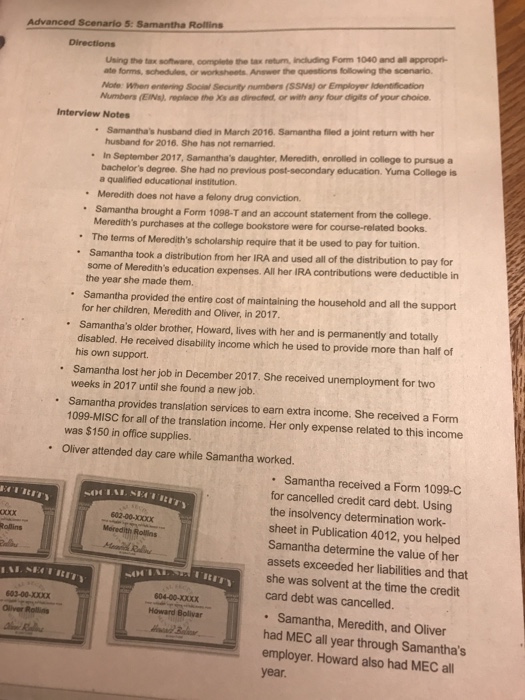

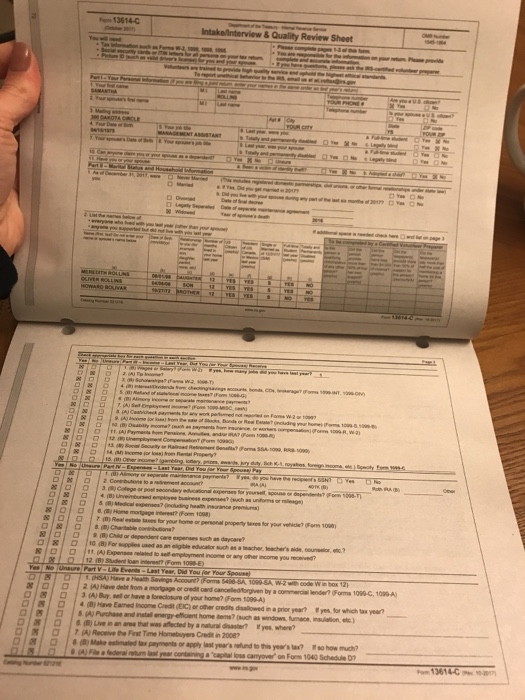

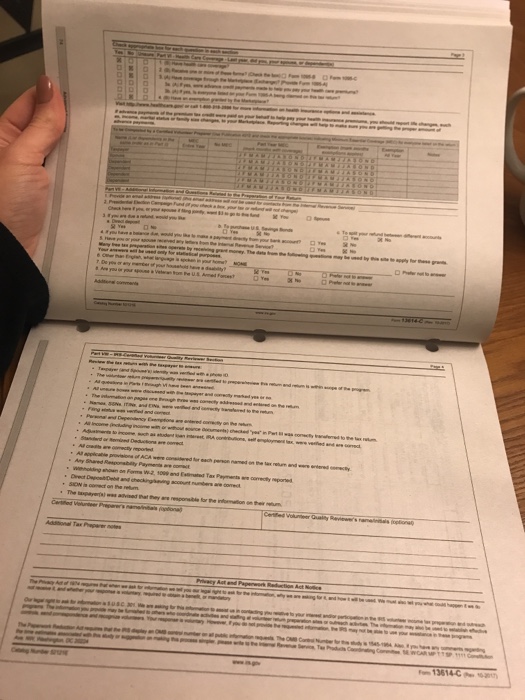

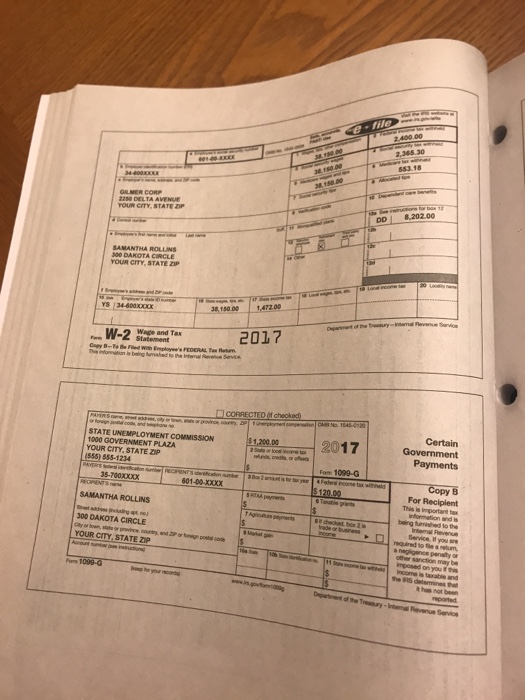

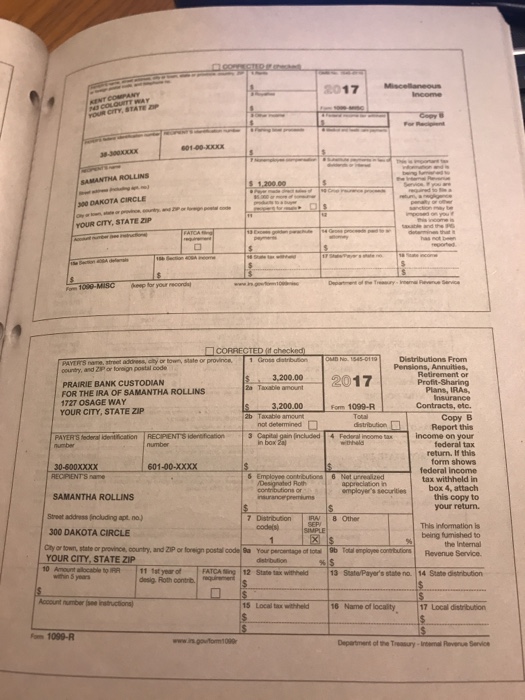

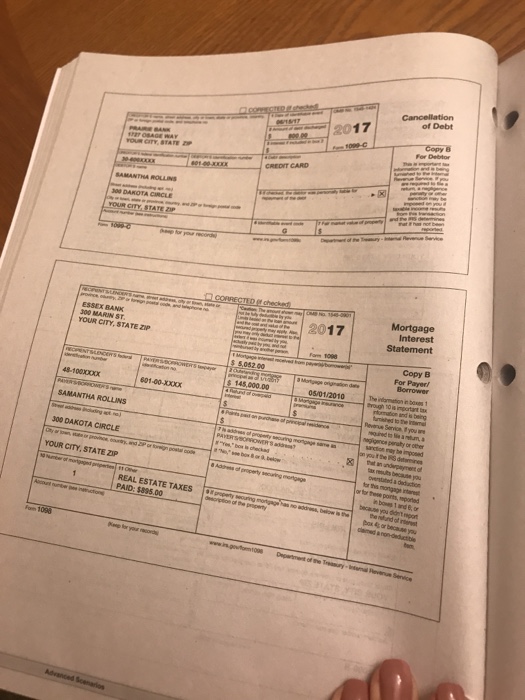

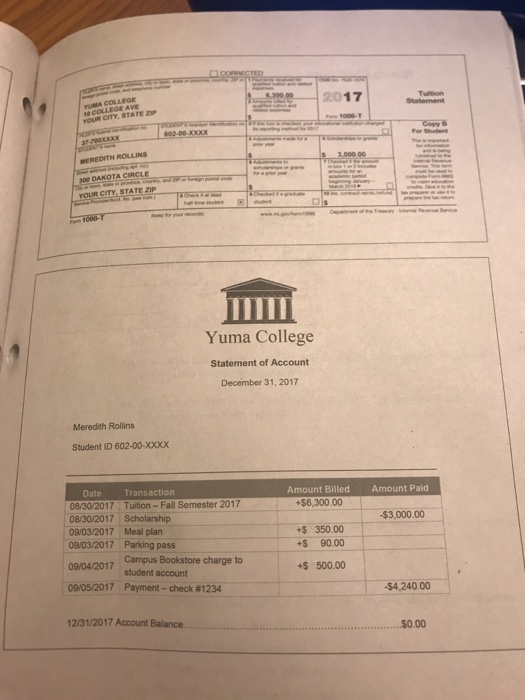

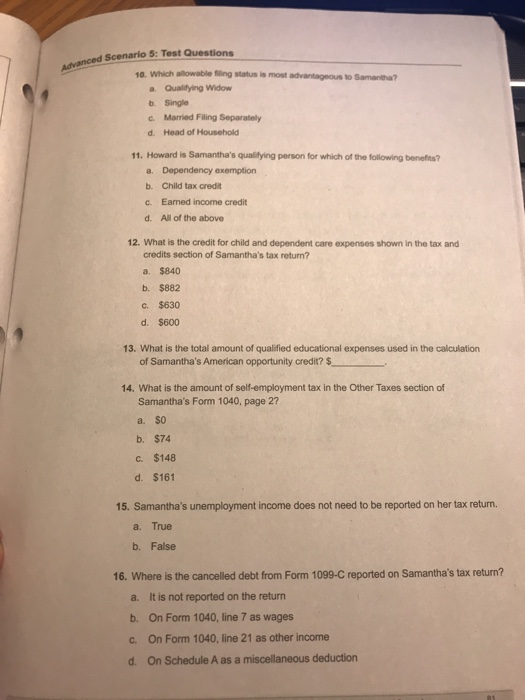

Advanced Scenario 5: Samantha Rollins Using the tax soware,complete the tax retum, including Form 1040 and all appropr ate forms, schedules, or worksheets Anewer the questions following the scenario Mote: When entering Social Secunity numbers (SSNs) or Employer ldentification Numbers (ENs replace the Xs as directed, or with any four digits of your choice. Interview Notes Samantha's husband died in March 2016. Samantha filed a joint return with her husband for 2016. She has not remarried In September 2017, Samantha's daughter, Meredith, enroliled in college to pursue a bachelor's degree. She had no previous post-secondary education. Yuma College is a qualified educational institution. Meredith does not have a felony drug conviction. Samantha brought a Form 1098-T and an account statement from the college Meredith's purchases at the college bookstore were for course-related books The terms of Meredith's scholarship require that it be used to pay for tuition Samantha took a distribution from her IRA and used all of the distribution to pay for some of Meredith's education expenses. All her IRA contributions were deductible in the year she made them. Samantha provided the entire cost of maintaining the household and all the support for her children, Meredith and Oliver, in 2017 Samantha's older brother, Howard, lives with her and is permanently and totally disabled. He received disability income which he used to provide more than half of his own support. Samantha lost her job in December 2017. She received unemployment for two . weeks in 2017 until she found a new job. .Samantha provides translation services to earn extra income. She received a Form 1099-MISC for all of the translation income. Her only expense related to this income was $150 in office supplies. Oliver attended day care while Samantha worked. Samantha received a Form 1099-C for cancelled credit card debt. Using the insolvency determination work- sheet in Publication 4012, you helped Samantha determine the value of her assets exceeded her liabilities and that she was solvent at the time the credit card debt was cancelled. 602-00-x00x Rollins 603-00-XxX Oliver Rollins 604-00-XXXX Howard Bolivar Samantha, Meredith, and Oliver had MEC all year through Samantha?s employer. Howard also had MEC all year Advanced Scenario 5: Samantha Rollins Using the tax soware,complete the tax retum, including Form 1040 and all appropr ate forms, schedules, or worksheets Anewer the questions following the scenario Mote: When entering Social Secunity numbers (SSNs) or Employer ldentification Numbers (ENs replace the Xs as directed, or with any four digits of your choice. Interview Notes Samantha's husband died in March 2016. Samantha filed a joint return with her husband for 2016. She has not remarried In September 2017, Samantha's daughter, Meredith, enroliled in college to pursue a bachelor's degree. She had no previous post-secondary education. Yuma College is a qualified educational institution. Meredith does not have a felony drug conviction. Samantha brought a Form 1098-T and an account statement from the college Meredith's purchases at the college bookstore were for course-related books The terms of Meredith's scholarship require that it be used to pay for tuition Samantha took a distribution from her IRA and used all of the distribution to pay for some of Meredith's education expenses. All her IRA contributions were deductible in the year she made them. Samantha provided the entire cost of maintaining the household and all the support for her children, Meredith and Oliver, in 2017 Samantha's older brother, Howard, lives with her and is permanently and totally disabled. He received disability income which he used to provide more than half of his own support. Samantha lost her job in December 2017. She received unemployment for two . weeks in 2017 until she found a new job. .Samantha provides translation services to earn extra income. She received a Form 1099-MISC for all of the translation income. Her only expense related to this income was $150 in office supplies. Oliver attended day care while Samantha worked. Samantha received a Form 1099-C for cancelled credit card debt. Using the insolvency determination work- sheet in Publication 4012, you helped Samantha determine the value of her assets exceeded her liabilities and that she was solvent at the time the credit card debt was cancelled. 602-00-x00x Rollins 603-00-XxX Oliver Rollins 604-00-XXXX Howard Bolivar Samantha, Meredith, and Oliver had MEC all year through Samantha?s employer. Howard also had MEC all year