Advanced Scenario 8: Richard Roosevelt

Directions

Using the tax software, complete the tax return, including Form 1040 and all appropri- ate forms, schedules, or worksheets . Answer the questions following the scenario .

Note: When entering Social Security numbers (SSNs) or Employer Identification

Numbers (EINs), replace the Xs as directed, or with any four digits of your choice.

Interview Notes

Richard is age 45 and single . Richards tax information was stolen and the IRS issued an Identity Protection PIN 123456 .

Richards mother, Martha, lives in a nursing home in a neighboring state . In 2020, she received $7,800 in Social Security income. Although she uses this money for her support, Richard has records showing he provided over half of her support in 2020 .

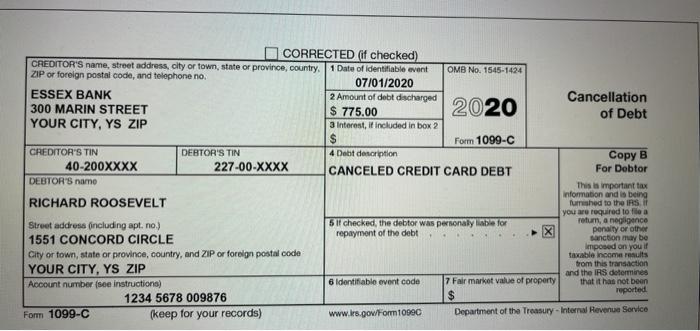

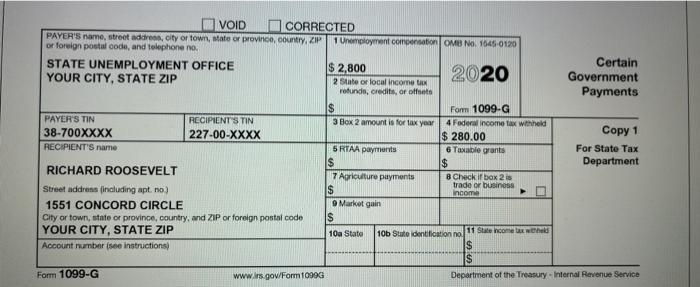

Richard lost his job in March when the state shut down due to the coronavirus pandemic . He received unemployment compensation for June and July .

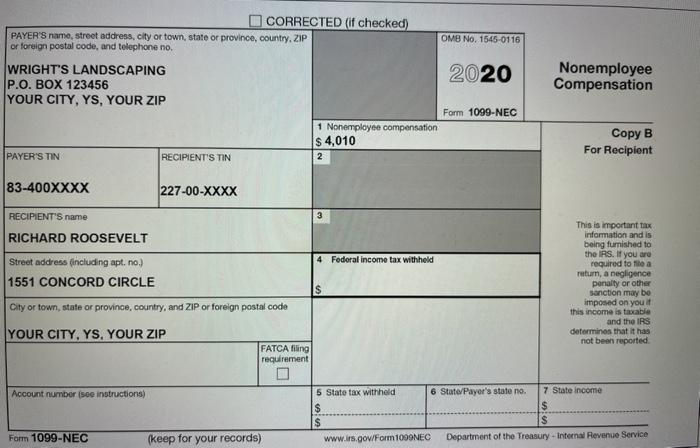

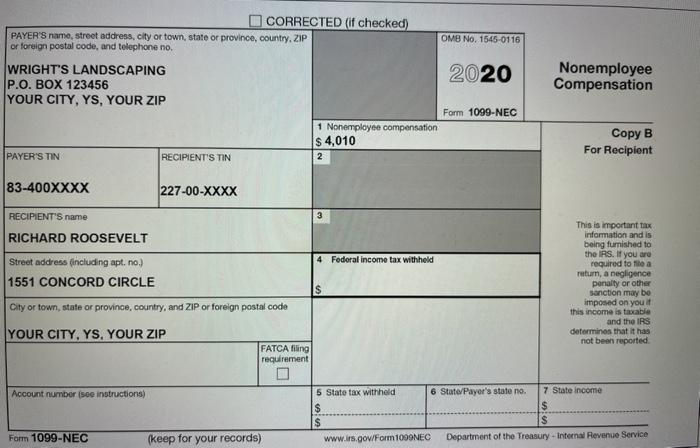

Richard began a landscape service in April and was paid on Form 1099-NEC . He also received cash receipts of $325 from clients not reported on a tax form. Richard uses the cash method of accounting .

He uses business code 561730 .

He has receipts for the following expenses:

Used lawnmower - $236

Business cards - $15

Rake - $19

Work gloves - $25

Lunches - $140

Work clothes suitable for everyday use - $175

Lunch box - $25

Richard has a detailed mileage log reporting:

Mileage from his home to his 1st clients home and mileage from his last clients home to his home 620 miles .

In addition, on the days Richard worked for multiple clients, he kept track of the mileage from the first clients home to the second clients home in case that mileage was also deductible . He logged 312 miles (not included in the 620 miles) .

The total mileage on his car for tax year 2020 was 9,543 miles . Of that, 8,611 were personal miles . He placed his only vehicle, a pick-up truck, in service on 4/15/2020 . He will take the standard mileage rate .

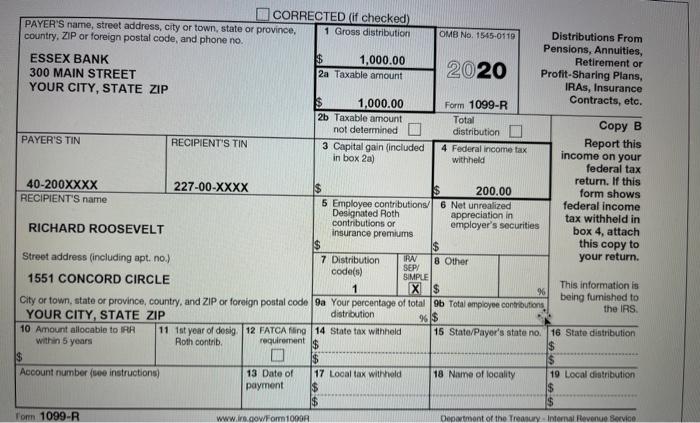

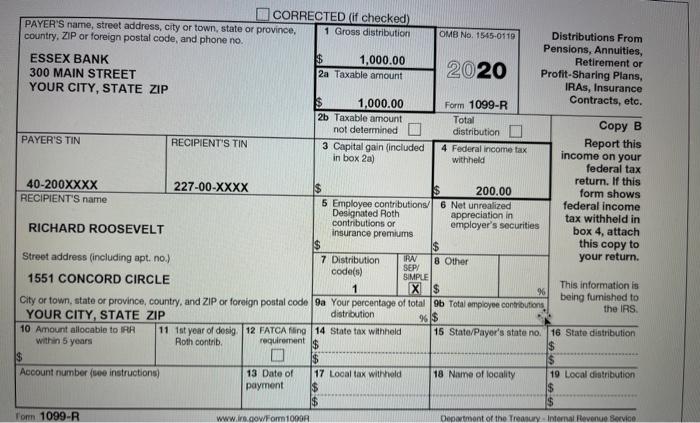

Richard took an early distribution from his IRA in April to help pay his living expenses while he was out of work due to COVID-19 . Richard did not repay this distribution by the due date of his 2020 tax return .

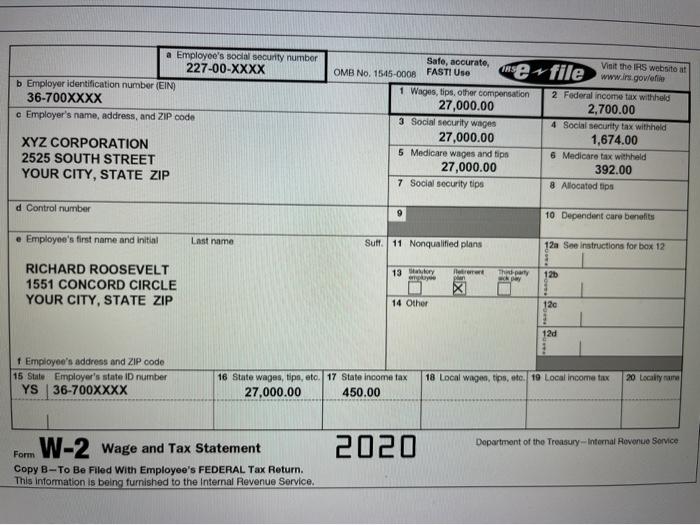

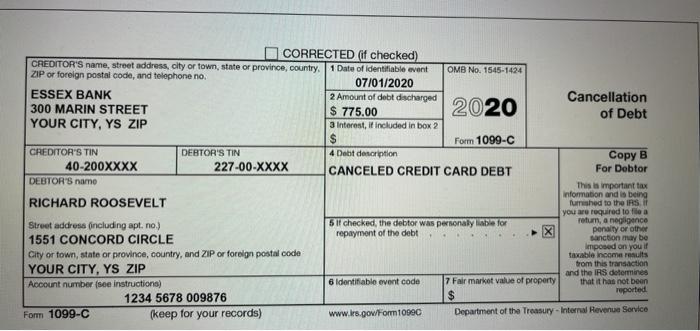

Richard settled with his credit card company on an outstanding bill and brought the Form 1099-C to the site . He isnt sure how it will impact his tax return for tax year 2020 . Richard determined he was solvent as of the date of the canceled debt .

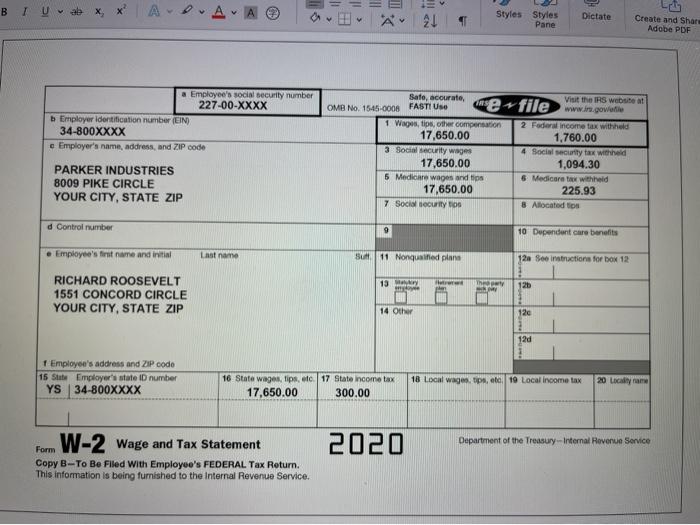

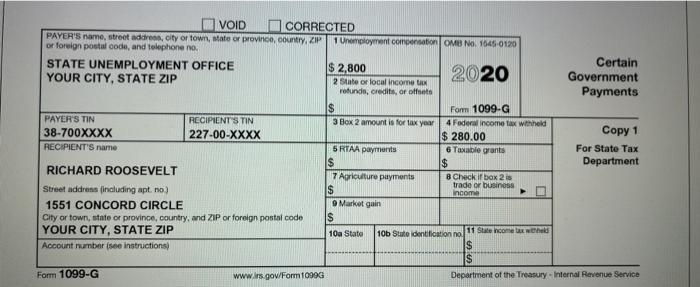

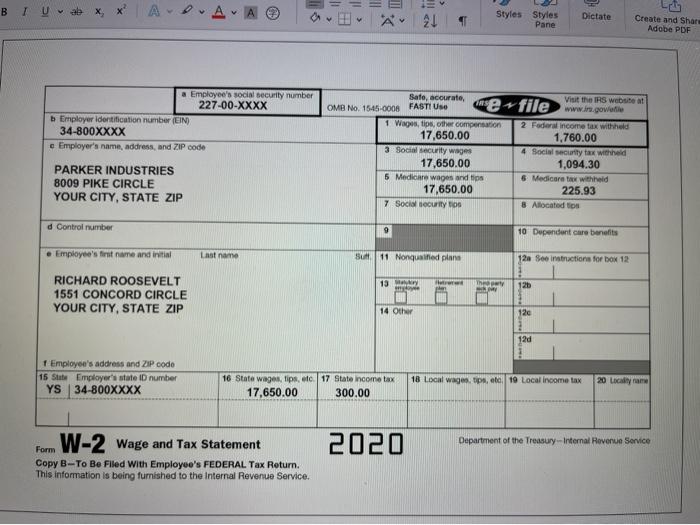

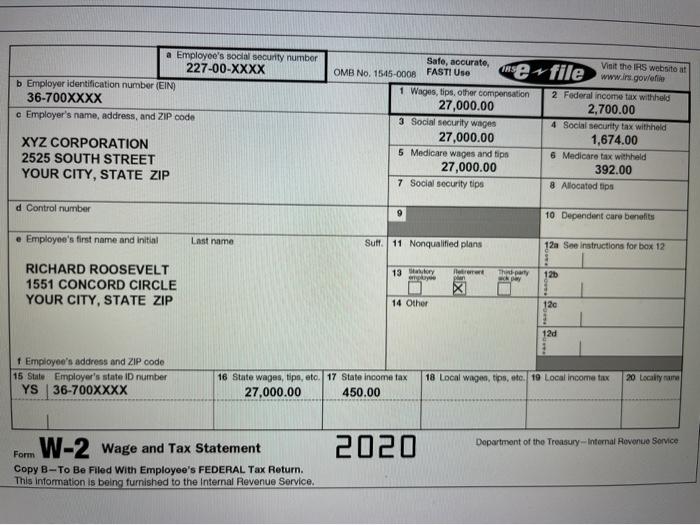

Richard went back to work in July and received a Form W-2 .

Richard doesnt have enough to itemize this year and will take the standard deduc- tion .

Richard received a $1,200 Economic Impact Payment (EIP) in April 2020.

Richard didnt have any health insurance in 2020 .

Additional information attached as pics

29 . Richards most beneficial filing status allowable is Head of Household.

a . True

b . False

30 . Which item(s) can be deducted by Richard as a business expense? a . Work gloves

b . Work clothes (suitable for everyday use) c . Rake

d . Both a and c

31 . What is the qualified business income (QBI) deduction on the Richards tax return?

a $0

b. $648

c. $718

d. $3,857

32 . Richard must report $ of his canceled debt on his 2020 tax return.

33 . Richard is required to pay a 10% additional tax on the early distribution from his

IRA account in 2020 . a . True

b . False

34 . Richard has been assigned an Identity Protection PIN by the IRS . How does this

affect preparation of Richards tax return?

a . The PIN must be entered during tax return preparation . b . The PIN will appear on Richards Form 1040 .

c. Failure to enter the PIN will cause Richards e-filed return to be rejected by the

IRS .

d . All of the above .

35 . Which of the following statements is true?

a . Richard is able to defer half the taxpayer and employer share of Social Security tax until December 31, 2021 and the other half until December 31, 2022 .

b . Richard is able to defer half of the taxpayer share of Social Security tax until December 31, 2021 and the other half until December 31, 2022 .

c . Richard is able to defer half of the employer share of Social Security tax until December 31, 2021 and the other half until December 31, 2022 .

d . Richard does not have the option to defer half of his share or the employer share of Social Security tax .

B Uab x x A 21 Styles Styles Pane Dictate Create and Share Adobe PDF me-file www.n.gov.al Visit this website at a Employee's social security number 227-00-XXXX b Employer identification number (EIN) 34-800XXXX e Employer's name, address, and ZIP code Safe, acourate OMB No. 1545-0006 FASTIUSO 1 Wages, tips, other compensation 17,650.00 3 Social Security wages 17,650.00 5 Medicare wages and tips 17,650.00 7 Social Security to PARKER INDUSTRIES 8009 PIKE CIRCLE YOUR CITY, STATE ZIP 2 Federal income tax withhold 1,760.00 4 Social Security tax withheld 1,094.30 6 Medicare to withheld 225.93 8 Allocated to d Control number 9 10 Dependent care benefits Employee's first name and initial Last name Su 11 Nonquified plans 12 Se instructions for box 12 13 May Hur "The 125 RICHARD ROOSEVELT 1551 CONCORD CIRCLE YOUR CITY, STATE ZIP 14 Other 12c 12d f Employee's address and ZIP codo 15 State Employer's state ID number YS 34-800XXXX 16 State Wages, tips, etc 17 State income tax 17,650.00 300.00 18 Local wagen tips, eta, 19 Local income tax 20 locally are W-2 Wage and Tax Statement 2020 Department of the Treasury -- Internal Revenue Service Form Copy B-To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. Visit the IRS websitost e file www.is.govletin a Employee's social security number 227-00-XXXX b Employer identification number (EIN 36-700XXXX c Employer's name, address, and ZIP code Safe, accurate, DAS OMB No. 1545-0008 FASTI Use 1 Wages, tips, other compensation 27,000.00 3 Social security wages 27,000.00 5 Medicare wages and tips 27,000.00 7 Social security tips XYZ CORPORATION 2525 SOUTH STREET YOUR CITY, STATE ZIP 2 Federal income tax withheld 2,700.00 4 Social security tax withheld 1,674.00 6 Medicare tax withheld 392.00 8 Allocated tips d Control number 10 Dependent care benefits e Employee's first name and initial Last name Sufl. 11 Nonqualified plans 12a See Instructions for box 12 13 kory They pay 12 pan RICHARD ROOSEVELT 1551 CONCORD CIRCLE YOUR CITY, STATE ZIP 14 Other 120 12d Employee's address and ZIP code 15 State Employer's state ID number YS 36-700XXXX 18 Local wage, tips, oto 19 Local income tax 20 loculty 16 State Wages, tips, eto 17 State income tax 27,000.00 450.00 Form W-2 Wage and Tax Statement 2020 Department of the Treasury -- Internal Revenue Service Copy B-To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. 2020 CORRECTED (if checked) CREDITOR'S name, street address, city or town, state or province, country. 1 Date of identifiable event ZIP or foreign postal code, and telephone no. OMB No. 1545-1424 07/01/2020 ESSEX BANK 2 Amount of debt discharged Cancellation 300 MARIN STREET $ 775.00 of Debt YOUR CITY, YS ZIP 3 Interest, if included in box 2 $ Form 1099-C CREDITOR'S TIN DEBTOR'S TIN 4 Debit description Copy B 40-200XXXX 227-00-XXXX CANCELED CREDIT CARD DEBT For Debtor DEBTOR'S namo This is important tax Information and is being RICHARD ROOSEVELT furnished to the IRS you are required to file a Street address including apt.no) 5 it checked the debtor was personal liable for retur, a negligence 1551 CONCORD CIRCLE repayment of the debt penalty or other sanction may be imposed on your City or town, state or province, country, and ZIP or foreign postal code taxable income results YOUR CITY, YS ZIP from this transaction and the IRS determines Account number (see instructions) 6 Identifiable event code 7 Fair market value of property that it has not been $ reported 1234 5678 009876 Form 1099-C (keep for your records) www.lrs.gow Form10990 Department of the Treasury - Internal Revenue Service 2020 Certain Government Payments VOID CORRECTED PAYER'S name, street address, city or town, Mate or province, country.ZIP 1 Unemployment compensation OMB No 1545-0120 or foreign postal code, and telephone no. STATE UNEMPLOYMENT OFFICE $ 2,800 YOUR CITY, STATE ZIP 2 State or local income tax rofunda, credits, or offset IS Form 1099-G PAYER'S TIN RECIPIENT'S TIN 3 Box 2 amount is for tax year 4 Federal income tax withhold 38-700XXXX 227-00-XXXX $ 280.00 RECIPIENT'S name 5 RTAA payments 6 Taxable grants $ $ RICHARD ROOSEVELT 7 Agriculture payments 8 Check if box 2 is Street address including apt, no $ trade or business Income 1551 CONCORD CIRCLE 9 Market gain City or town, state or province, country, and ZIP or foreign postal code S YOUR CITY, STATE ZIP 10a State 10b State Identification no. 11 State come a wh Account number (see instructions) IS Copy1 For State Tax Department Form 1099-G www.irs gov/Form10996 Department of the Treasury - Internal Revenue Service CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country.ZIP or foreign postal code, and telephone no. OMB No. 1545-0116 2020 WRIGHT'S LANDSCAPING P.O. BOX 123456 YOUR CITY, YS, YOUR ZIP Nonemployee Compensation Form 1099-NEC 1 Nonemployee compensation $ 4,010 2 Copy B For Recipient PAYER'S TIN RECIPIENT'S TIN 83-400XXXX 227-00-XXXX RECIPIENT'S name 3 RICHARD ROOSEVELT 4 Federal income tax withheld Street address (including apt. no.) 1551 CONCORD CIRCLE This is important tax Information and is being furnished to the IRS. If you are required to file a return, a negligence penalty or other Sanction may be imposed on yout this income is taxable and the IRS determines that it has not been reported S City or town, state or province, country, and ZIP or foreign postal code YOUR CITY, YS, YOUR ZIP FATCA filing requirement Account number (see instructions) 5 State tax withhold 6 State/Payer's state no. 7 State income $ $ $ www.is.gov/Form1000NEC Department of the Treasury - Internal Revenue Service Form 1099-NEC (keep for your records) 2020 $ CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, 1 Gross distribution OMB No. 1545-0119 country. ZIP or foreign postal code, and phone no. Distributions From Pensions, Annuities, ESSEX BANK $ 1,000.00 Retirement or 300 MAIN STREET 2a Taxable amount Profit Sharing Plans, IRAs, Insurance YOUR CITY, STATE ZIP 1,000.00 Form 1099-R Contracts, etc. 2b Taxable amount Total not determined distribution D PAYER'S TIN RECIPIENT'S TIN 3 Capital gain (included 4 Federal income tax Report this income on your in box 2a) withheld federal tax return. If this 40-200XXXX 227-00-XXXX $ 200.00 form shows RECIPIENT'S name 5 Employee contributions/ 6 Net unrealized federal income Designated Roth appreciation in tax withheld in contributions or RICHARD ROOSEVELT employer's securities insurance premiums box 4, attach $ this copy to Street address (including apt. no.) 7 Distribution your return. 8 Other SEPY code(s) 1551 CONCORD CIRCLE SIMPLE This information is 1 X $ 96 being furnished to City or town, state or province, country, and ZIP or foreign postal code ga Your percentage of total ob Total employee contributions the IRS YOUR CITY, STATE ZIP distribution %$ 10 Amount allocable to RR 11 1st year of desig 12 FATCA filing 14 State tax withheld 15 State/Payor's state no. 16 State distribution within 5 years Roth contrib requirement 1$ $ $ $ Account number (see instructions) 13 Date of 17 Local tax withhold 18 Name of locality 19 Local distribution payment Form 1099-R www.in.gowFor 1000R Department of the Treasury Internal Revenue Service B Uab x x A 21 Styles Styles Pane Dictate Create and Share Adobe PDF me-file www.n.gov.al Visit this website at a Employee's social security number 227-00-XXXX b Employer identification number (EIN) 34-800XXXX e Employer's name, address, and ZIP code Safe, acourate OMB No. 1545-0006 FASTIUSO 1 Wages, tips, other compensation 17,650.00 3 Social Security wages 17,650.00 5 Medicare wages and tips 17,650.00 7 Social Security to PARKER INDUSTRIES 8009 PIKE CIRCLE YOUR CITY, STATE ZIP 2 Federal income tax withhold 1,760.00 4 Social Security tax withheld 1,094.30 6 Medicare to withheld 225.93 8 Allocated to d Control number 9 10 Dependent care benefits Employee's first name and initial Last name Su 11 Nonquified plans 12 Se instructions for box 12 13 May Hur "The 125 RICHARD ROOSEVELT 1551 CONCORD CIRCLE YOUR CITY, STATE ZIP 14 Other 12c 12d f Employee's address and ZIP codo 15 State Employer's state ID number YS 34-800XXXX 16 State Wages, tips, etc 17 State income tax 17,650.00 300.00 18 Local wagen tips, eta, 19 Local income tax 20 locally are W-2 Wage and Tax Statement 2020 Department of the Treasury -- Internal Revenue Service Form Copy B-To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. Visit the IRS websitost e file www.is.govletin a Employee's social security number 227-00-XXXX b Employer identification number (EIN 36-700XXXX c Employer's name, address, and ZIP code Safe, accurate, DAS OMB No. 1545-0008 FASTI Use 1 Wages, tips, other compensation 27,000.00 3 Social security wages 27,000.00 5 Medicare wages and tips 27,000.00 7 Social security tips XYZ CORPORATION 2525 SOUTH STREET YOUR CITY, STATE ZIP 2 Federal income tax withheld 2,700.00 4 Social security tax withheld 1,674.00 6 Medicare tax withheld 392.00 8 Allocated tips d Control number 10 Dependent care benefits e Employee's first name and initial Last name Sufl. 11 Nonqualified plans 12a See Instructions for box 12 13 kory They pay 12 pan RICHARD ROOSEVELT 1551 CONCORD CIRCLE YOUR CITY, STATE ZIP 14 Other 120 12d Employee's address and ZIP code 15 State Employer's state ID number YS 36-700XXXX 18 Local wage, tips, oto 19 Local income tax 20 loculty 16 State Wages, tips, eto 17 State income tax 27,000.00 450.00 Form W-2 Wage and Tax Statement 2020 Department of the Treasury -- Internal Revenue Service Copy B-To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. 2020 CORRECTED (if checked) CREDITOR'S name, street address, city or town, state or province, country. 1 Date of identifiable event ZIP or foreign postal code, and telephone no. OMB No. 1545-1424 07/01/2020 ESSEX BANK 2 Amount of debt discharged Cancellation 300 MARIN STREET $ 775.00 of Debt YOUR CITY, YS ZIP 3 Interest, if included in box 2 $ Form 1099-C CREDITOR'S TIN DEBTOR'S TIN 4 Debit description Copy B 40-200XXXX 227-00-XXXX CANCELED CREDIT CARD DEBT For Debtor DEBTOR'S namo This is important tax Information and is being RICHARD ROOSEVELT furnished to the IRS you are required to file a Street address including apt.no) 5 it checked the debtor was personal liable for retur, a negligence 1551 CONCORD CIRCLE repayment of the debt penalty or other sanction may be imposed on your City or town, state or province, country, and ZIP or foreign postal code taxable income results YOUR CITY, YS ZIP from this transaction and the IRS determines Account number (see instructions) 6 Identifiable event code 7 Fair market value of property that it has not been $ reported 1234 5678 009876 Form 1099-C (keep for your records) www.lrs.gow Form10990 Department of the Treasury - Internal Revenue Service 2020 Certain Government Payments VOID CORRECTED PAYER'S name, street address, city or town, Mate or province, country.ZIP 1 Unemployment compensation OMB No 1545-0120 or foreign postal code, and telephone no. STATE UNEMPLOYMENT OFFICE $ 2,800 YOUR CITY, STATE ZIP 2 State or local income tax rofunda, credits, or offset IS Form 1099-G PAYER'S TIN RECIPIENT'S TIN 3 Box 2 amount is for tax year 4 Federal income tax withhold 38-700XXXX 227-00-XXXX $ 280.00 RECIPIENT'S name 5 RTAA payments 6 Taxable grants $ $ RICHARD ROOSEVELT 7 Agriculture payments 8 Check if box 2 is Street address including apt, no $ trade or business Income 1551 CONCORD CIRCLE 9 Market gain City or town, state or province, country, and ZIP or foreign postal code S YOUR CITY, STATE ZIP 10a State 10b State Identification no. 11 State come a wh Account number (see instructions) IS Copy1 For State Tax Department Form 1099-G www.irs gov/Form10996 Department of the Treasury - Internal Revenue Service CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country.ZIP or foreign postal code, and telephone no. OMB No. 1545-0116 2020 WRIGHT'S LANDSCAPING P.O. BOX 123456 YOUR CITY, YS, YOUR ZIP Nonemployee Compensation Form 1099-NEC 1 Nonemployee compensation $ 4,010 2 Copy B For Recipient PAYER'S TIN RECIPIENT'S TIN 83-400XXXX 227-00-XXXX RECIPIENT'S name 3 RICHARD ROOSEVELT 4 Federal income tax withheld Street address (including apt. no.) 1551 CONCORD CIRCLE This is important tax Information and is being furnished to the IRS. If you are required to file a return, a negligence penalty or other Sanction may be imposed on yout this income is taxable and the IRS determines that it has not been reported S City or town, state or province, country, and ZIP or foreign postal code YOUR CITY, YS, YOUR ZIP FATCA filing requirement Account number (see instructions) 5 State tax withhold 6 State/Payer's state no. 7 State income $ $ $ www.is.gov/Form1000NEC Department of the Treasury - Internal Revenue Service Form 1099-NEC (keep for your records) 2020 $ CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, 1 Gross distribution OMB No. 1545-0119 country. ZIP or foreign postal code, and phone no. Distributions From Pensions, Annuities, ESSEX BANK $ 1,000.00 Retirement or 300 MAIN STREET 2a Taxable amount Profit Sharing Plans, IRAs, Insurance YOUR CITY, STATE ZIP 1,000.00 Form 1099-R Contracts, etc. 2b Taxable amount Total not determined distribution D PAYER'S TIN RECIPIENT'S TIN 3 Capital gain (included 4 Federal income tax Report this income on your in box 2a) withheld federal tax return. If this 40-200XXXX 227-00-XXXX $ 200.00 form shows RECIPIENT'S name 5 Employee contributions/ 6 Net unrealized federal income Designated Roth appreciation in tax withheld in contributions or RICHARD ROOSEVELT employer's securities insurance premiums box 4, attach $ this copy to Street address (including apt. no.) 7 Distribution your return. 8 Other SEPY code(s) 1551 CONCORD CIRCLE SIMPLE This information is 1 X $ 96 being furnished to City or town, state or province, country, and ZIP or foreign postal code ga Your percentage of total ob Total employee contributions the IRS YOUR CITY, STATE ZIP distribution %$ 10 Amount allocable to RR 11 1st year of desig 12 FATCA filing 14 State tax withheld 15 State/Payor's state no. 16 State distribution within 5 years Roth contrib requirement 1$ $ $ $ Account number (see instructions) 13 Date of 17 Local tax withhold 18 Name of locality 19 Local distribution payment Form 1099-R www.in.gowFor 1000R Department of the Treasury Internal Revenue Service