Question

AeroBeing is a large company with two departments: aerospace and air transport. Each department currently finances its activities through 45% of debt finance, 35% of

AeroBeing is a large company with two departments: aerospace and air transport. Each department currently finances its activities through 45% of debt finance, 35% of ordinary equity, and 20% of preferred equity.

The cost of preferred equity is equal to 11%. The company's borrowing rate is 10%, while its tax rate is 35%.

AeroBeing's management would like to know the minimum weighted average cost of capital for each department. Since the beta for the two departments cannot be computed, the management identified two companies that operate in the same sectors and have a capital structure similar to AeroBeing, thus providing good proxies for the required beta values.

The first company is a key operator in the aerospace sector and has a beta of 1.5, while the second company is a growing player in the air transport sector that has a beta of 0.5. The risk-free rate is currently 9% and the expected market return is 15%.

i.Compute the weighted average cost of capital for each department of AeroBeing.

Compare the two found. How would AeroBeing use this information?

Compare the two found. How would AeroBeing use this information?

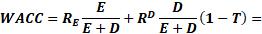

WACC RE = E E+D + RD D E + D (1-T) =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the weighted average cost of capital WACC for each department of AeroBeing we will use the following information Cost of preferred equity R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started