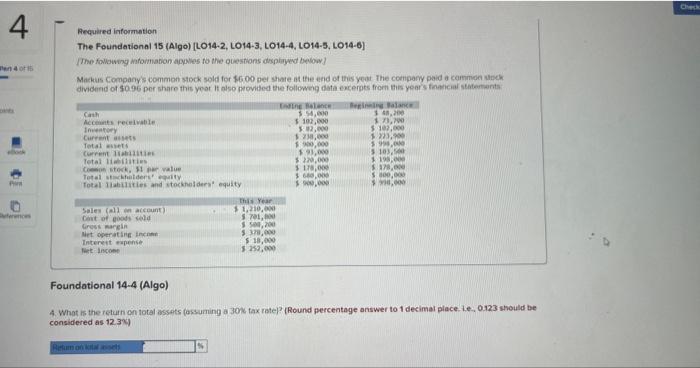

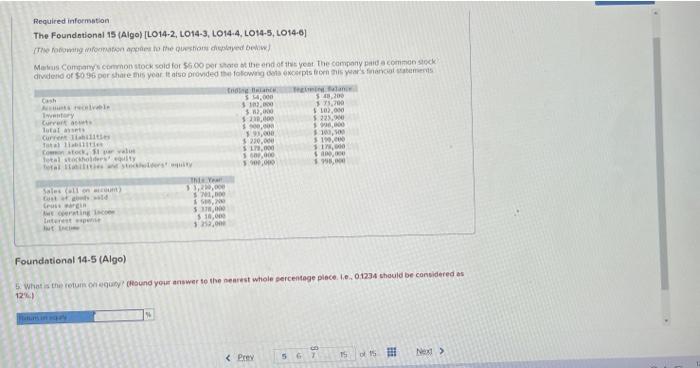

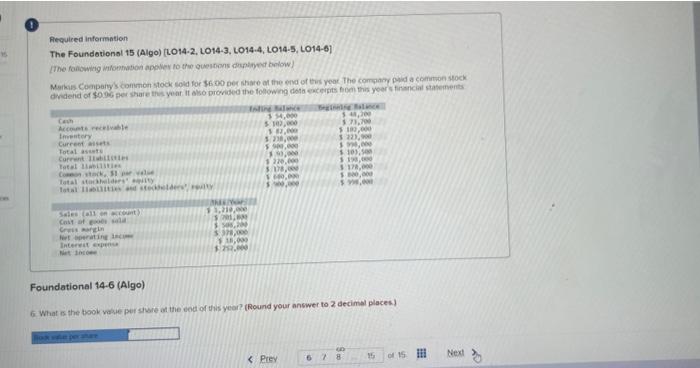

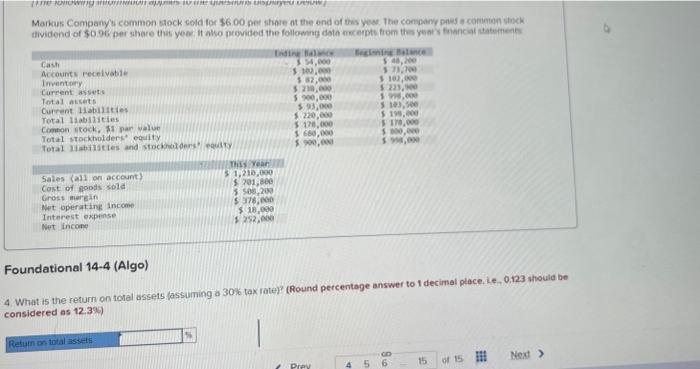

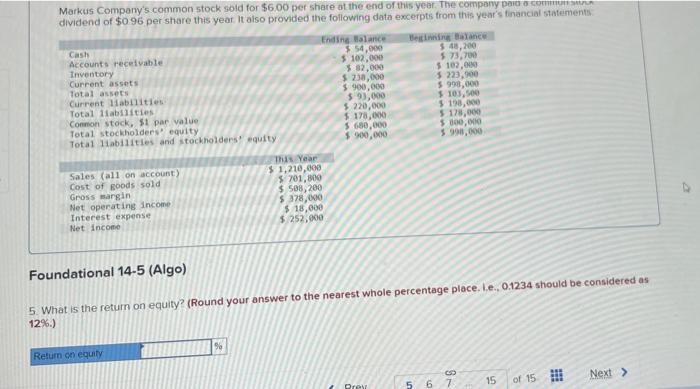

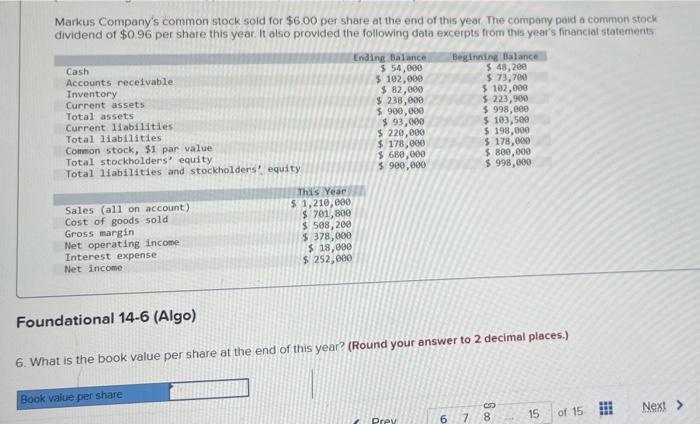

Aequared information The Foundational 15 (Algo) [LO14-2, LO14-3, LO14-4, LO14-5, LO14-6] [The following matomation appiles to the questions dreplined beliow] Maskus Company's common sock sold for $600 bei share at the end of this yeor the compary paid a cammon areck dividend of $096 per share this year it olso povided the followeig data excerpts from this years fineicial statertants. Foundational 14-4 (Algo) 4. What is the return on total assets fassuming a 301 , tax ratep? (Round percentage answer to 1 decimal place. Le: o.323 should be considered as 12.34 ) Required informetion The Foundotional 15 (Algo) [LO14-2, LO14-3, LO14.4, LO14-5, LO14-6] Foundational 14-5 (Algo) 5. What is the retum oriequiby? (Round year answer to the nearest whole sercentege plece. l.e. 0.1234 should be cansidered as 124 fiequired information The Foundetionel 15 (Algo) [LO14-2, LO14-3, LO14-4, LO14-5, LO14-6) Markas Compary's conmin stock sold for 3600 per share of the erva of thes year. The compary phid a cominut seck: Foundational 14.6 (Algo) 6. What is the book wave per shure of the eod of this year? (Round your answer to 2 decimal places.) Markus Company's common stock sold for $6.00 pet shore at the end of bis year. The compayy phes a cominiph stock dividend of 50.96 per shore this yoar it also provided the following dote ercerpts from thes year s financiar statements Foundational 14-4 (Algo) 4. What is the return on total assets fassuming a 30% tax rate)? (Round percentage answer to 1 decimal place, le, 0.123 should be considered as 12.399 Markus Compary's common stock sold for $6.00 per share ot the end of this year. The compeny paid o corinuuinusis dividend of $096 per share this year It aiso provided the following data excerpts from this year's financial statements. Foundational 14-5 (Algo) 5. What is the retum on equity? (Round your answer to the nearest whole percentage place. L.e., 0.1234 should be considered as 12\%.) Markus Company's common stock sold for $6.00 per share at the end of this year. The company paid a common stock dividend of $0.96 per share this year. It also provided the following data excerpts from this year's financial statements Foundational 14-6 (Algo) 6. What is the book value per share at the end of this year? (Round your answer to 2 decimal places.)