Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Advertising costs for the stereo system will be RM8,500 per month. The factory building depreciation expense is RM7,200 per year. Property taxes on the

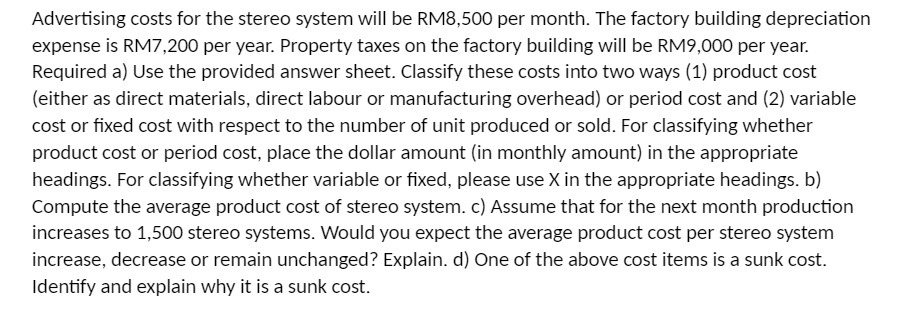

Advertising costs for the stereo system will be RM8,500 per month. The factory building depreciation expense is RM7,200 per year. Property taxes on the factory building will be RM9,000 per year. Required a) Use the provided answer sheet. Classify these costs into two ways (1) product cost (either as direct materials, direct labour or manufacturing overhead) or period cost and (2) variable cost or fixed cost with respect to the number of unit produced or sold. For classifying whether product cost or period cost, place the dollar amount (in monthly amount) in the appropriate headings. For classifying whether variable or fixed, please use X in the appropriate headings. b) Compute the average product cost of stereo system. c) Assume that for the next month production increases to 1,500 stereo systems. Would you expect the average product cost per stereo system increase, decrease or remain unchanged? Explain. d) One of the above cost items is a sunk cost. Identify and explain why it is a sunk cost.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Sheet Cost Item Product Cost or Period Cost Variable Cost or Fixed Cost Monthly Amount RM Adv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664277bf5027b_980035.pdf

180 KBs PDF File

664277bf5027b_980035.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started