Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Advanced Taxation Chapter Withholding Tax. ASAP PLEASE State whether each of the following payment is subject to withholding tax. If your answer is Yes, state

Advanced Taxation Chapter Withholding Tax. ASAP PLEASE

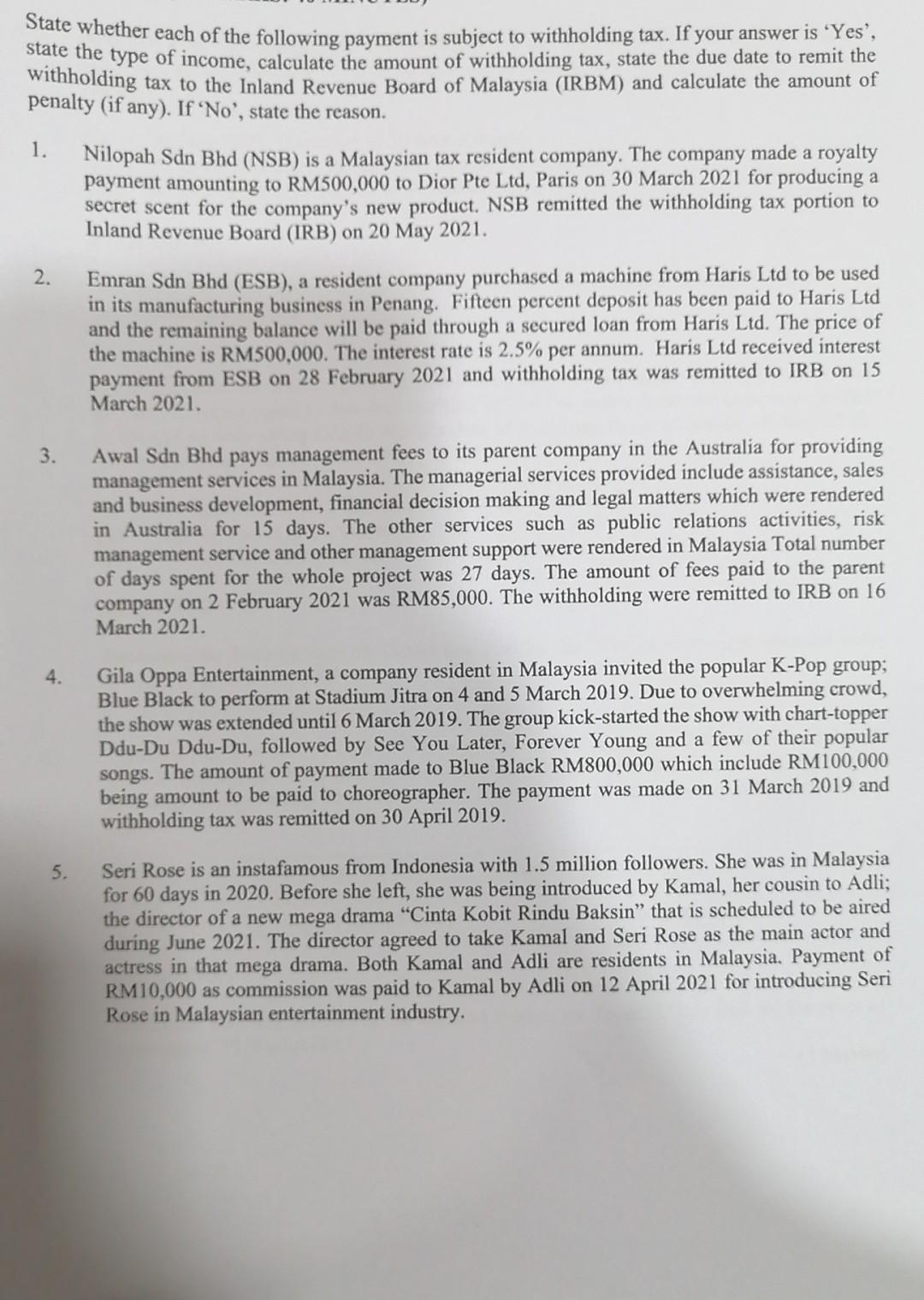

State whether each of the following payment is subject to withholding tax. If your answer is Yes, state the type of income, calculate the amount of withholding tax, state the due date to remit the withholding tax to the Inland Revenue Board of Malaysia (IRBM) and calculate the amount of penalty (if any). If No', state the reason. Nilopah Sdn Bhd (NSB) is a Malaysian tax resident company. The company made a royalty payment amounting to RM500,000 to Dior Pte Ltd, Paris on 30 March 2021 for producing a secret scent for the company's new product. NSB remitted the withholding tax portion to Inland Revenue Board (IRB) on 20 May 2021. 1. 2. Emran Sdn Bhd (ESB), a resident company purchased a machine from Haris Ltd to be used in its manufacturing business in Penang. Fifteen percent deposit has been paid to Haris Ltd and the remaining balance will be paid through a secured loan from Haris Ltd. The price of the machine is RM500,000. The interest rate is 2.5% per annum. Haris Ltd received interest payment from ESB on 28 February 2021 and withholding tax was remitted to IRB on 15 March 2021. 3. Awal Sdn Bhd pays management fees to its parent company in the Australia for providing management services in Malaysia. The managerial services provided include assistance, sales and business development, financial decision making and legal matters which were rendered in Australia for 15 days. The other services such as public relations activities, risk management service and other management support were rendered in Malaysia Total number of days spent for the whole project was 27 days. The amount of fees paid to the parent company on 2 February 2021 was RM85,000. The withholding were remitted to IRB on 16 March 2021. 4. Gila Oppa Entertainment, a company resident in Malaysia invited the popular K-Pop group; Blue Black to perform at Stadium Jitra on 4 and 5 March 2019. Due to overwhelming crowd, the show was extended until 6 March 2019. The group kick-started the show with chart-topper Ddu-Du Ddu-Du, followed by See You Later, Forever Young and a few of their popular songs. The amount of payment made to Blue Black RM800,000 which include RM100,000 being amount to be paid to choreographer. The payment was made on 31 March 2019 and withholding tax was remitted on 30 April 2019. 5. Seri Rose is an instafamous from Indonesia with 1.5 million followers. She was in Malaysia for 60 days in 2020. Before she left, she was being introduced by Kamal, her cousin to Adli; the director of a new mega drama "Cinta Kobit Rindu Baksin" that is scheduled to be aired during June 2021. The director agreed to take Kamal and Seri Rose as the main actor and actress in that mega drama. Both Kamal and Adli are residents in Malaysia. Payment of RM10,000 as commission was paid to Kamal by Adli on 12 April 2021 for introducing Seri Rose in Malaysian entertainment industry, State whether each of the following payment is subject to withholding tax. If your answer is Yes, state the type of income, calculate the amount of withholding tax, state the due date to remit the withholding tax to the Inland Revenue Board of Malaysia (IRBM) and calculate the amount of penalty (if any). If No', state the reason. Nilopah Sdn Bhd (NSB) is a Malaysian tax resident company. The company made a royalty payment amounting to RM500,000 to Dior Pte Ltd, Paris on 30 March 2021 for producing a secret scent for the company's new product. NSB remitted the withholding tax portion to Inland Revenue Board (IRB) on 20 May 2021. 1. 2. Emran Sdn Bhd (ESB), a resident company purchased a machine from Haris Ltd to be used in its manufacturing business in Penang. Fifteen percent deposit has been paid to Haris Ltd and the remaining balance will be paid through a secured loan from Haris Ltd. The price of the machine is RM500,000. The interest rate is 2.5% per annum. Haris Ltd received interest payment from ESB on 28 February 2021 and withholding tax was remitted to IRB on 15 March 2021. 3. Awal Sdn Bhd pays management fees to its parent company in the Australia for providing management services in Malaysia. The managerial services provided include assistance, sales and business development, financial decision making and legal matters which were rendered in Australia for 15 days. The other services such as public relations activities, risk management service and other management support were rendered in Malaysia Total number of days spent for the whole project was 27 days. The amount of fees paid to the parent company on 2 February 2021 was RM85,000. The withholding were remitted to IRB on 16 March 2021. 4. Gila Oppa Entertainment, a company resident in Malaysia invited the popular K-Pop group; Blue Black to perform at Stadium Jitra on 4 and 5 March 2019. Due to overwhelming crowd, the show was extended until 6 March 2019. The group kick-started the show with chart-topper Ddu-Du Ddu-Du, followed by See You Later, Forever Young and a few of their popular songs. The amount of payment made to Blue Black RM800,000 which include RM100,000 being amount to be paid to choreographer. The payment was made on 31 March 2019 and withholding tax was remitted on 30 April 2019. 5. Seri Rose is an instafamous from Indonesia with 1.5 million followers. She was in Malaysia for 60 days in 2020. Before she left, she was being introduced by Kamal, her cousin to Adli; the director of a new mega drama "Cinta Kobit Rindu Baksin" that is scheduled to be aired during June 2021. The director agreed to take Kamal and Seri Rose as the main actor and actress in that mega drama. Both Kamal and Adli are residents in Malaysia. Payment of RM10,000 as commission was paid to Kamal by Adli on 12 April 2021 for introducing Seri Rose in Malaysian entertainment industryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started