Answered step by step

Verified Expert Solution

Question

1 Approved Answer

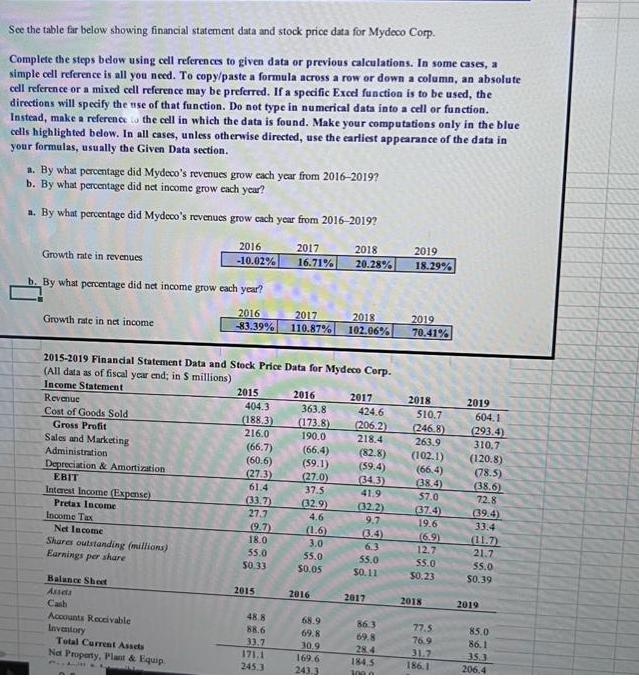

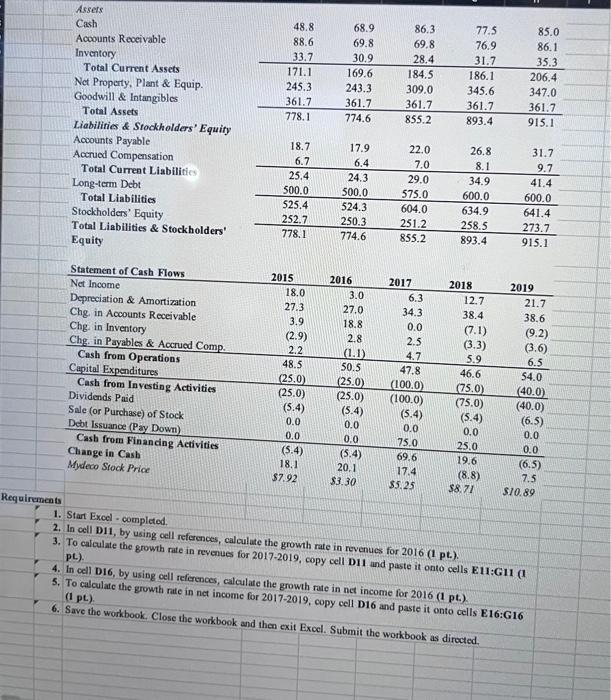

See the table far below showing financial statement data and stock price data for Mydeco Corp. Complete the steps below using cell references to

See the table far below showing financial statement data and stock price data for Mydeco Corp. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. a. By what percentage did Mydeco's revenues grow each year from 2016-2019? b. By what percentage did net income grow each year? a. By what percentage did Mydeco's revenues grow each year from 2016-2019? Growth rate in revenues b. By what percentage did net income grow each year? 0 Growth rate in net income Cost of Goods Sold Gross Profit Sales and Marketing Administration Depreciation & Amortization EBIT Interest Income (Expense) Pretax Income Income Tax 2015-2019 Financial Statement Data and Stock Price Data for Mydeco Corp. (All data as of fiscal year end; in S millions) Income Statement Revenue Net Income Shares outstanding (millions) Earnings per share 2016 -10.02% Balance Sheet Assets Cash Accounts Receivable Inventory Total Current Assets Not Property, Plant & Equip 44E 2016 2017 2018 -83.39% 110.87% 102.06% 2015 404.3 (188.3) 216.0 (66.7) (60.6) (27.3) 61.4 (33.7) 27.7 (9.7) 18.0 55.0 50.33 2017 16.71% 2015 48.8 88.6 33.7 171.1 245,3 2016 363.8 (173.8) 190.0 (66.4) (59.1) (27.0) 37.5 (32.9) 4.6 (1.6) 3.0 55.0 $0.05 2016 2018 20.28% 68.9 69.8 30.9 169.6 243.3 2017 424.6 (206.2) 218.4 (82.8) (59.4) (34.3) 41.9 (32.2) 9.7 (3.4) 6.3 55.0 $0.11 2017 86.3 69.8 28.4 184.5 1000 2019 18.29% 2019 70.41% 2018 510.7 (246.8) 263.9 (102.1) (66.4) (38.4) $7.0 (37.4) 19.6 (6.9) 12.7 55.0 $0.23 2018 77.5 76.9 31.7 186.1 2019 604.1 (293.4) 310.7 (120.8) (78.5) (38.6) 72.8 (39.4) 33.4 (11.7) 21.7 55.0 $0.39 2019 85.0 86.1 35.3 206.4 Administration Depreciation & Amortization EBIT Interest Income (Expense) Pretax Income Income Tax Net Income Shares outstanding (millions) Earnings per share Balance Sheet Assets Cash Accounts Receivable Inventory Total Current Assets Net Property, Plant & Equip. Goodwill & Intangibles Total Assets Liabilities & Stockholders' Equity Accounts Payable Accrued Compensation Total Current Liabilities Long-term Debt Total Liabilities Stockholders' Equity Total Liabilities & Stockholders' Equity Statement of Cash Flows Net Income Depreciation & Amortization Chg. in Accounts Receivable Chg. in Inventory Chg. in Payables & Accrued Comp. Cash from Operations Capital Expenditures Cash from Investing Activities Dividends Paid Sale (or Purchase) of Stock Debt Issuance (Pay Down) Cash from Financing Activities Change in Cash Mydeco Stock Price (60.6) (27.3) 61.4 (33.7) 27.7 (9.7) 18.0 55.0 $0.33 2015 48.8 88.6 33.7 171.1 245.3 361.7 778.1 18.7 6.7 25.4 500.0 525.4 252.7 778.1 2015 18.0 27.3 3.9 (2.9) 2.2 48.5 (25.0) (25.0) (5.4) 0.0 0.0 (5.4) 18.1 $7.92 (59.1) (27.0) 37.5 (32.9) 4.6 (1.6) 3.0 55.0 $0.05 2016 68.9 69.8 30.9 169.6 243.3 361.7 774.6 17.9 6.4 24.3 500.0 524.3 250.3 774.6 2016 3.0 27.0 18.8 2.8 20.1 $3.30 (59.4) (34.3) 41.9 (32.2) 9.7 (3.4) 6.3 55.0 $0.11 2017 86.3 69.8 28.4 184.5 309.0 361.7 855.2 2017 22.0 7.0 29.0 575.0 604.0 251.2 855.2 6.3 34.3 0.0 2.5 4.7 50.5 47.8 (25.0) (100.0) (25.0) (100.0) (5.4) (5.4) 0.0 0.0 0.0 75.0 (5.4) 9.6 17.4 $5.25 (66.4) (38.4) 57.0 (37.4) 19.6 (6.9) 2018 12.7 $0.23 55.0 2018 77.5 76.9 31.7 186.1 345.6 361.7 893.4 26.8 8.1 34.9 600.0 634.9 258.5 893.4 $8.71 12.7 38.4 (7.1) (3.3) 5.9 46.6 (75.0) (75.0) (5.4) 0.0 25.0 19.6 (8.8) (120.8) (78.5) (38.6) 72.8 (39.4) 33.4 (11.7) 21.7 55.0 $0.39 2019 85.0 86.1 35.3 206.4 2019 347.0 361.7 915.1 31.7 9.7 41.4 600.0 641.4 273.7 915.1 21.7 38.6 (9.2) (3.6) 6.5 54.0 (40.0) (40.0) (6.5) 0.0 0.0 (6.5) 7.5 $10.89 Requirements Assets Cash Accounts Receivable Inventory Total Current Assets Net Property, Plant & Equip. Goodwill & Intangibles Total Assets Liabilities & Stockholders' Equity Accounts Payable Accrued Compensation Total Current Liabilities) Long-term Debt Total Liabilities Stockholders' Equity Total Liabilities & Stockholders' Equity Statement of Cash Flows Net Income Depreciation & Amortization Chg. in Accounts Receivable Chg. in Inventory Chg. in Payables & Accrued Comp. Cash from Operations Capital Expenditures Cash from Investing Activities Dividends Paid Sale (or Purchase) of Stock Debt Issuance (Pay Down) Cash from Financing Activities Change in Cash Mydeco Stock Price 48.8 88.6 33.7 171.1 245.3 361.7 778.1 18.7 6.7 25.4 500.0 525.4 252.7 778.1 2015 18.0 27.3 3.9 (2.9) 2.2 48.5 (25.0) (25.0) (5.4) 0.0 0.0 (5.4) 18.1 $7.92 68.9 69.8 30.9 169.6 243.3 361.7 774.6 17.9 6.4 24.3 500.0 524.3 250.3 774.6 2016 3.0 27.0 18.8 0.0 (5.4) 20.1 $3.30 86.3 69.8 28.4 184.5 309.0 361.7 855.2 22.0 7.0 29.0 575.0 604.0 251,2 855.2 2017 6.3 34.3 0.0 2.5 4.7 47.8 2.8 (1.1) 50.5 (25.0) (100.0) (25.0) (100.0) (5.4) (5.4) 0.0 0.0 75.0 69.6 17.4 $5.25 186.1 345.6 361.7 893.4 77.5 76.9 31.7 26.8 8.1 34.9 600.0 634.9 258.5 893.4 2018 12.7 38.4 (7.1) (3.3) 5.9 46.6 (75.0) (75.0) (5.4) 0.0 25.0 19.6 (8.8) $8.71 85.0 86.1 35.3 206.4 347.0 361.7 915.1 31.7 9.7 41.4 600.0 641.4 273.7 915.1 2019 21.7 38.6 (9.2) (3.6) 6.5 54.0 (40.0) (40.0) (6.5) 0.0 0.0 (6.5) 7.5 $10.89 1. Start Excel - completed. 2. In cell D11, by using cell references, calculate the growth rate in revenues for 2016 (1 pt.). 3. To calculate the growth rate in revenues for 2017-2019, copy cell D11 and paste it onto cells E11:G11 (1) pt.). 4. In cell D16, by using cell references, calculate the growth rate in net income for 2016 (1 pt.). 5. To calculate the growth rate in net income for 2017-2019, copy cell D16 and paste it onto cells E16:G16 (1 pt.). 6. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

step ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started