Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Advise Homes on the assessability of the above receipts. Principles of income tax law must be referred to in your advice. (Ignore capital gains tax

Advise Homes on the assessability of the above receipts. Principles of income tax law must be referred to in your advice. (Ignore capital gains tax implications).

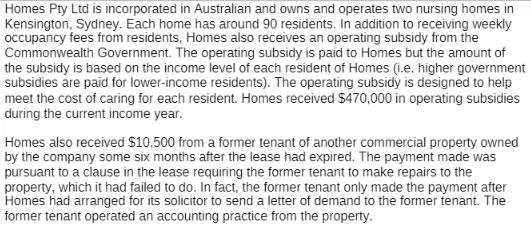

Advise Homes on the assessability of the above receipts. Principles of income tax law must be referred to in your advice. (Ignore capital gains tax implications). Homes Pty Ltd is incorporated in Australian and owns and operates two nursing homes in Kensington, Sydney. Each home has around 90 residents. In addition to receiving weekly occupancy fees from residents, Homes also receives an operating subsidy from the Commonwealth Government. The operating subsidy is paid to Homes but the amount of the subsidy is based on the income level of each resident of Homes (i.e. higher government subsidies are paid for lower-income residents). The operating subsidy is designed to help meet the cost of caring for each resident. Homes received $470,000 in operating subsidies during the current income year. Homes also received $10,500 from a former tenant of another commercial property owned by the company some six months after the lease had expired. The payment made was pursuant to a clause in the lease requiring the former tenant to make repairs to the property, which it had failed to do. In fact, the former tenant only made the payment after Homes had arranged for its solicitor to send a letter of demand to the former tenant. The former tenant operated an accounting practice from the property.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The assessability of the receipts for Homes Pty Ltd would depend on the principles of income tax law ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started