Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a-f on #1 a-e on #2 for quick upvote! thanks Singing Fish Fine Foods has a current annual cash dividend policy of $3.75. The price

a-f on #1

a-e on #2 for quick upvote! thanks

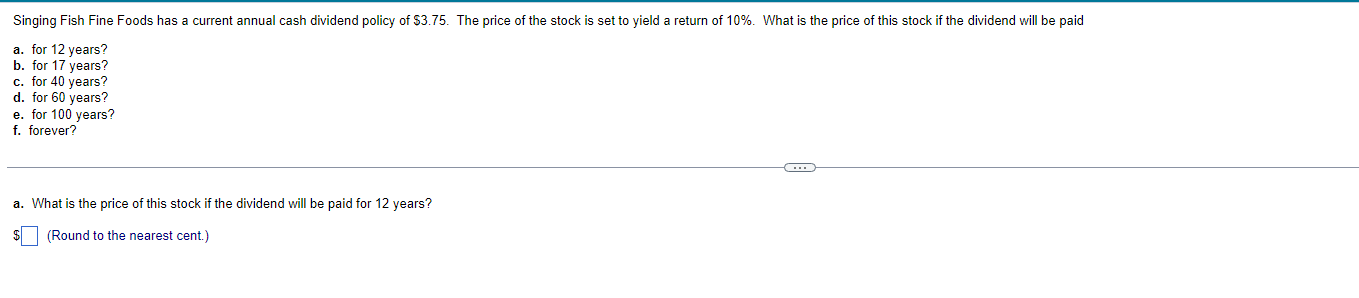

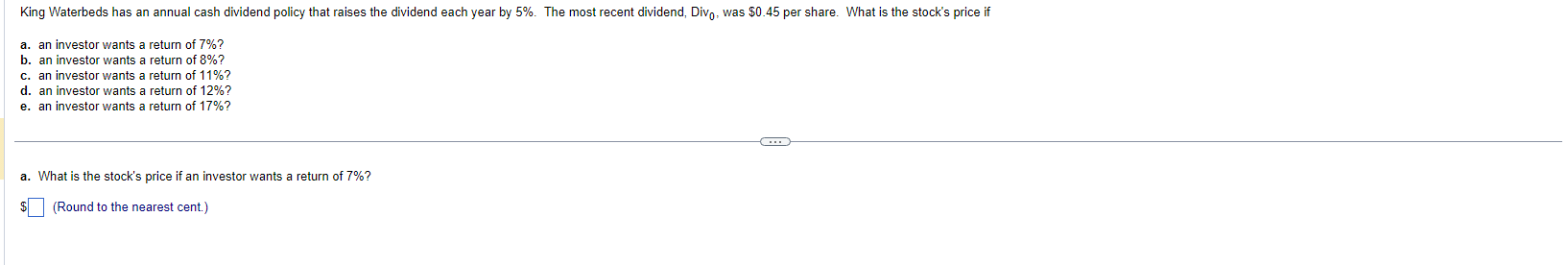

Singing Fish Fine Foods has a current annual cash dividend policy of $3.75. The price of the stock is set to yield a return of 10%. What is the price of this stock if the dividend will be paid a. for 12 years? b. for 17 years? c. for 40 years? d. for 60 years? e. for 100 years? f. forever? a. What is the price of this stock if the dividend will be paid for 12 years? (Round to the nearest cent.) King Waterbeds has an annual cash dividend policy that raises the dividend each year by 5%. The most recent dividend, Div 0 , was $0.45 per share. What is the stock's price if a. an investor wants a return of 7% ? b. an investor wants a return of 8% ? c. an investor wants a return of 11% ? d. an investor wants a return of 12% ? e. an investor wants a return of 17% ? a. What is the stock's price if an investor wants a return of 7% ? (Round to the nearest cent.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started