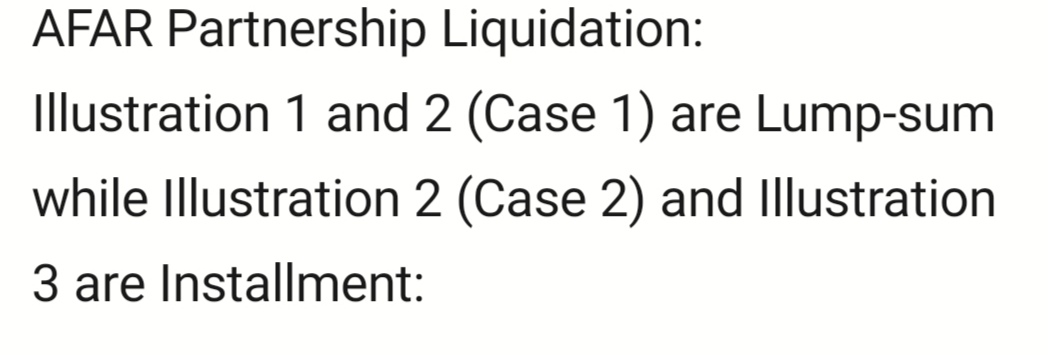

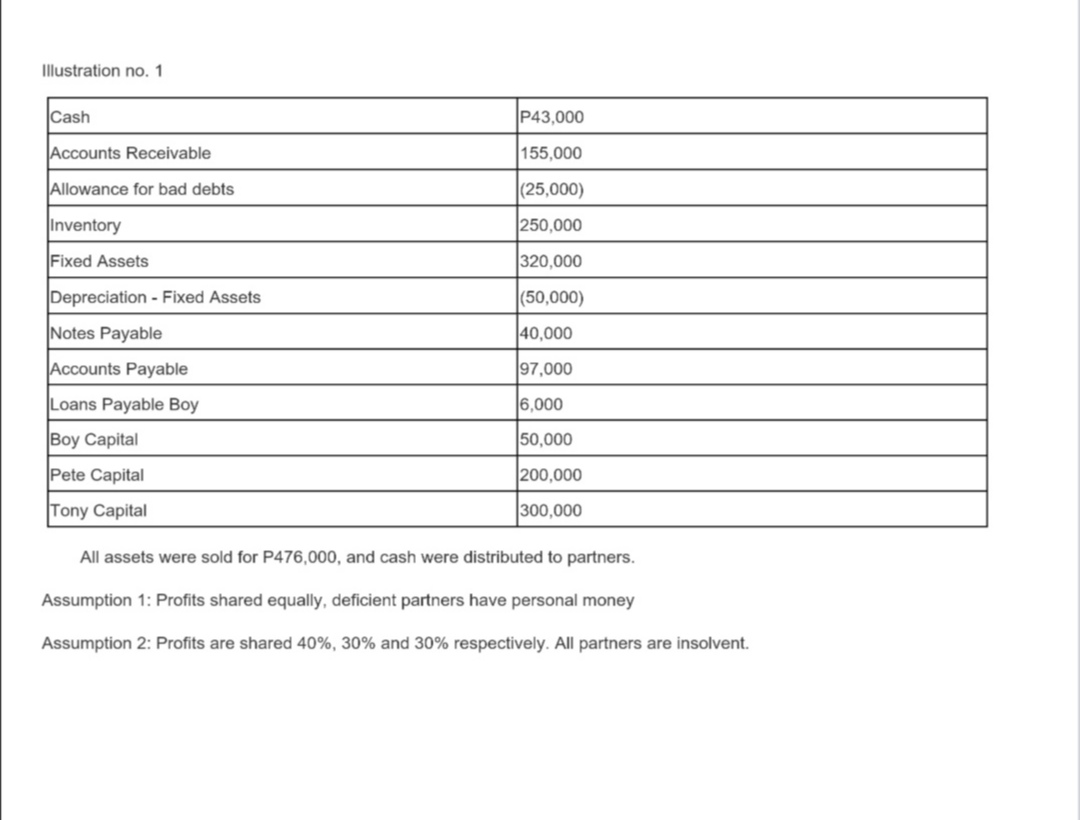

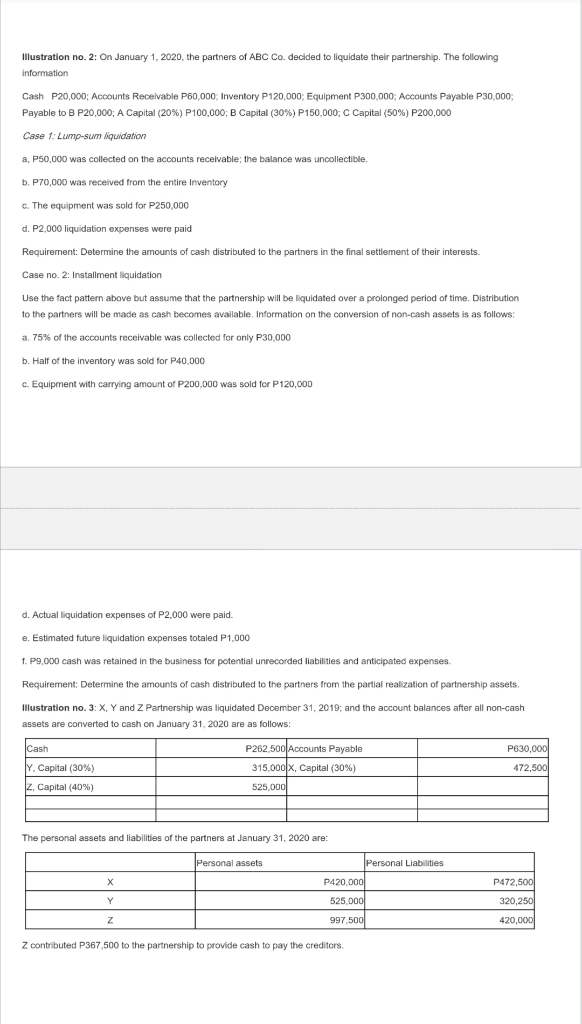

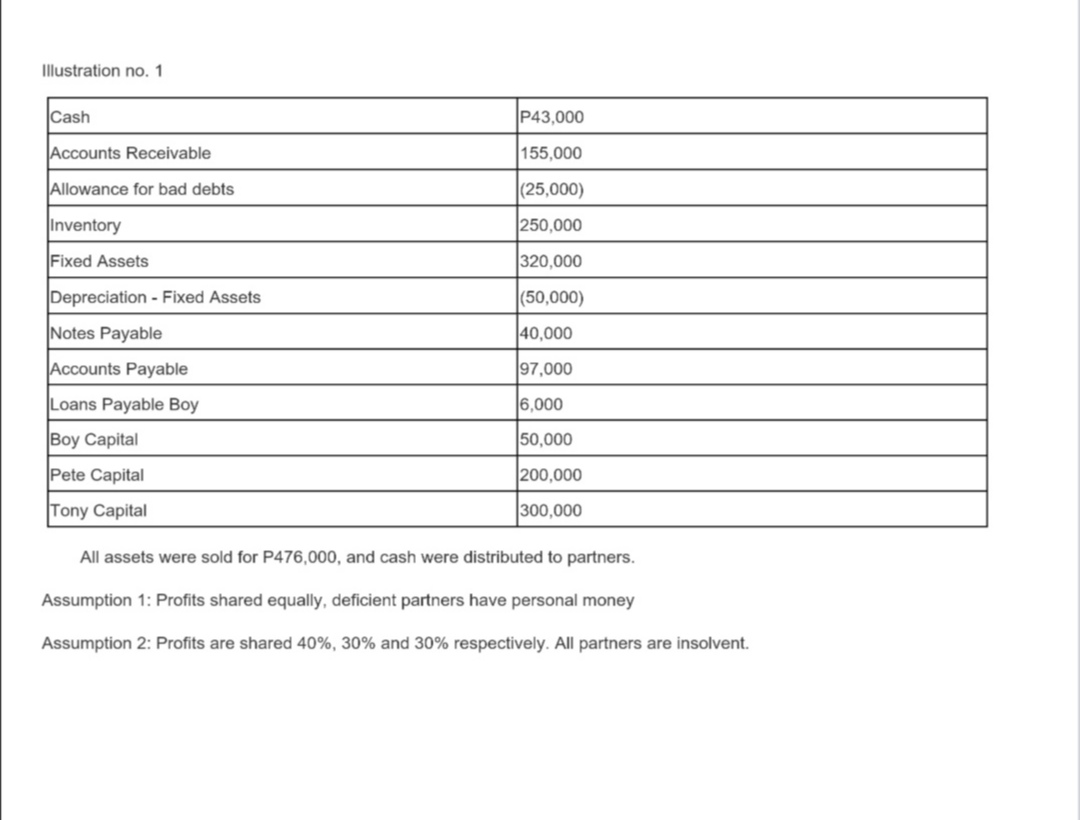

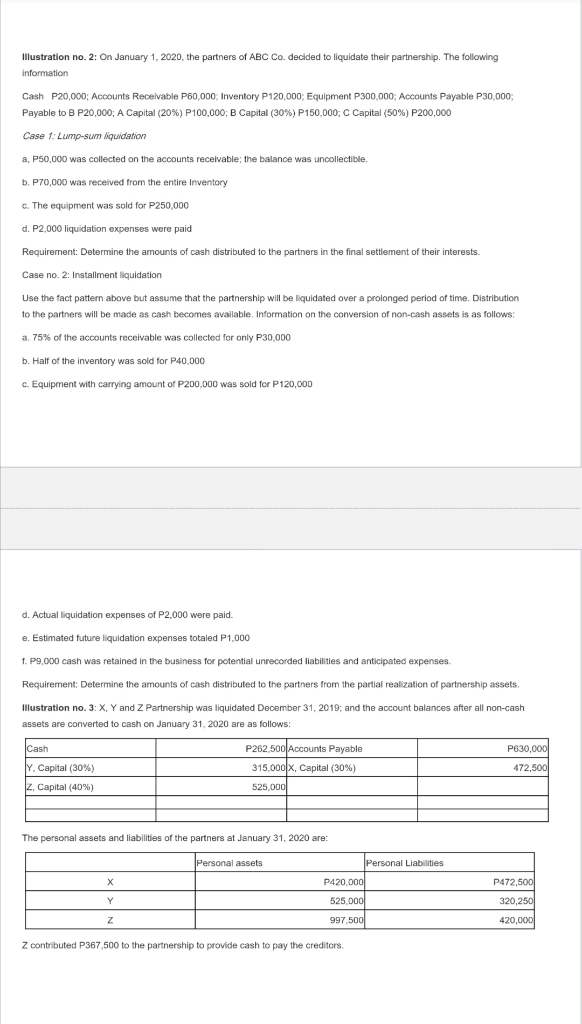

AFAR Partnership Liquidation: Illustration 1 and 2 (Case 1) are Lump-sum while Illustration 2 (Case 2) and Illustration 3 are Installment: Illustration no. 1 Cash Accounts Receivable Allowance for bad debts P43,000 155,000 (25,000) 250,000 320,000 (50,000) Inventory Fixed Assets Depreciation - Fixed Assets 40,000 Notes Payable Accounts Payable Loans Payable Boy Boy Capital Pete Capital Tony Capital 97,000 6,000 50,000 200.000 300,000 All assets were sold for P476,000, and cash were distributed to partners. Assumption 1: Profits shared equally, deficient partners have personal money Assumption 2: Profits are shared 40%, 30% and 30% respectively. All partners are insolvent. Illustration no. 2: On January 1, 2020, the partners of ABC Co. decided to liquidate their partnership. The following information Cash P20,000; Accounts Receivable P60,000 Inventory P120,000; Equipment P300,000; Accounts Payable P30,000; Payable to B P20,000; A Capital (20%) P100,000; B Capital (30%) P150,000: C Capital (50%) P200,000 Case 1: Lump-sun liquidation a, P50,000 was collected on the accounts receivable; the balance was uncollectible. b. P70,000 was received from the entire Inventory c. The equipment was sold for P250,000 d. P2,000 liquidation expenses were paid Requirement: Determine the amounts of cash distributed to the partners in the final settlement of their interests. Case no. 2: Installment liquidation Use the fact pattern above but assume that the partnership will be liquidated over a prolonged period of time. Distribution to the partners will be made as cash becomes available. Information on the conversion of non-cash assets is as follows: a. 75% of the accounts receivable was collected for only P30,000 b. Half of the inventory was sold for P40,000 c. Equipment with carrying amount of P200,000 was sold for P120,000 d. Actual liquidation expenses of P2,000 were paid. e. Estimated future liquidation expenses totaled P1,000 1. P9,000 cash was retained in the business for potential unrecorded liabilities and anticipated expenses. Requirement: Determine the amounts of cash distributed to the partners from the partial realization of partnership assets. Illustration no. 3: X, Y and Z Partnership was liquidated December 31, 2019; and the account balances after all non-cash assets are converted to cash on January 31, 2020 are as follows: Icash P262,500 Accounts Payable 315,000 X, Capital (30%) 525,000 P630,000 472,500 Y. Capital (30%) Iz, Capital (40%) The personal assets and liabilities of the partners at January 31, 2020 are: Personal assets Personal Liabilities P420,000 525,000 P472,500 320,250 420,000 997,500 Z contributed P367,500 to the partnership to provide cash to pay the creditors AFAR Partnership Liquidation: Illustration 1 and 2 (Case 1) are Lump-sum while Illustration 2 (Case 2) and Illustration 3 are Installment: Illustration no. 1 Cash Accounts Receivable Allowance for bad debts P43,000 155,000 (25,000) 250,000 320,000 (50,000) Inventory Fixed Assets Depreciation - Fixed Assets 40,000 Notes Payable Accounts Payable Loans Payable Boy Boy Capital Pete Capital Tony Capital 97,000 6,000 50,000 200.000 300,000 All assets were sold for P476,000, and cash were distributed to partners. Assumption 1: Profits shared equally, deficient partners have personal money Assumption 2: Profits are shared 40%, 30% and 30% respectively. All partners are insolvent. Illustration no. 2: On January 1, 2020, the partners of ABC Co. decided to liquidate their partnership. The following information Cash P20,000; Accounts Receivable P60,000 Inventory P120,000; Equipment P300,000; Accounts Payable P30,000; Payable to B P20,000; A Capital (20%) P100,000; B Capital (30%) P150,000: C Capital (50%) P200,000 Case 1: Lump-sun liquidation a, P50,000 was collected on the accounts receivable; the balance was uncollectible. b. P70,000 was received from the entire Inventory c. The equipment was sold for P250,000 d. P2,000 liquidation expenses were paid Requirement: Determine the amounts of cash distributed to the partners in the final settlement of their interests. Case no. 2: Installment liquidation Use the fact pattern above but assume that the partnership will be liquidated over a prolonged period of time. Distribution to the partners will be made as cash becomes available. Information on the conversion of non-cash assets is as follows: a. 75% of the accounts receivable was collected for only P30,000 b. Half of the inventory was sold for P40,000 c. Equipment with carrying amount of P200,000 was sold for P120,000 d. Actual liquidation expenses of P2,000 were paid. e. Estimated future liquidation expenses totaled P1,000 1. P9,000 cash was retained in the business for potential unrecorded liabilities and anticipated expenses. Requirement: Determine the amounts of cash distributed to the partners from the partial realization of partnership assets. Illustration no. 3: X, Y and Z Partnership was liquidated December 31, 2019; and the account balances after all non-cash assets are converted to cash on January 31, 2020 are as follows: Icash P262,500 Accounts Payable 315,000 X, Capital (30%) 525,000 P630,000 472,500 Y. Capital (30%) Iz, Capital (40%) The personal assets and liabilities of the partners at January 31, 2020 are: Personal assets Personal Liabilities P420,000 525,000 P472,500 320,250 420,000 997,500 Z contributed P367,500 to the partnership to provide cash to pay the creditors