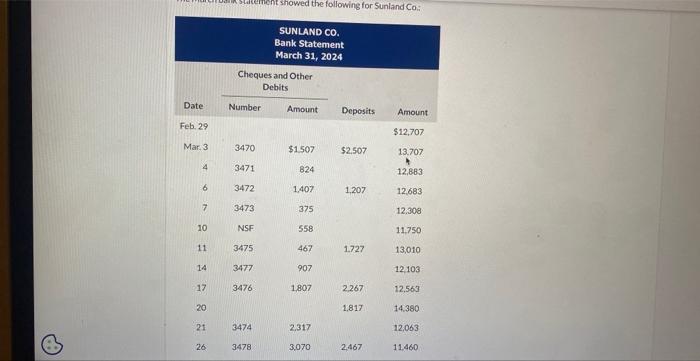

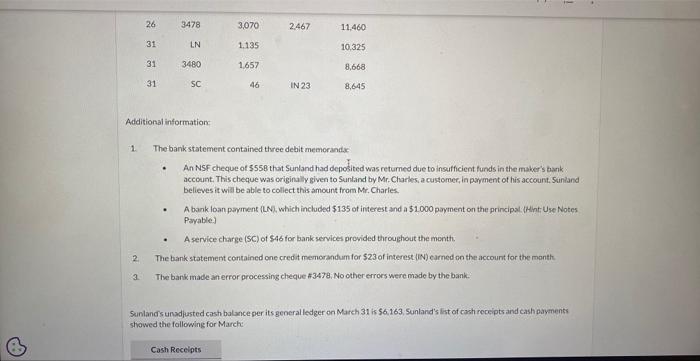

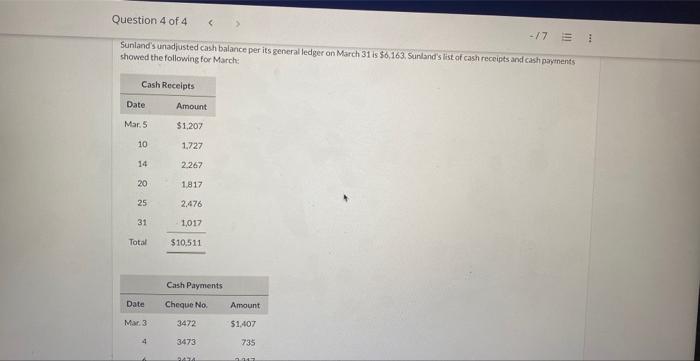

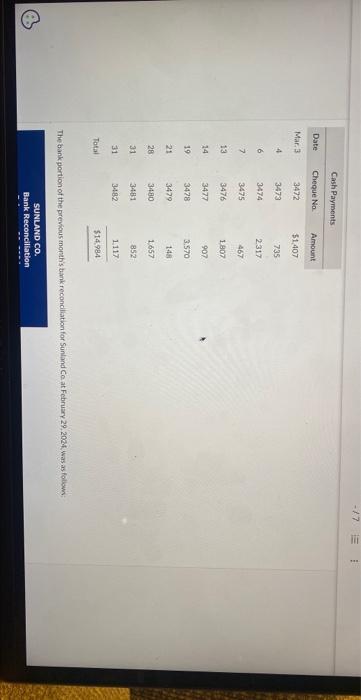

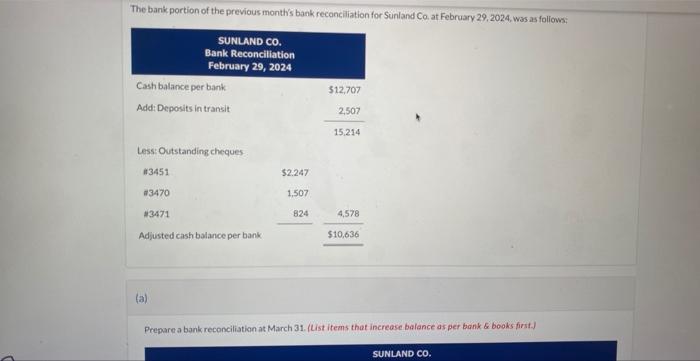

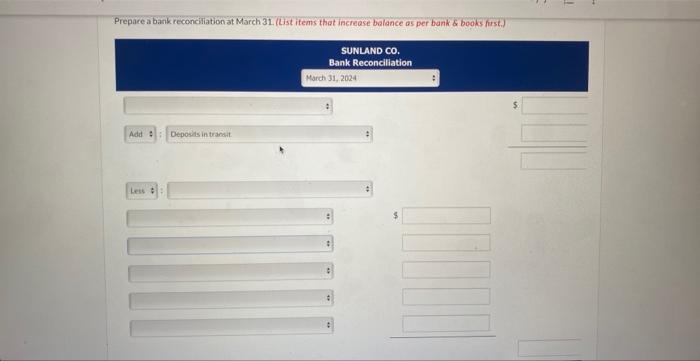

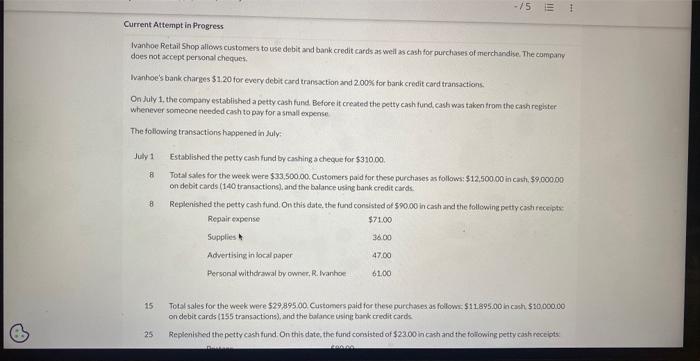

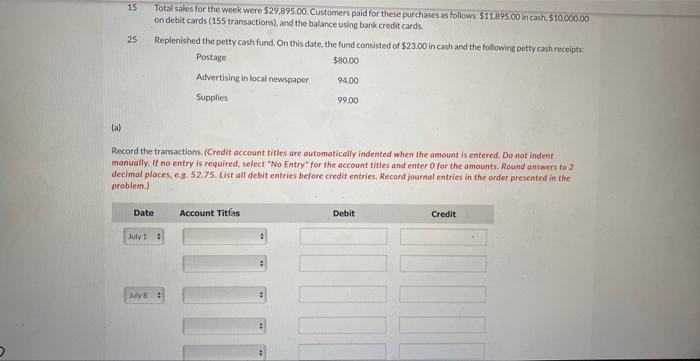

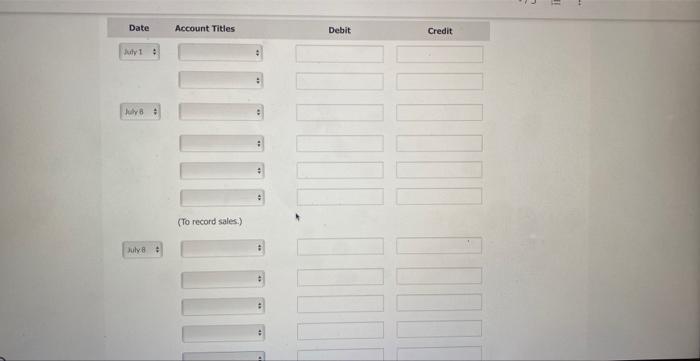

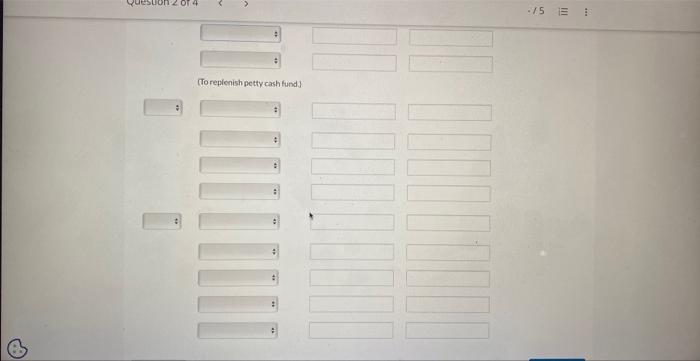

Aent showed the following for Sunland Co: Additional information 1. The banks statement contained three debit memorandix - An NSF cheque of 5558 that Sunland had deposited was returned due to insufficient funds in the maker's bank account. This cheque was criginally given to Sunland by Mr. Charles, a customer, in payment of his account, Sanland believes it wisl be able to collect this amount from Mr. Charies. - A bank loan payment (LNi, which included $135 of interest and a $1000 payment on the principal: (Hint: Use Notes Payable.] - A service charge (SC) of S4b for bankservices provided throughout the month. 2. The bank statement contained one credit memorandum for 523 of interest (IN) eamed on the accourt for the manth. 3. The bank made an error processing cheque $3478. No other errors were made by the bank: Sunland s unadjusted cash balance per its general ledger on March 31 is $6.163, Sunland's last of cash receipts and cash payments stowed the following for March: Sunland's unadfusted cash balance per its general ledger on March 31 is 56,163, Sunland's list of cash reccipts and cash payynents showed the following for March: The bank portion of the previeus tnonthis bamk reconcilation for Sunland Ce at February 29,2004 , was as follewi The bank portion of the previous month's bank reconciliation for Sunland Co. at February 29, 2024, was as foliows: (a) Prepare a bank reconciliation at March 31. flist items that increase balance as per bank books first. Prepace a bank reconcilation at March 31 . (List items that increase balance as per bank \& beoks first.) Ivanhoe Retail Shop aliows customers to use debit and bank credit cards as weil as cash for purchases of merchandise. The campany does not accept personsl cheques. Ivanhoe's bank charges $1,20 for every debit card transction and 2000 for bank credit card transactions. On July t, the compary established a petty cash fund Before it created the petty cash furd cash was taken trom the cash reghter whenever someone needed cash to pay for a small expense The following transactions happened in July: July.1 Established the petty cash fund by cashing a cheque for $31000 B Total sales for the week were $33,500,00. Customers paid for theso purchases is follows: $12,500,00 in casth,$9,000,00 on debit cards ( 140 transactions), and the balance using bank eredit cards. B Replenished the petty casci tund. On this date, the fund consisted of 59000 in cash and the follewing peity cast receiph: 15 Total sales for the week were 52989500 . Customers paid for these purchases as follow: $11895.00 a coh $10000.00 on debit cards (155 transactions), and the balance isine bank credit cards 25 Replenished the petty cash fund. On this date the fund consisted of $23.00 incash and the following petty cash receiots: 15 Totai sales for the week were $29,895,00. Customers paid for these purchases as follows. $11,895.00 incash, $10,000.00 on debit cards ( 155 transactions), and the balance ueling bank credit cards: 25 Replenished the petty cash fund. On this date, the fund consisted of $23.00 in cash and the following petty cash receipts: (a) Record the transactions, (Credit account titles are automaticaliy indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter 0 for the amounts. Round answers to 2 decimal places, e.9. 52.75. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) (To record sales.) [Toreplenish petycash fund]