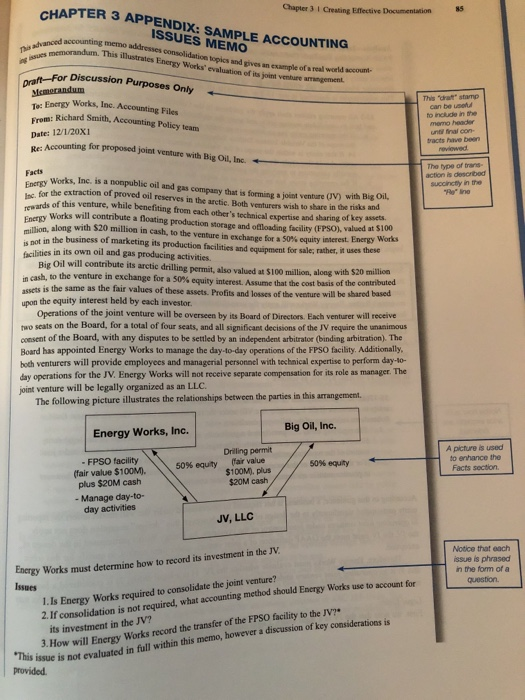

A-F

Chapter 3 I Creating Effective Documentation As the Energy Works memo in this chapter ilustrates, accounting issues are not always strnighnomemo. Con- lowing questions are intended to highlight some of the many judgments and altematives prescin sidering that memo, respond to the following, Use the Energy Works (Codification research is not necessary for this exercise.) a. Why is it important for Energy Works to determine which consolidation model applies (variable or 2. in that memo. Con- memo, and your own thinking, to respond. What difference does it make which model applies, if the company might come to the same voting)? not consolidate) either way? Describe the judgments involved in determining whether the JV is considered a business. What would have happened if Energy Works had not qualified for use of the business scope exception? What analysis would have been performed next? b. c. d. The facts state that Energy Works will manage the day-to-day operations of the JV. In what circumstances might this day-to-day management have caused the venturers to not be considered an operating joint venture under joint controf? e. What three possible alternative treatments are considered or described in Issue 2 of the memo? Very briefly, explain each. The evaluation of Energy sible Codification topics could apply. Sketch out a simple flowchart of the decisions an acc would have to make in evaluating Issue 3. Works' transfer of equipment to the joint venture is not straightforward; many pos- . Company A is exchanging its patent for a building in Michigan ple B has taken out a loan for 3. Draw a picture illustrating the following fact patterm: plus $750,000 cash, from Company B. Company $750,000 from Sub Bank in anticipation of the exchange. Sub Bank is a wholly owned f Parent Bank CHAPTER S APPESIES DAMLE ACCOUNTING Chapter 3 I Creating Effective Documentation 85 3 APPENDIX: ISSUES MEMO SAMPLE ACCOUNTING memo addresses consolidation topics and gives an his as memorandum. This illustrates Energy Works' evaluation of illustrates example of a real world account- its joint venhure amngement Purposes Only Te: Energy Works, Inc. Accounting Files From: Date: 12/1/20X1 This "dhat" stamp o include in the unti final con- Richard Smith, Accounting Policy team Accounting for proposed joint venture with Big Oil, Inc. Facts Energy The type of trans- action is describod succincty in the Works, Inc. is a nonpublic oil and gas company that is forming a joint venture for the extraction of proved oil reserves in the arctic. Both venturers wish to share in the risks and (JV) with Big Oil, ceards of this venture, while benefiting from each other's technical expertise and sharing of key assets Energy million, along with $20 Works will contribute a floating production storage and ofloading facility (FPSO), valued at $100 milion in cash, to the venture in exchange for a 50% equity interest. Energy is not in the business of marketing its production facilities and equipment for sale, rathet, i uses the Works in its own oil and gas producing activities Big Oil will contribute its arctic drilling permit, also valued at $100 million, along with $20 to the venture in exchange for a 50% equity interest. Assume that the cost basis of the contributed asets is the same as the fair values of these assets Profits and losses of the venture will be shared assets is the same will be shared based upon the equity interest held by each investor. Operations of the joint venture will be overseen by its Board of Directors. Each venturer will receive two seats on the Board, for a total of four seats, and all significant decisions of the IV require the unanimous consent of the Board, with any disputes to be settled by an independent arbitrator (binding arbitration). The Board has appointed Energy Works to manage the day-to-day operations of the FPSO facility. Additionally both venturers will provide employees and managerial personnel with technical expertise to perform day-10- day operations for the JV. Energy Works will not receive separate compensation for its role as manager. The joint venture will be legally organized as an LLC The following picture illustrates the relationships between the parties in this arrangement. Big Oil, Inc. Energy Works, Inc. 4 picture is used to enhance the Facts section Driling permit par value $100M). plus FPSO facility 50% equity 50% equity plus $20M cash Manage day-to- day activities $20M cash JV, LLC Energy Works must determine how to record its investment in the JV Issues Notice that each ssue is phrased n the form of a question 2. If consolidation is not required, what accounting method should Energy Works use to account for Works record the transfer of the FPSO facility to the JV? ho 1.ls Energy Works required to consolidate the joint venture? its investment in the JV? this memo, however a discussion of key considerations is this issue is not evaluated in full within provided