Question

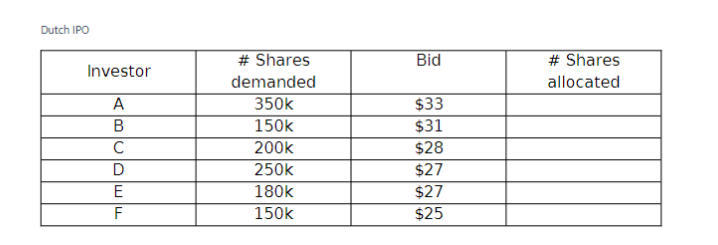

Aerospace Z is a private firm that recently went public. The managers of the firm have decided to undertake a Dutch IPO to sell 1,000,000

Aerospace Z is a private firm that recently went public. The managers of the firm have decided to undertake a Dutch IPO to sell 1,000,000 shares. The following table summarises all the bids the firm received.

a) What is the IPO price? (2 marks)

b) What is the number of shares allocated to each investor? (14)

c) How much money does Aerospace Z raise from the IPO? (2 marks)

d) If the IPO represented 50% of total value of the firm, what is the

percentage of Aerospace Z owned by investor A? (3 marks)

e) If the stock price rises by 20% the day after the IPO, what is the dollar

amount of the profit investor A makes? (3 marks)

f) Given the 20% increase in the price of the stock after the IPO day,

there are rumors that the underwriters did not do a good job in pricing

the stock, hence underpricing the security. How much money is left on

the table due to this underpricing? (3 marks)

Question 2.

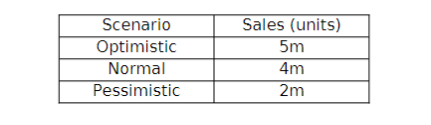

ILI corporation manufactures surgical masks. The corporation has spent

$38m in fixed production costs (excluding depreciation cost). Each box of

surgical masks costs $4.45 to produce, and given the high demand for these

masks, the ILI plans to sell each box for $17.45. There is $3.8m depreciation

cost every year. The corporate tax rate is 40%. (25 marks)

a) The sales and marketing team have prepared the following table to

provide management with potential scenarios for sales. What is the

DOL when sales levels are optimistic? (4 marks)

b) If there is 10% decrease in sales, what is corresponding change in ILI's

EBIT? (4 marks)

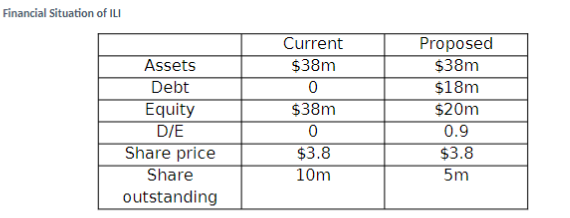

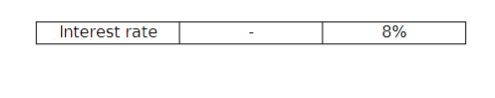

ILI is currently fully equity funded. However, the managers are considering

levering up the firm to reach a D

E =0.9. The following table shows the financial

situation of the firm with and without leverage.

Dutch IPO Investor # Shares demanded Bid A 350k $33 B 150k $31 C 200k $28 D 250k $27 E 180k $27 F 150k $25 # Shares allocated

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer a The IPO price is determined by the bid of the investor who demands the highest number of shares In this case Investor A demands 350000 shares ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started